Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

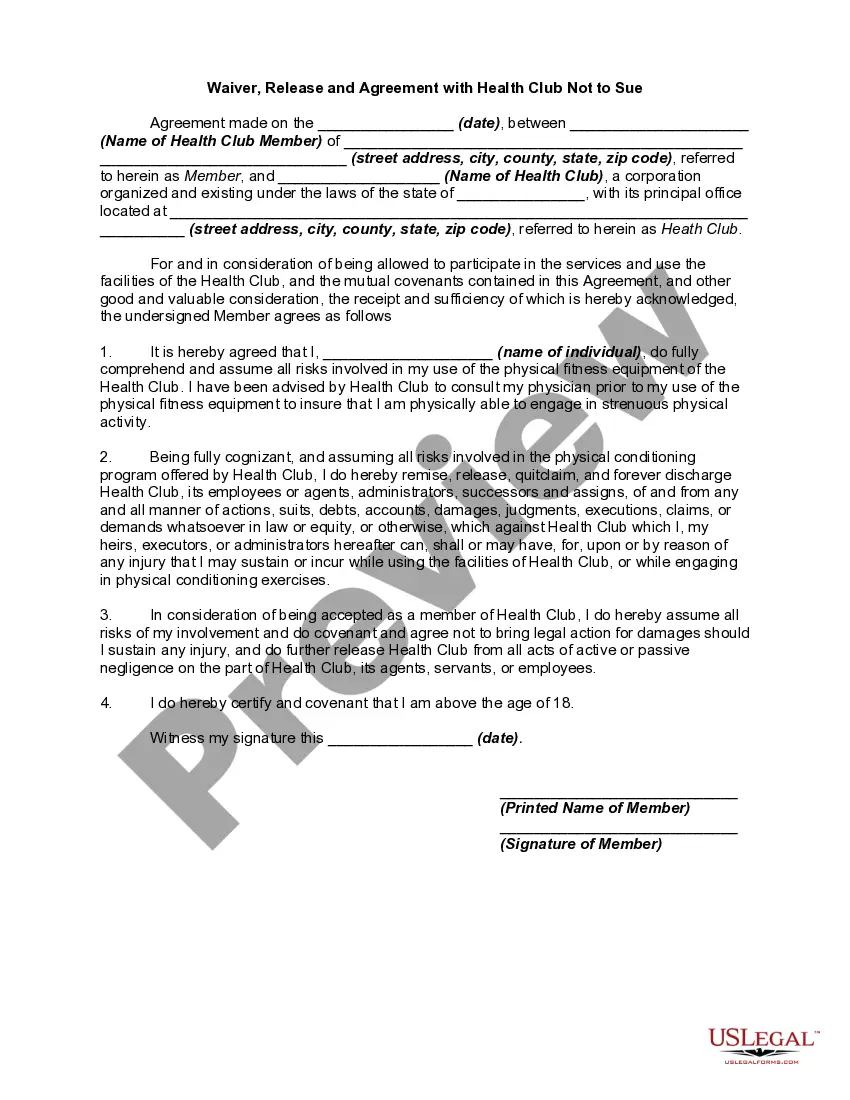

US Legal Forms - among the biggest libraries of legal kinds in the USA - gives a variety of legal record web templates it is possible to acquire or produce. Making use of the web site, you can find thousands of kinds for company and person functions, categorized by classes, says, or keywords and phrases.You can find the newest versions of kinds just like the Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets in seconds.

If you already possess a subscription, log in and acquire Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets in the US Legal Forms local library. The Obtain button will appear on every develop you see. You get access to all in the past acquired kinds from the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, here are easy recommendations to get you started:

- Be sure to have chosen the correct develop to your town/region. Select the Preview button to analyze the form`s information. Browse the develop information to actually have chosen the right develop.

- If the develop does not suit your specifications, use the Look for area towards the top of the screen to find the one which does.

- When you are satisfied with the form, verify your selection by clicking the Purchase now button. Then, opt for the prices plan you like and offer your references to sign up for an accounts.

- Method the deal. Utilize your charge card or PayPal accounts to perform the deal.

- Pick the structure and acquire the form on your own device.

- Make adjustments. Fill up, change and produce and signal the acquired Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Each design you added to your money lacks an expiry particular date and is also yours eternally. So, if you want to acquire or produce yet another version, just go to the My Forms section and then click in the develop you want.

Obtain access to the Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets with US Legal Forms, the most extensive local library of legal record web templates. Use thousands of specialist and status-specific web templates that fulfill your organization or person requirements and specifications.

Form popularity

FAQ

5 Key Steps to Prepare a Purchase Price Allocation After A Business CombinationStep 1: Determine the Fair Value of Consideration Paid.Step 2: Revalue all Existing Assets and Liabilities to their Acquisition Date Fair Values.Step 3: Identify Intangible Assets Acquired.More items...?

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

Typically, it is a three-step process:Determining the purchase price (total consideration paid)Identifying the correct assets acquired and liabilities assumed.Calculating the fair market value of those assets and liabilities.

Reduce the purchase price by the amount of Class I assets (cash and equivalents) transferred from seller to buyer. Allocate the remaining purchase price to Class II assets (Securities), then to Class III (Accounts Receivable), IV (Inventory), V (Fixed Assets), and VI (Intangibles) assets in that order.

In acquisition accounting, purchase price allocation is a practice in which an acquirer allocates the purchase price into the assets and liabilities of the target company acquired in the transaction. Purchase price allocation is an important step in accounting reporting after the completion of a merger or acquisition.

Allocating the purchase price, or total sale price, of a business among the various assets of the business (asset classes) is necessary for tax purposes when a business is sold. This is the case regardless of whether the sale is structured as a stock sale or an asset sale.

Purchase price allocation (PPA) is an application of goodwill accounting whereby one company (the acquirer), when purchasing a second company (the target), allocates the purchase price into various assets and liabilities acquired from the transaction.

The Internal Revenue Code requires that both buyers and sellers submit a purchase price allocation on form 8594.

Generally, a purchase price allocation is an exercise that identifies each individual asset purchased, tangible and intangible, as well as any liabilities, then the assets are assigned a value. Typically, it is a three-step process: Determining the purchase price (total consideration paid)