Georgia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legally binding contract that ensures a smooth transition of ownership when a partner in a professional partnership passes away. This agreement takes into account the financial implications of such an event, ensuring the deceased partner's interest is properly valued and purchased by the remaining partners. Keywords: Georgia Buy-Sell Agreement, Life Insurance, Fund Purchase, Deceased Partner's Interest, Professional Partnership. There are different types of Georgia Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership. Here are some of them: 1. Cross-Purchase Agreement: In this type of agreement, each partner agrees to purchase the deceased partner's interest directly from their estate. Each partner would then own a proportionate share of the business based on their investment. 2. Entity Purchase Agreement: Also known as a stock redemption agreement, this type of agreement allows the professional partnership itself to buy the deceased partner's interest. The partnership uses life insurance policies on each partner to fund the purchase. 3. Wait-and-See Agreement: This agreement provides flexibility by allowing the surviving partners to choose between a cross-purchase or an entity purchase agreement after the death of a partner. The decision is typically based on the financial circumstances of the remaining partners at that time. 4. Hybrid Agreement: A hybrid agreement combines elements of both the cross-purchase and entity purchase agreements. This type of agreement is often used in partnerships with many partners, where it may not be feasible for each partner to purchase the deceased partner's interest individually. Regardless of the specific type, Georgia Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership are designed to provide a fair and orderly transfer of ownership in the event of a partner's death. They protect the interests of both the deceased partner's estate and the remaining partners, ensuring the continuity and stability of the professional partnership.

Georgia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

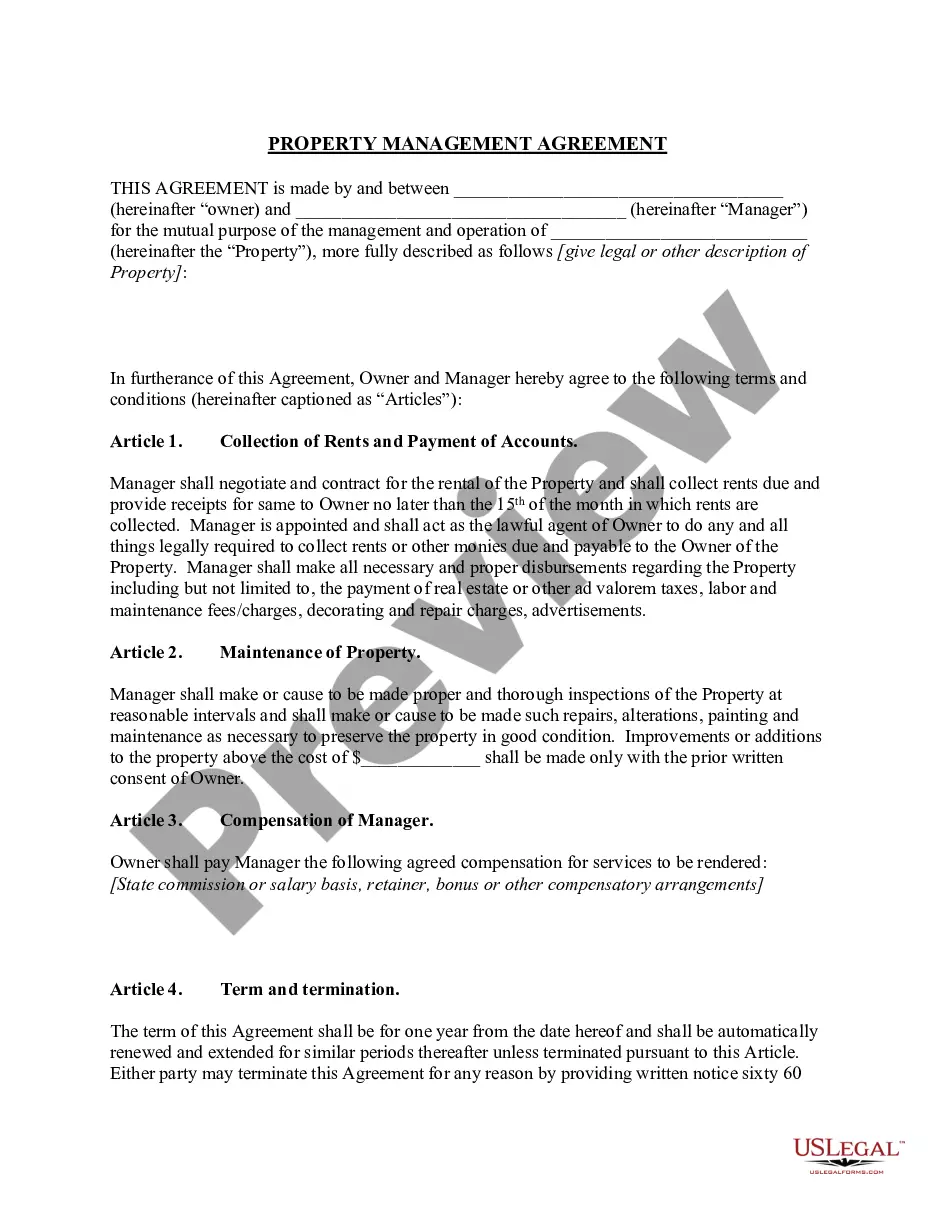

How to fill out Georgia Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

US Legal Forms - one of the largest collections of legal templates in the USA - offers an extensive selection of legal document formats that you can download or create.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest forms such as the Georgia Buy-Sell Agreement with Life Insurance to Fund the Purchase of a Deceased Partner's Interest in a Professional Partnership within moments.

If you already have a subscription, Log In and obtain the Georgia Buy-Sell Agreement with Life Insurance to Fund the Purchase of a Deceased Partner's Interest in a Professional Partnership from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make changes. Fill out, modify, and print and sign the downloaded Georgia Buy-Sell Agreement with Life Insurance to Fund the Purchase of a Deceased Partner's Interest in a Professional Partnership. Each template you save in your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or create another copy, simply go to the My documents section and click on the form you need. Access the Georgia Buy-Sell Agreement with Life Insurance to Fund the Purchase of a Deceased Partner's Interest in a Professional Partnership with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Ensure you have selected the appropriate form for your area/region.

- Click on the Preview button to review the form's content.

- Check the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Order now button.

- Then, select the pricing plan you want and provide your information to register for an account.

Form popularity

FAQ

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

Advantages of a Cross Purchase Plan When the owner(s) purchase the business interest of their departed or deceased owner, their basis increases by what they pay to the exiting owner or estate of the deceased owner. This then improves the tax consequences of their exit if it occurs during their lifetime.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

Using Life Insurance To Fund a Buy-Sell Agreement Life insurance is one of the most popular methods to fund a buy-sell agreement. In this scenario, the company purchases insurance on the life of each of its owners.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Interesting Questions

More info

Welcome to The Financial Institute — the most comprehensive suite of tools and resources for your business! What are we? The Financial Institute empowers you to develop and implement cost-effective solutions that enable your company to expand and improve its profitability. We offer a team of experts to make these solutions simple, economical and effective. We help you improve profitability and increase revenue with the best, most effective information and tools. Whether you need a quick start with your marketing strategy, understand how your employees' wages affect your bottom line, identify which financial products and services will be best for you, or know the ins and outs of operating outside US borders, The Financial Institute can help! Our mission is to help you become profitable and grow your business Here at the Financial Institute, we believe in your future.