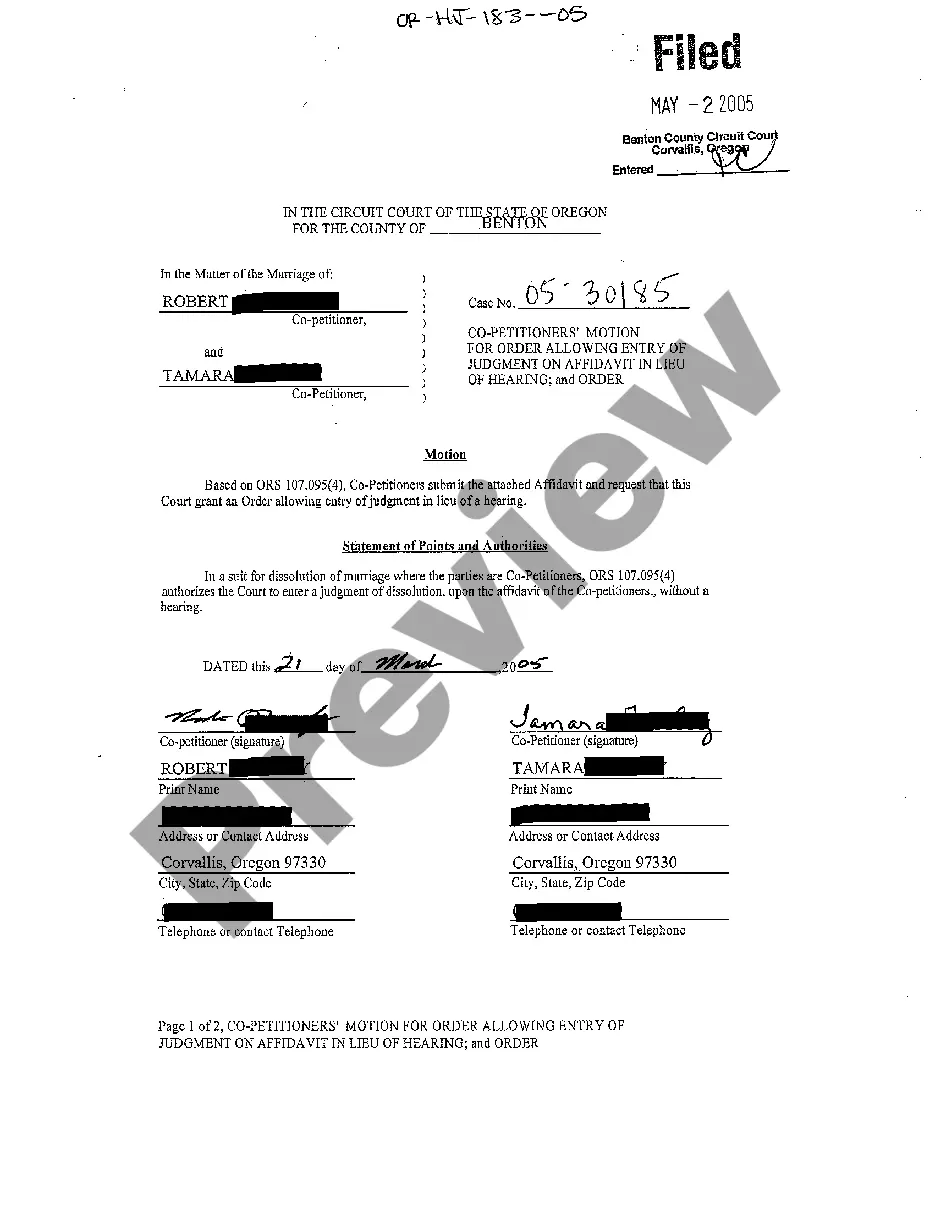

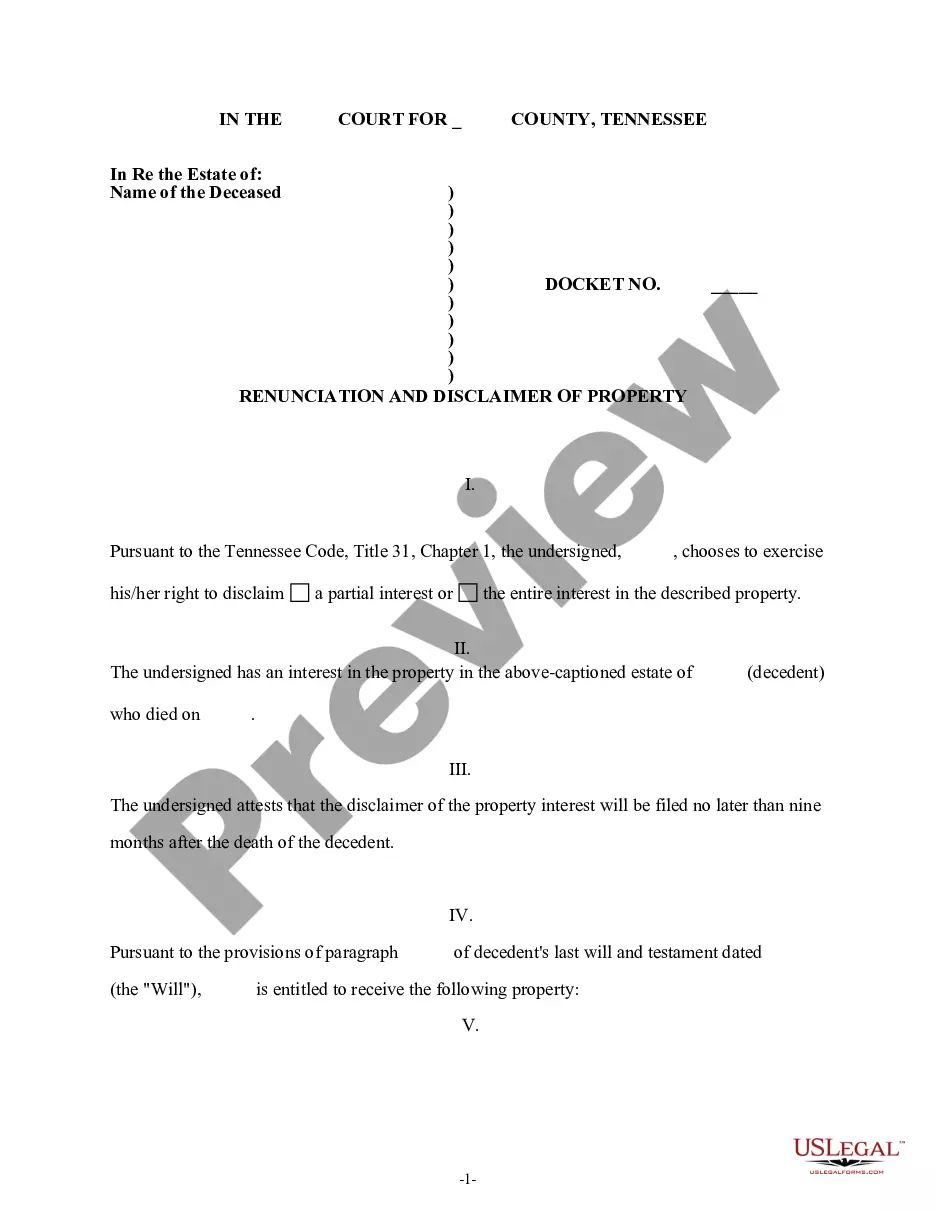

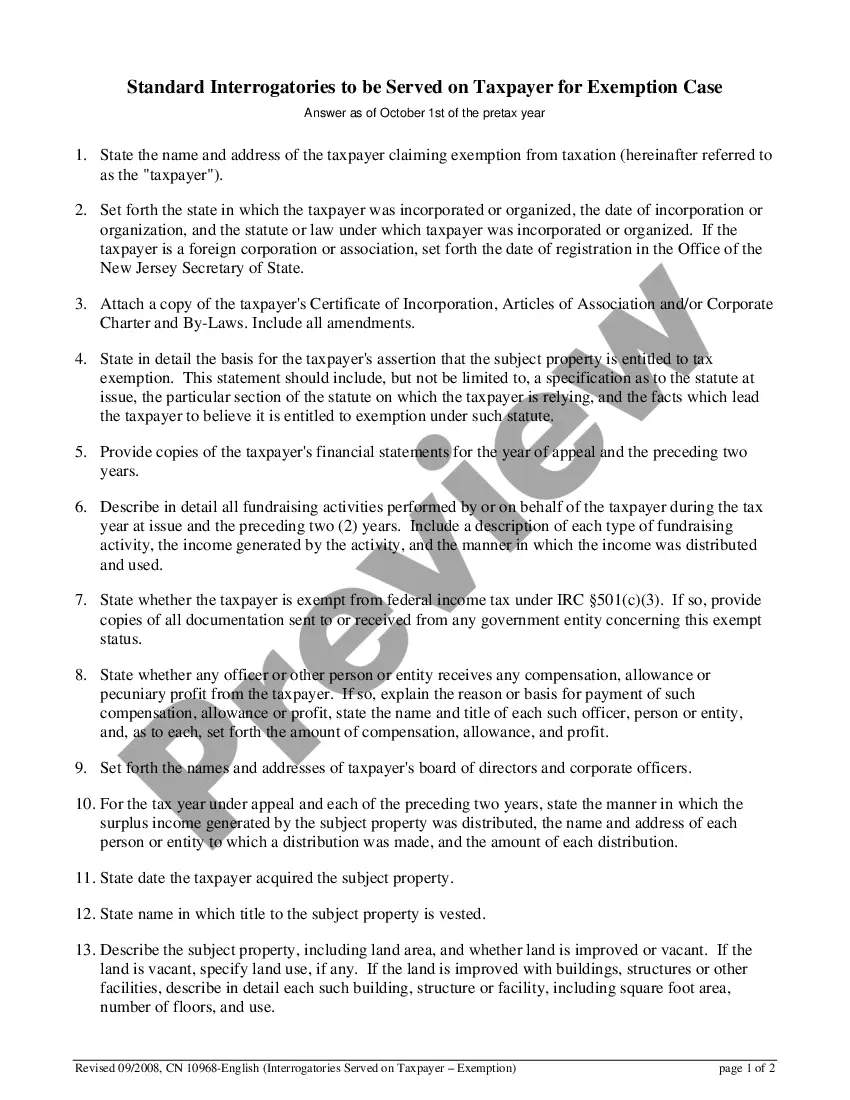

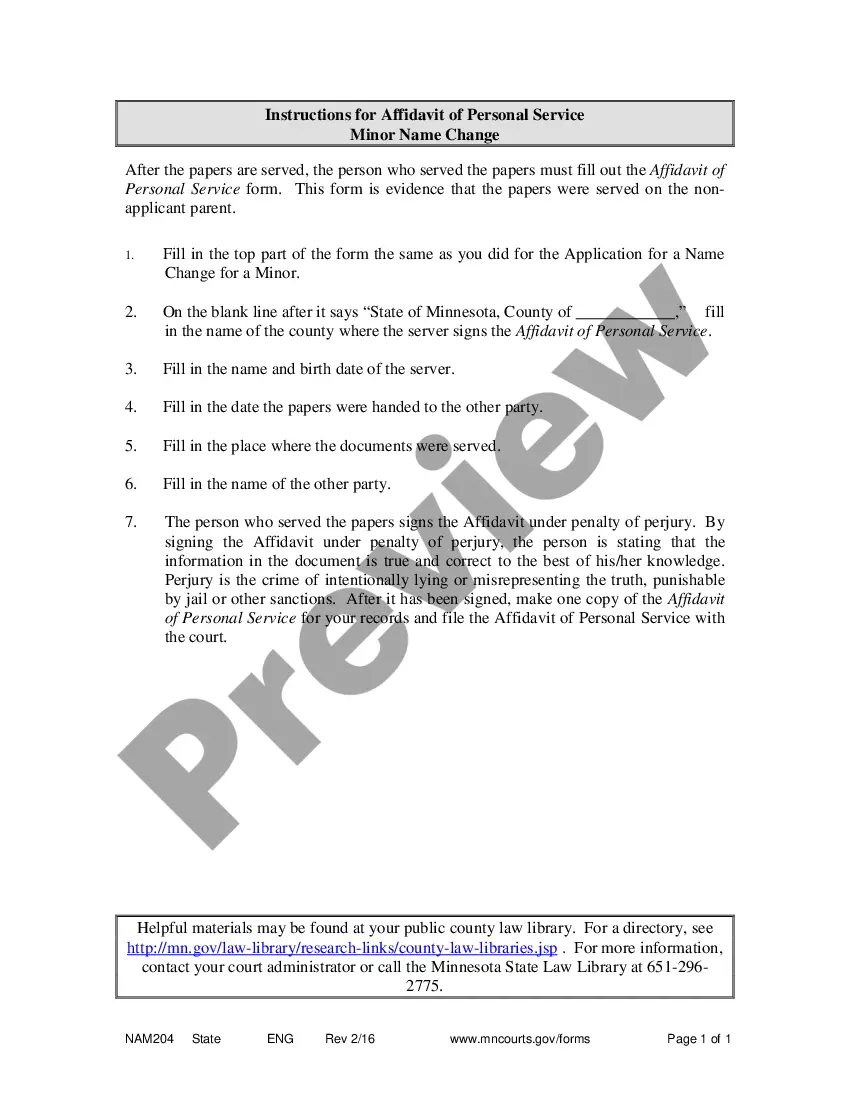

The Georgia Service Bureau Form is a document used in the state of Georgia for various administrative and legal purposes. It is primarily used to record and process specific information related to individuals, businesses, or organizations. This detailed form ensures accurate data collection and streamlines administrative procedures. The Georgia Service Bureau Form serves as an essential tool for different types of transactions, such as licensing, permits, registrations, certifications, and other legal proceedings. This form is often required by government agencies, local authorities, or private entities to gather pertinent information, verify eligibility, and maintain accurate databases. There are several types of Georgia Service Bureau Forms, each designed to cater to specific requirements. Some prominent variations include: 1. Georgia Business Service Bureau Form: This type of form focuses on capturing information related to business entities operating in Georgia. It typically requests details such as the business name, address, contact information, industry type, tax identification number, nature of the business, and ownership structure. This form is crucial for business registrations, licensing, and certifications. 2. Georgia Driver's Service Bureau Form: Designed for drivers residing in Georgia, this form gathers essential information from individuals applying for or renewing their driver's licenses. It collects personal data such as name, address, date of birth, social security number, and driving history. This form is used to assess a candidate's eligibility for driving privileges, conduct background checks, and maintain accurate state driving records. 3. Georgia Tax Service Bureau Form: This form is primarily utilized for tax-related matters in Georgia. It enables individuals and businesses to report their income, assets, deductions, and other relevant financial information necessary for tax filing and compliance. Tax Service Bureau Forms play a crucial role in determining tax liabilities, calculating refunds, and ensuring accurate and fair tax assessments. 4. Georgia Vital Records Service Bureau Form: Used to collect information related to birth, death, marriage, and divorce events, this form serves as an essential component of vital record registrations in Georgia. It captures details such as names of individuals involved, dates and locations of events, parent information (for births), and contact information. This form helps maintain an accurate database of vital records and facilitates legal proceedings related to these events. In conclusion, the Georgia Service Bureau Form is a comprehensive administrative tool utilized for various purposes within the state. It caters to different aspects such as business registrations, driver's licenses, tax processes, and vital record management. By providing accurate and detailed information on these forms, individuals and organizations ensure compliance with the applicable regulations and contribute to a more efficient and organized administrative system.

Georgia Service Bureau Form

Description

How to fill out Georgia Service Bureau Form?

US Legal Forms - one of the largest libraries of legitimate types in the States - offers a wide array of legitimate document templates you are able to download or printing. Using the website, you will get thousands of types for enterprise and person functions, categorized by groups, states, or keywords and phrases.You will find the most recent variations of types much like the Georgia Service Bureau Form in seconds.

If you already have a membership, log in and download Georgia Service Bureau Form in the US Legal Forms local library. The Down load key will show up on each and every develop you view. You gain access to all earlier downloaded types within the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, here are simple guidelines to help you started:

- Make sure you have selected the right develop for the area/area. Click on the Review key to examine the form`s information. Browse the develop explanation to ensure that you have chosen the correct develop.

- In case the develop does not satisfy your specifications, take advantage of the Look for area towards the top of the display to find the one who does.

- When you are happy with the form, verify your choice by clicking on the Acquire now key. Then, opt for the rates program you favor and supply your accreditations to register to have an accounts.

- Method the financial transaction. Use your bank card or PayPal accounts to perform the financial transaction.

- Choose the formatting and download the form on your system.

- Make changes. Fill up, change and printing and indication the downloaded Georgia Service Bureau Form.

Every design you added to your account does not have an expiry particular date and is the one you have eternally. So, if you wish to download or printing an additional duplicate, just visit the My Forms portion and click about the develop you want.

Get access to the Georgia Service Bureau Form with US Legal Forms, by far the most comprehensive local library of legitimate document templates. Use thousands of specialist and state-particular templates that meet up with your organization or person demands and specifications.

Form popularity

FAQ

You Can Owe Georgia State Income Tax on Florida Wages If you live in Florida and work in Georgia, you'll usually have Georgia tax withheld from your paycheck and file a Georgia tax return as well as a federal tax return at the end of the year. You won't be taxed by Florida, since that state doesn't tax anyone's income.

Nonresidents, who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return, are required to file a Georgia income tax return.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently disabled. Retirement income includes items such as: interest, dividends, net rentals, capital gains, royalties, pensions, annuities, and the first $4000.00 of earned income.

Submit the completed Articles of Organization, transmittal, form, and $110 filing fee to the Secretary of State's Corporations Division.

Can I electronically file a return if I am claiming IND-CR credits, taxes paid to another state or business pass through credits (BEST)? Yes, Georgia will accept all electronic returns with credits. You do not need to mail in any forms unless they are requested by the Department.

If one spouse is a resident and one is a part-year resident or nonresident, enter 3 in the residency status box and complete Form 500, Schedule 3 to calculate Georgia taxable income. Part-year Residents.

If you are a legal resident of another state, you are not required to file a Georgia income tax return if: Your only activity for financial gain or profit in Georgia consists of performing services in Georgia for an employer as an employee.

You do not have to register your business with the state of Georgia unless you are planning to incorporate, become a specific legal entity or if you plan to do business with the state, in which case you will need to become a registered vendor through the Department of Administrative Services.

Create & File RegistrationVisit the Secretary of State's online services page.Create a user account.Select create or register a business.Fill out the required information about your business entity (listed above).Pay the $100 filing fee by approved credit card: Visa, MasterCard, American Express, or Discover.

This form may be used to record the weekly examination of Lifting Equipment used on construction sites, as set out in the Safety, Health and Welfare at Work (General Application) Regulations, 2007. This form was produced by the HSA to facilitate the recording of the weekly examination as per these regulations.