Georgia Private Trust Company

Description

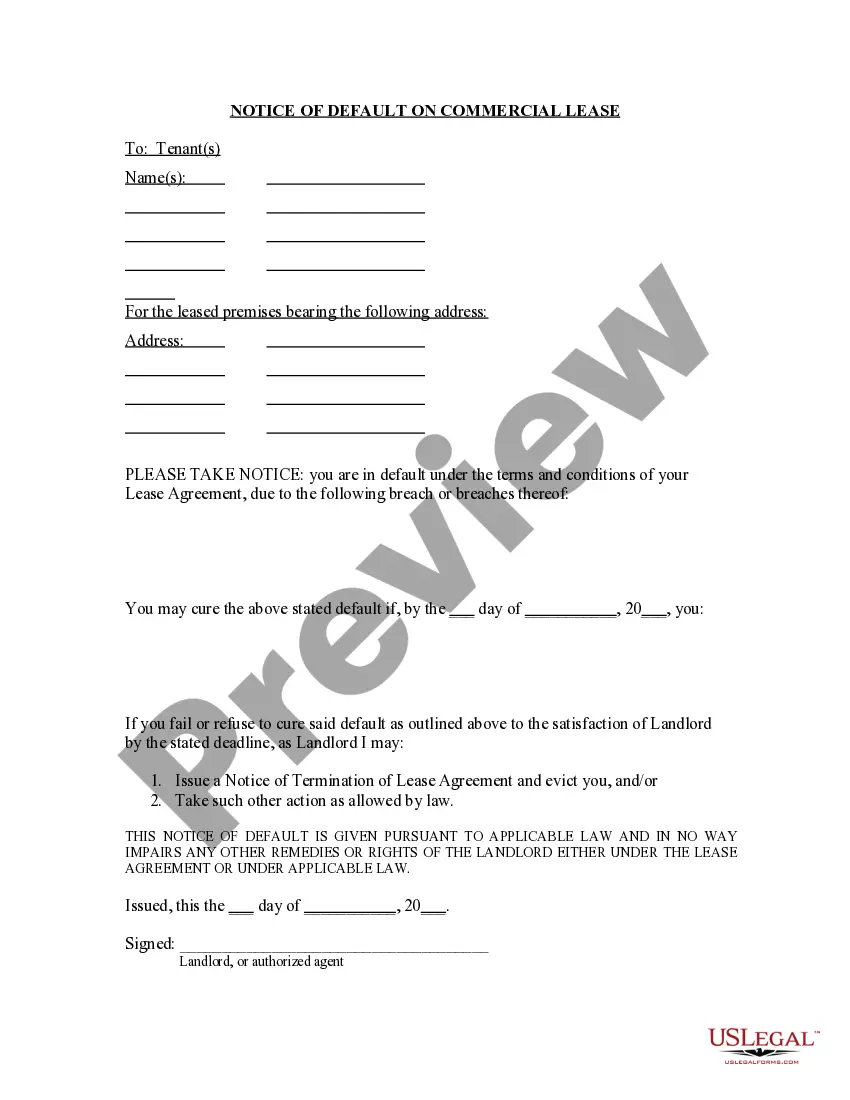

How to fill out Private Trust Company?

Are you currently in a situation that you require papers for either enterprise or specific reasons almost every day time? There are tons of legal papers templates available on the Internet, but locating versions you can rely on isn`t effortless. US Legal Forms gives a huge number of form templates, just like the Georgia Private Trust Company, that happen to be composed to meet federal and state needs.

When you are presently informed about US Legal Forms website and have a free account, just log in. Following that, you are able to down load the Georgia Private Trust Company template.

Should you not have an account and would like to begin using US Legal Forms, follow these steps:

- Get the form you want and ensure it is for your right town/area.

- Use the Review switch to review the form.

- See the outline to actually have selected the right form.

- In case the form isn`t what you`re seeking, make use of the Search field to discover the form that meets your needs and needs.

- When you obtain the right form, click Acquire now.

- Choose the rates plan you need, submit the specified details to create your bank account, and pay money for your order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper formatting and down load your duplicate.

Get all the papers templates you possess purchased in the My Forms menus. You can obtain a additional duplicate of Georgia Private Trust Company anytime, if possible. Just click on the required form to down load or print the papers template.

Use US Legal Forms, by far the most considerable assortment of legal types, to conserve time and steer clear of mistakes. The service gives appropriately made legal papers templates that can be used for a selection of reasons. Generate a free account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Trusts are completely private and do not need a court to enact them. The terms of the trust, beneficiaries, and assets are not public record.

There are just six steps to setting up a trust:Decide how you want to set up the trust.Create a trust document.Sign and notarize the agreement.Set up a trust bank account.Transfer assets into the trust.For other assets, designate the trust as beneficiary.

For a Georgia will or trust, the average cost is between $300-600, but the amount you spend depends on how complex the document is and whether you use a template or an attorney. Again, this is an average. Your attorney may charge more or less. Some attorneys may work from a template.

Trusts are completely private and do not need a court to enact them. The terms of the trust, beneficiaries, and assets are not public record. Trusts are also more difficult to contest than wills. Creating a living trust in Georgia protects not only your assets, but you personally.

While having a will is important for everyone, depending on your assets and family situation, a revocable living trust may be a better for you than a will or vice versa. A revocable living trust allows you to avoid the probate process.

Draw up the trust document: You can do this online with a program or get the help of a lawyer. Get the document notarized: Sign the document before a notary public. Put your property into the trust: This does take some paperwork, so while you can do it by yourself a lawyer may be useful.

A trust company is a separate corporate entity owned by a bank or other financial institution, law firm, or independent partnership. A trust is an arrangement that allows a third party or trustee to hold assets or property for a beneficiary or beneficiaries.

To make a living trust in Georgia, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...