Georgia Credit Application

Category:

State:

Multi-State

Control #:

US-134-AZ

Format:

Word;

PDF;

Rich Text

Instant download

Description

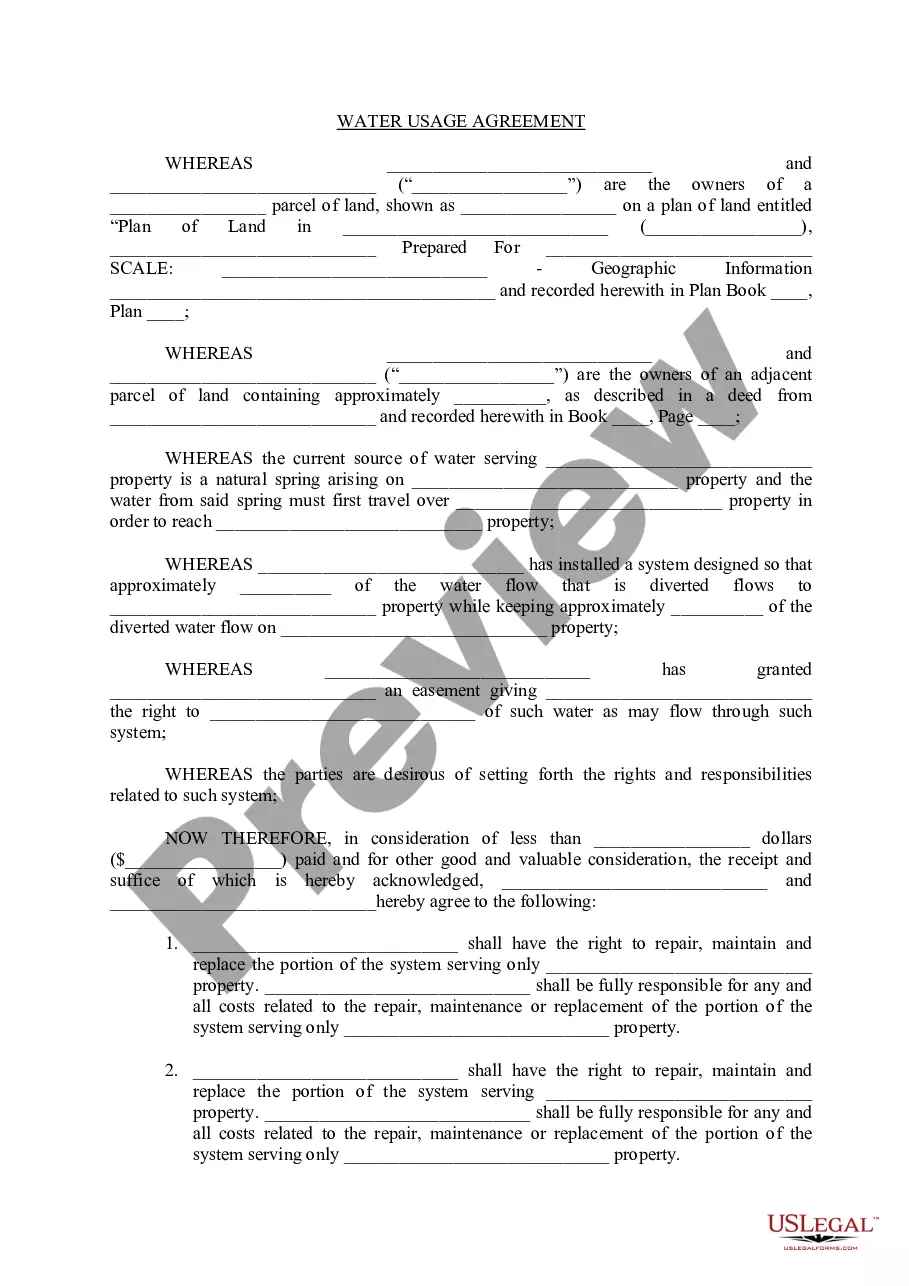

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

How to fill out Credit Application?

If you wish to finalize, obtain, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to locate the Georgia Credit Application in just a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and click the Acquire button to obtain the Georgia Credit Application.

- You can also access documents you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.