Georgia Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

Are you in a situation where you need documents for either business or personal reasons daily.

There are numerous legal document templates available online, but finding those you can trust isn’t easy.

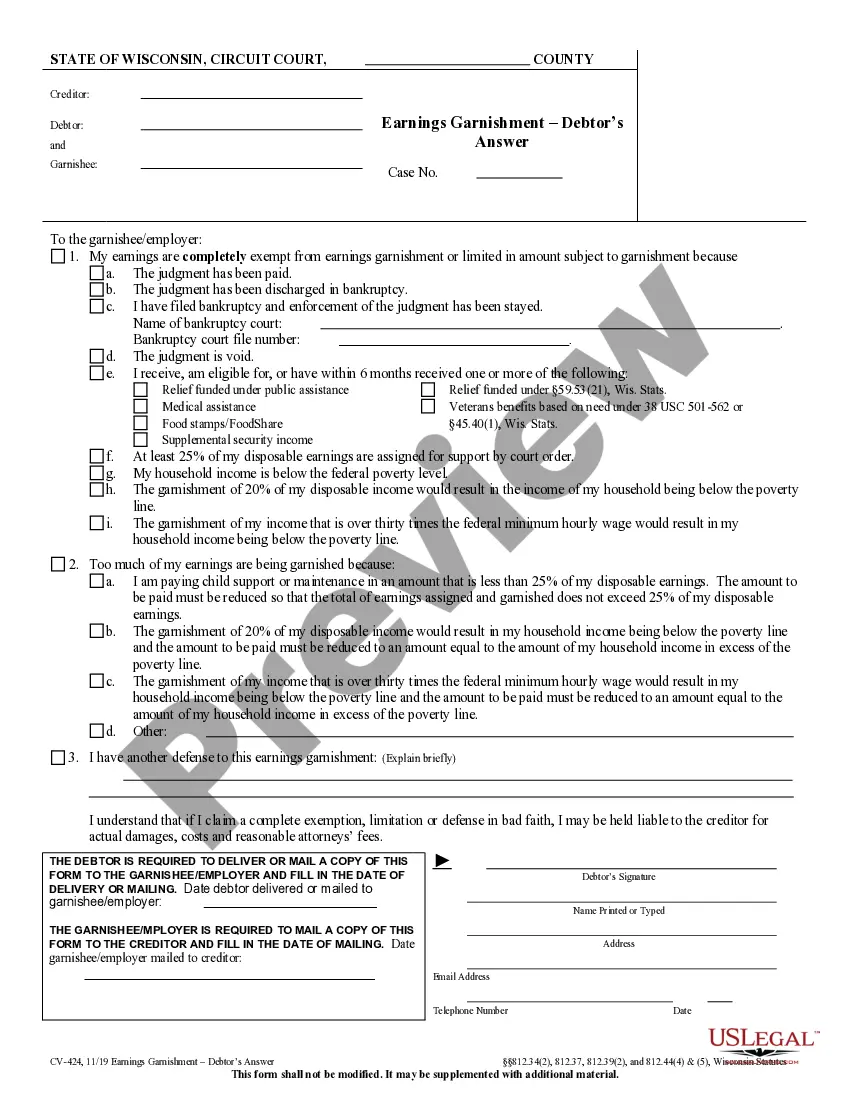

US Legal Forms offers thousands of form templates, such as the Georgia Guaranty without Pledged Collateral, that are designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the Georgia Guaranty without Pledged Collateral template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your respective city/state.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct template.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you’ve purchased in the My documents menu.

- You can obtain an additional copy of the Georgia Guaranty without Pledged Collateral anytime as desired. Just click the necessary form to download or print the document template.

Form popularity

FAQ

Secured Guaranty Documents means that certain Unconditional Guaranty and that certain security agreement, dated as of the Effective Date, executed by Guarantor in favor of Bank, as the same may be renewed, amended, extended or restated from time to time.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

Secured Guarantees means collectively, with respect to any Lien Grantor, any Secured Revolver Guarantee of such Lien Grantor and any Secured Term Guarantee of such Lien Grantor and a "Secured Guarantee" refers to any such guarantee, as the context may require.

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport. Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.