Georgia Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

If you need to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Utilize the website's straightforward and user-friendly search function to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or search terms.

Step 4. After locating the form you need, click the Buy Now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Georgia Fair Credit Act Disclosure Notice in just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to obtain the Georgia Fair Credit Act Disclosure Notice.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

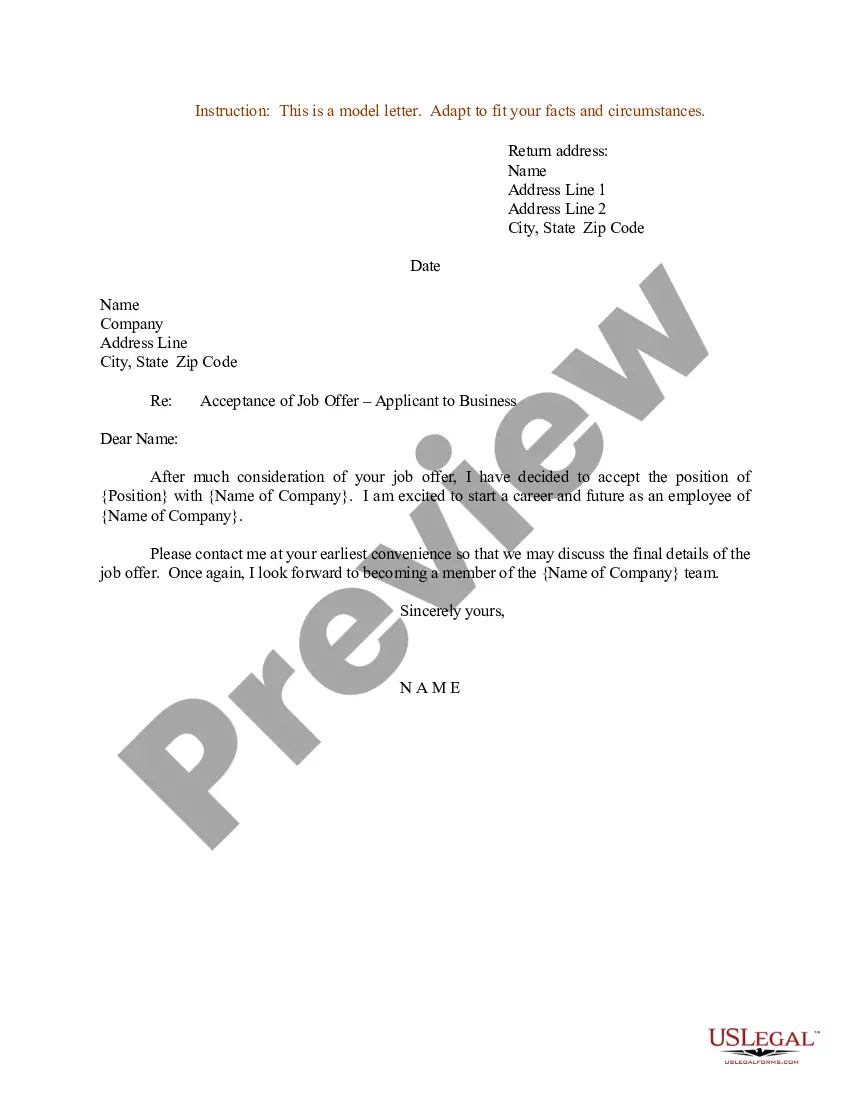

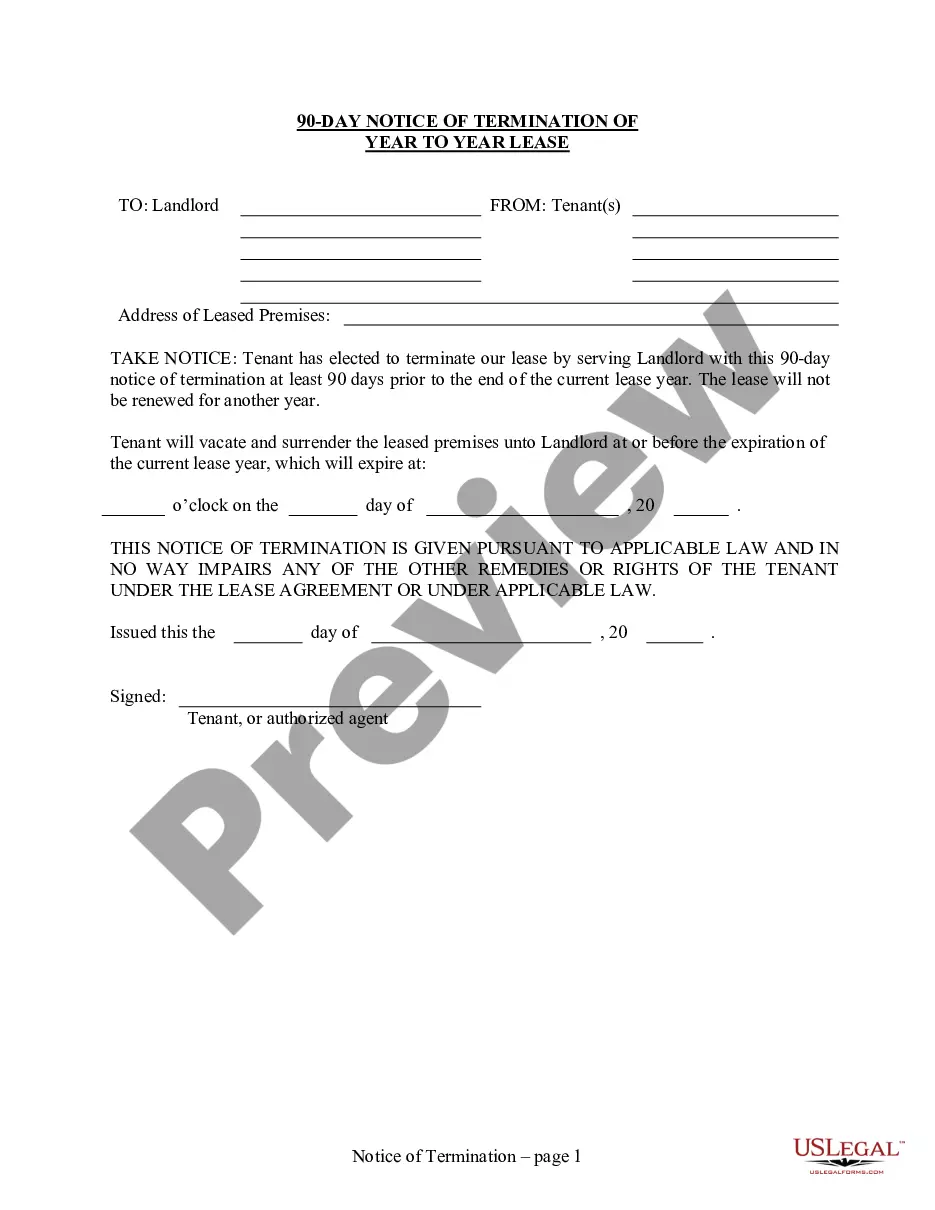

- Step 2. Use the Preview option to review the content of the form. Do not forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

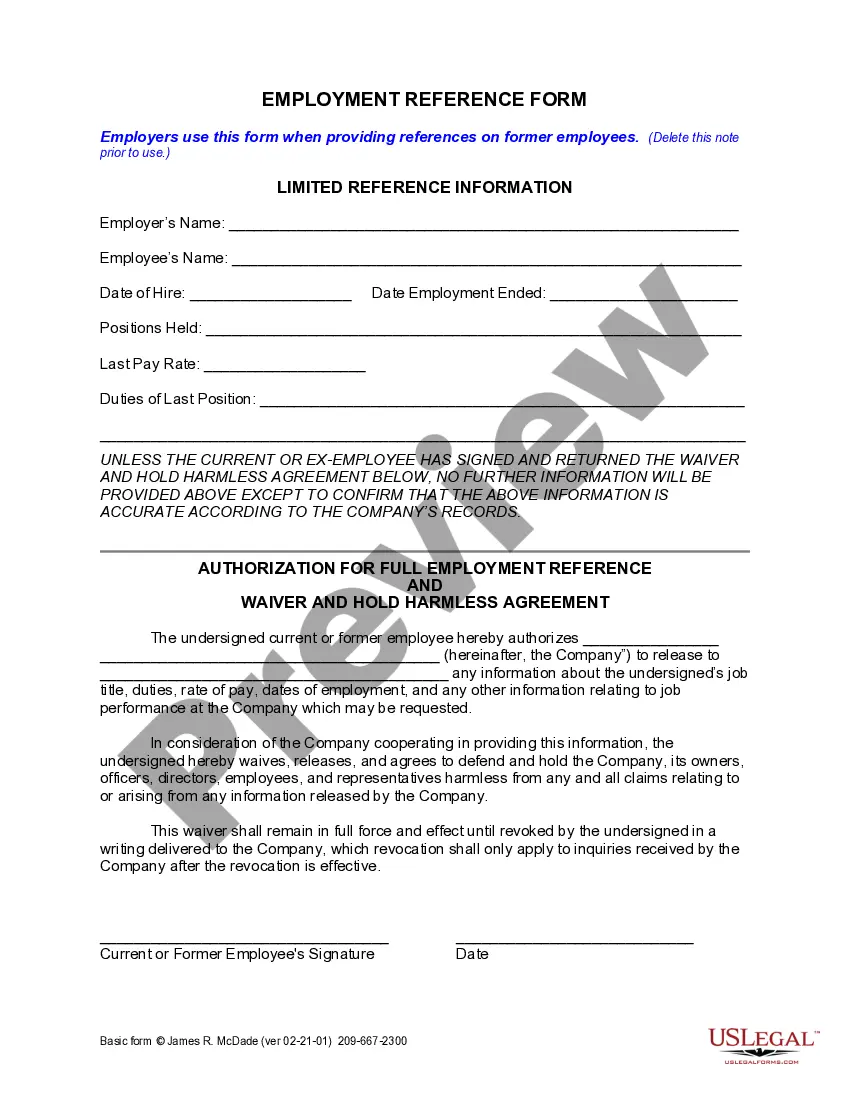

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing. On December 21, 2011, the CFPB restated FCRA regulations under its authority at 12 CFR Part 1022 (76 Fed. Reg.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.