Title: A Comprehensive Guide to Georgia Specific Guaranty: Types and Features Introduction: Georgia Specific Guaranty (SG) is a legal concept that provides financial assurance in various transactions within the state of Georgia, USA. This article will delve into the essential details of SG, explore its significance, and discuss different types of guarantees offered in Georgia. Definition and Significance: A Georgia Specific Guaranty is a legally binding contract in which a guarantor (individual or entity) promises to assume responsibility for the obligations and debts of a borrower or debtor, should they default on their payment. This financial guarantee, specific to Georgia, serves as a safeguard for lenders, ensuring that they receive their dues even if the primary party cannot fulfill the loan or contract independently. Types of Georgia Specific Guaranty: 1. Personal Guaranty: This is the most common form of SG, involving an individual agreeing to be personally liable for the financial obligations of the borrower. In case of default, the lender holds the guarantor accountable for repayment. 2. Corporate Guaranty: In this type, a business entity acts as the guarantor, offering financial backing to secure the borrower's obligations. Should the borrower default, the company assumes responsibility for repayment on behalf of the borrower. 3. Limited Guaranty: With a limited guaranty, the guarantor's liability is restricted to a specific amount or certain defined circumstances. This type offers a predetermined limit on the guarantor's responsibility, providing additional protection. 4. Continuing Guaranty: A continuing guaranty comes into effect when the guarantor covers multiple transactions over time, typically revolving around a credit line or ongoing business relationship. It remains in force until the guarantor formally revokes it or the lender terminates the agreement. 5. Absolute Guaranty: An absolute guaranty holds the guarantor fully responsible for the debt or obligations of the borrower without any limited liability protection. It encompasses all present and future obligations, leaving little room for negotiation. Conclusion: Georgia Specific Guaranty plays a vital role in securing transactions and minimizing risks in the state of Georgia. By understanding the various types of guaranty, individuals and businesses can make informed decisions while seeking credit or entering into contractual agreements. Lenders also gain confidence in their investments, knowing that a guarantor stands ready to fulfill the obligations, even if the primary borrower fails. Understanding the intricacies of Georgia Specific Guaranty empowers both borrowers and lenders, facilitating smoother financial transactions throughout the state.

Georgia Specific Guaranty

Description

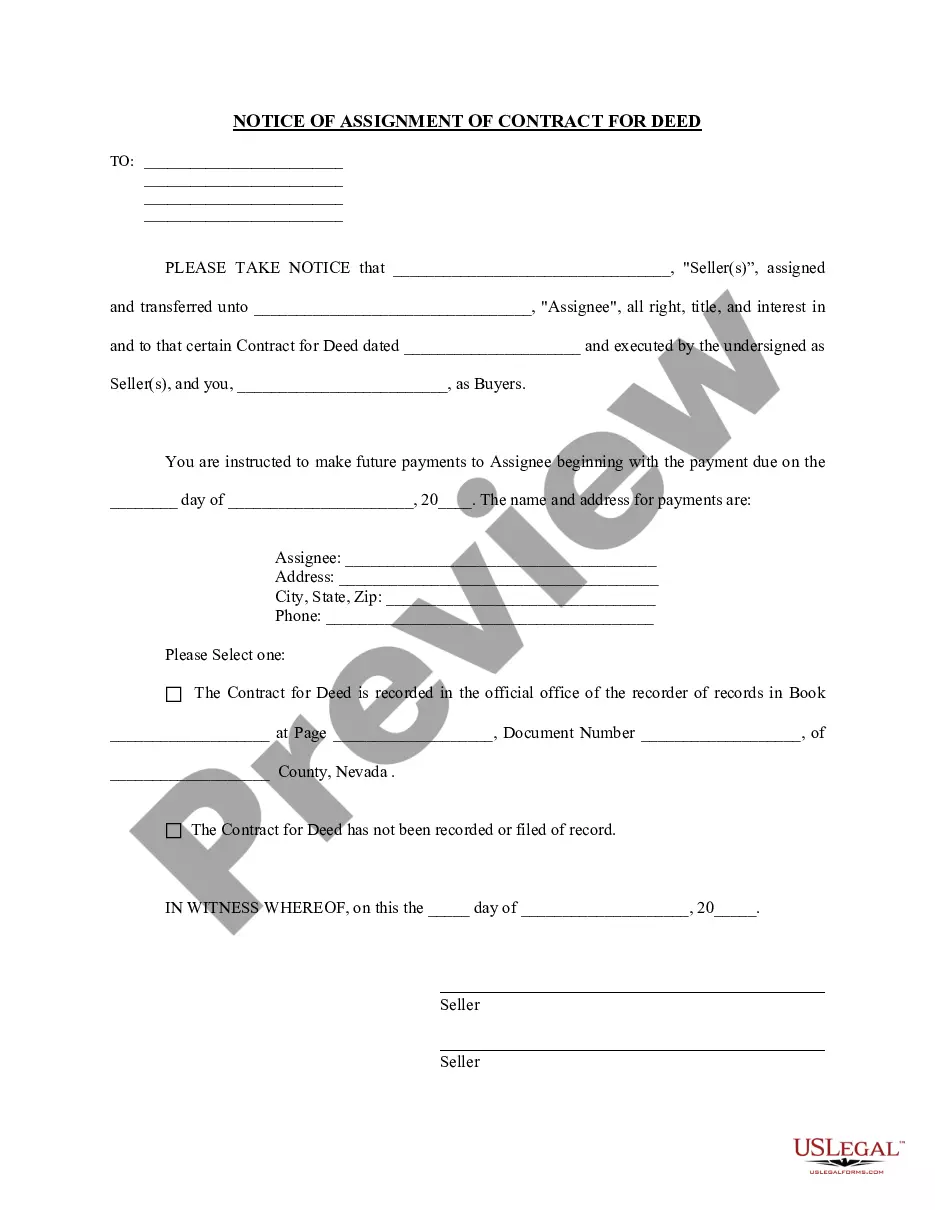

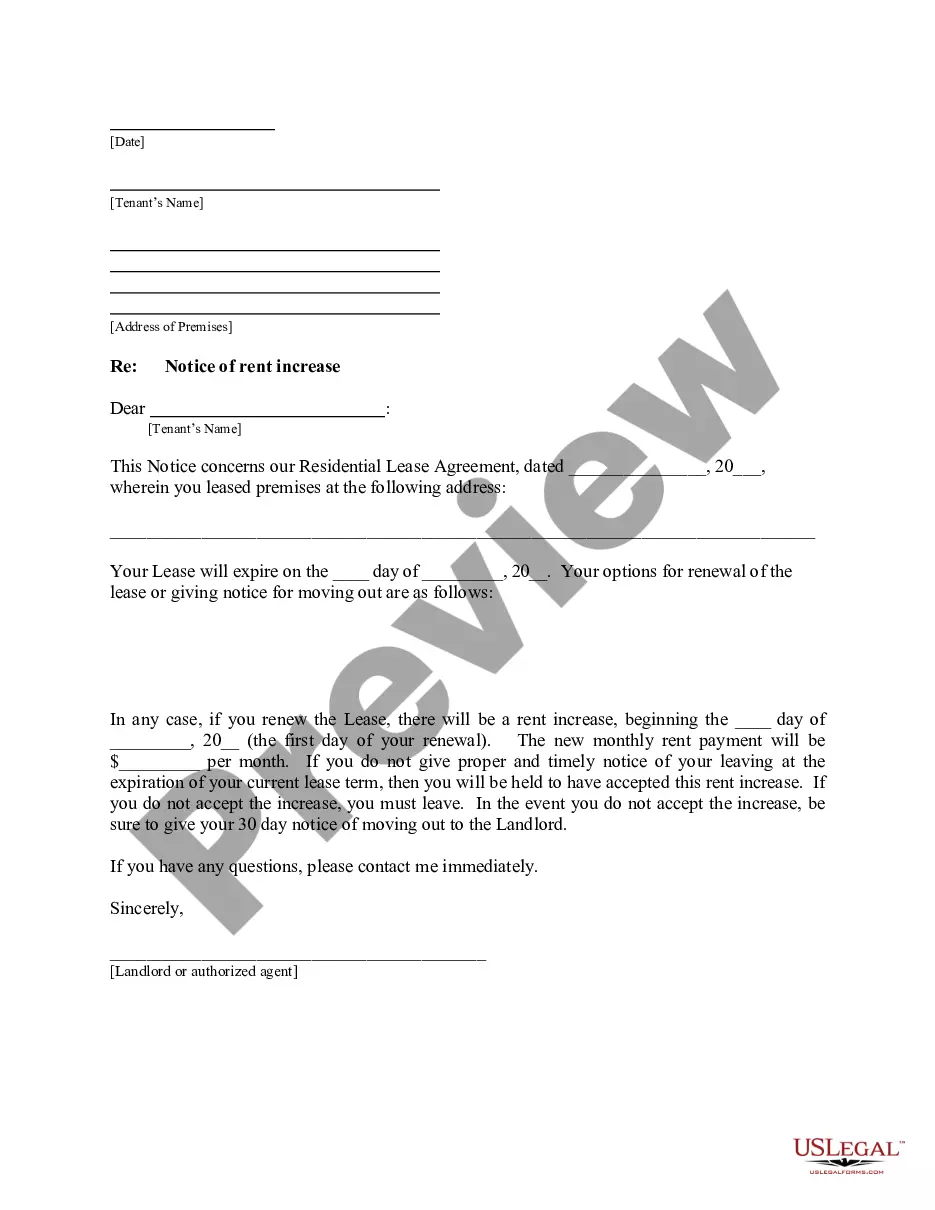

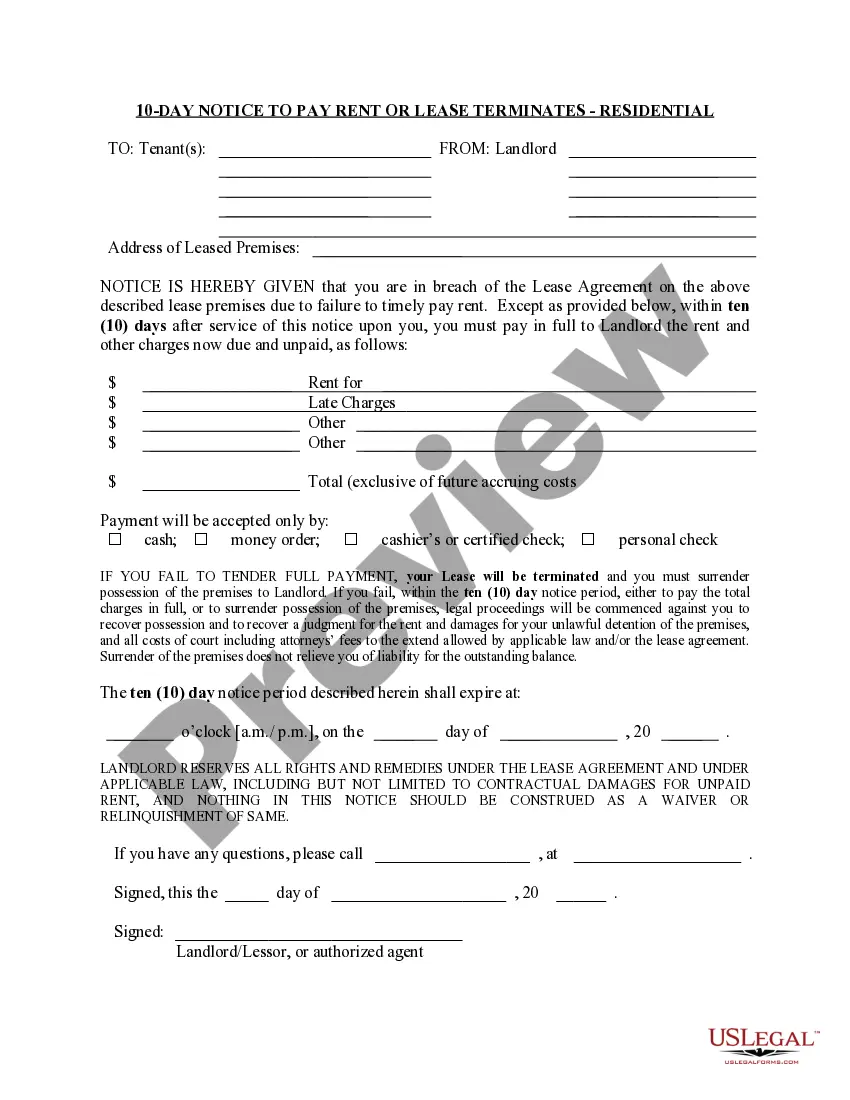

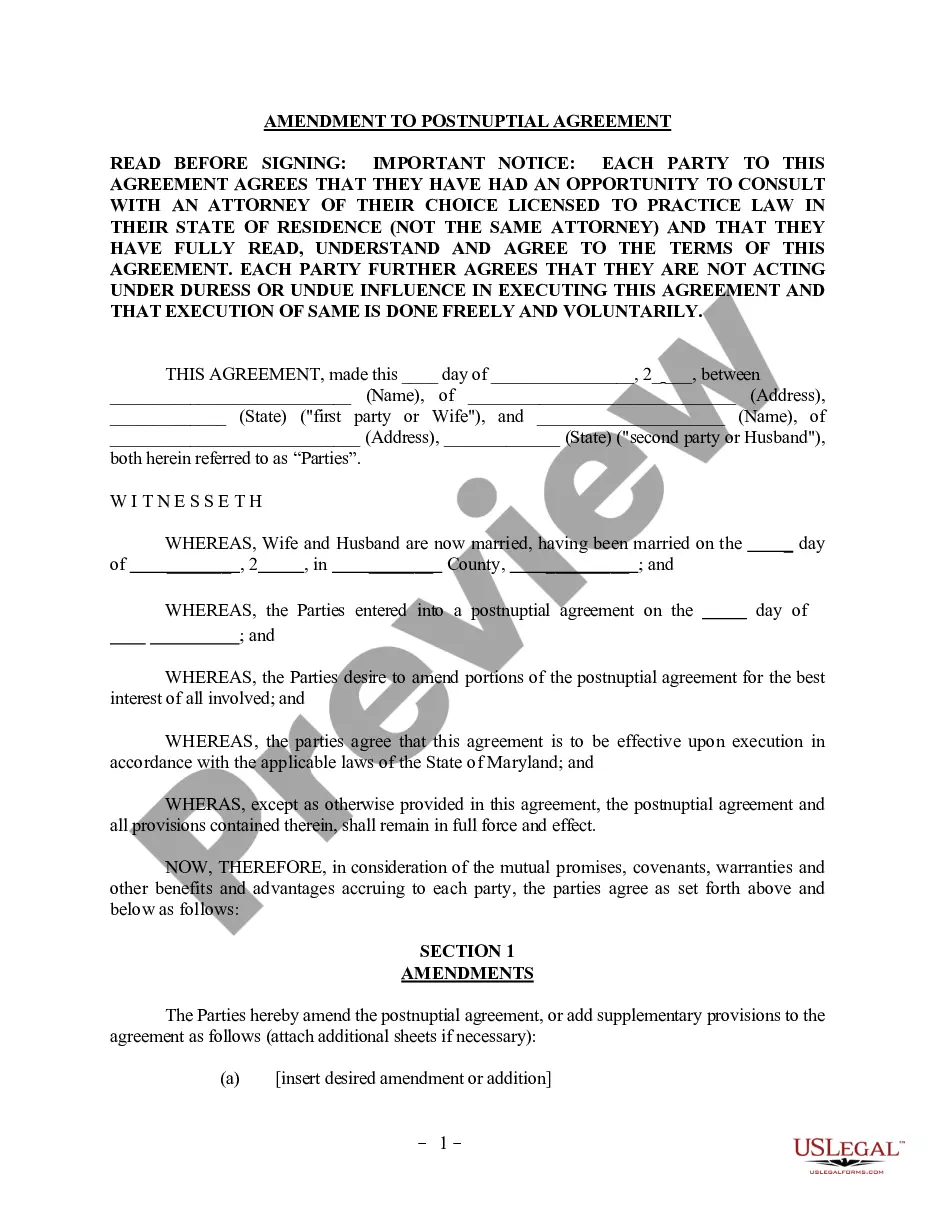

How to fill out Georgia Specific Guaranty?

If you require extensive, acquire, or produce valid document templates, utilize US Legal Forms, the foremost collection of lawful forms available online.

Utilize the site’s straightforward and efficient search functionality to locate the documents necessary for you.

Numerous templates for corporate and personal purposes are categorized by types and regions, or keywords.

Every legal document template you purchase is yours permanently.

You have access to each form you saved in your account. Go to the My documents section and select a form to print or download again.

- Use US Legal Forms to locate the Georgia Specific Guaranty in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Georgia Specific Guaranty.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the form you need, click the Get now button. Choose the payment plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Georgia Specific Guaranty.

Form popularity

FAQ

Surety bonds in Georgia act as a financial guarantee ensuring compliance with laws and regulations. When you secure a Georgia Specific Guaranty, a third-party surety company backs your promise to fulfill contractual obligations. If you fail to meet these obligations, the surety company steps in to cover losses, which you then must repay. This process protects project owners and stakeholders from potential risks associated with contractual failures.

Yes, if you earn income in Georgia as a nonresident, you must file a Georgia nonresident tax return. This requirement applies even if you live in another state. Understanding your tax liabilities is important, especially when navigating the Georgia Specific Guaranty context. Consulting with a tax professional can help clarify your obligations and ensure you comply with state laws.

To obtain a surety bond in Georgia, start by assessing your needs and the type of bond required. Next, gather relevant documents, such as your financial information and project details. It’s beneficial to work with a reputable bonding company or broker who understands the Georgia Specific Guaranty process. They can guide you through the application process, ensuring you meet all state requirements efficiently.

The State Small Business Credit Initiative (SSBCI) is a federal program designed to enhance access to capital for small businesses. It provides states with funding to develop programs that support lending, which can be particularly beneficial when obtaining a Georgia Specific Guaranty. This initiative serves as a crucial resource for small business owners, ensuring they have the financial backing necessary to grow and thrive.

The Georgia Fair Lending Act aims to prevent discriminatory lending practices and promote equitable access to credit for all residents. By establishing guidelines and protections, this act enhances the landscape for borrowers seeking financing, including those interested in Georgia Specific Guaranty options. The law's provisions ensure that lending practices remain fair and transparent, strengthening trust between lenders and the community.

The code 44 14 13 in Georgia relates to the rights and obligations of a debtor and their guarantor in real estate transactions. It elaborates on the related provisions that protect both parties' interests. Knowing this code is essential for anyone dealing with property agreements under a Georgia Specific Guaranty. It ensures compliance with local regulations.

Section 11 2 314 of the Georgia Code addresses warranty and the guarantee in contracts related to the sale of goods. It specifies the standards that ensure the goods sold meet certain expectations. Understanding this section is vital for both buyers and sellers involved in a Georgia Specific Guaranty. It can support legal clarity in commercial transactions.

The obligation of a guarantor includes meeting the financial commitments if the primary borrower fails to do so. This responsibility can cover loans, leases, and other agreements. The Georgia Specific Guaranty outlines these obligations clearly to prevent confusion between parties. Understanding these duties is crucial for anyone considering becoming a guarantor.

A guarantor has specific rights against a creditor following the fulfillment of their obligations. For instance, once the guarantor pays off the defaulted amount, they can seek reimbursement from the borrower. The Georgia Specific Guaranty ensures that these rights are protected by law. It creates a framework for guarantors to reclaim their financial standing.

The act of God law in Georgia refers to unforeseen events that prevent a party from fulfilling contractual obligations. This law acknowledges natural disasters like floods and hurricanes as valid justifications. Acknowledging these circumstances can protect involved parties under the Georgia Specific Guaranty. It is essential to understand how these situations may impact agreements.

Interesting Questions

More info

What happens to all of us whose money is there? It's gone.” That was the warning given by Tim Mandarin, the managing member of Wachovia Bank, in a presentation in 2005 at a forum called Money Matters, sponsored by JPMorgan's investment manager Long Term Capital Management. The problem that banks were taking on, he said, was that they were facing unprecedented risk in the global financial system. After the subprime market imploded, and the American housing bubble collapsed just as the crisis was winding down in the US, banks across the globe took on massive amounts of debt, including mortgage debt. However, just as many banks were overburdened with subprime mortgage debt, their profitability fell by almost half during the recession. Because of their relative size and the fact that credit losses were so concentrated, banks that borrowed money on other collateral, such as bank deposit deposits, were at the greatest risk of losing this money in a collapse.