Georgia Mileage Reimbursement Form

Description

How to fill out Mileage Reimbursement Form?

Selecting the most suitable authorized document template can be a challenge.

Clearly, there is a broad range of templates accessible online, but how do you discover the official form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Georgia Mileage Reimbursement Form, which you can utilize for business and personal purposes.

If the form does not satisfy your requirements, utilize the Search area to find the appropriate form.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Georgia Mileage Reimbursement Form.

- Use your account to review the official forms you have obtained previously.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

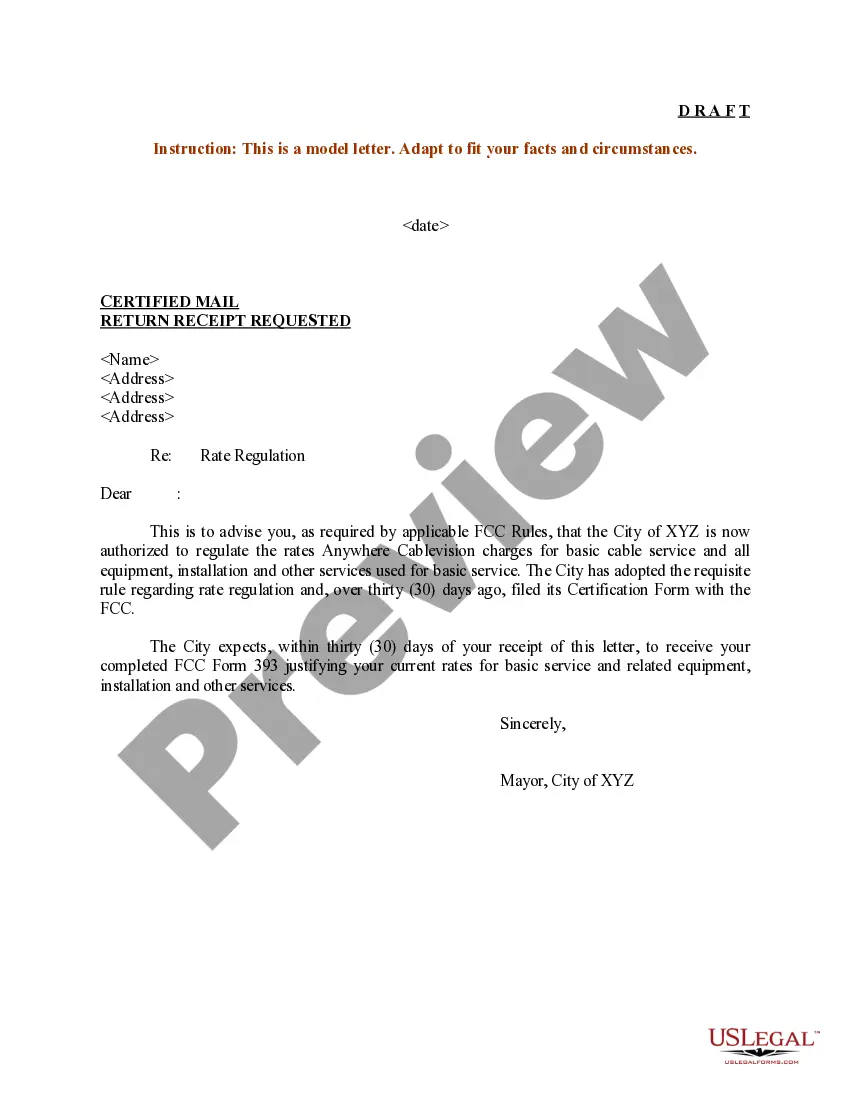

- First, ensure you have chosen the correct form for your city/state. You can browse the form by clicking the Preview button and review the form description to confirm it is the right one for you.

Form popularity

FAQ

A Mileage Reimbursement Form is a document that is given to the accounting department for reimbursement of the traveling costs. Mileage reimbursements are usually done on a bi-monthly or a monthly basis.

Effective for travel occurring on or after January 1, 2022:Mileage is to be reimbursed at $0.585 per mile for business travel.

For calendar year 2021, the mileage reimbursement rates are $. 56/mile for Tier 1 mileage and $. 16/mile for Tier 2 mileage. Georgia College considers all travel within Georgia Tier 1 mileage.

Beginning January 1, 2020, the standard mileage rates for the use of a car (van, pickup or panel truck) will be: 57.5 cents per mile for business miles driven, down from 58 cents in 2019. 17 cents per mile driven for medical or moving purposes, down from 20 cents in 2019.

On the federal level, there is no requirement for employers to reimburse employees for mileage when using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

2022 employee and non-employee rate is $0.585 per mile. 2021 employee and non-employee rate is $0.56 per mile.

For calendar year 2021, the mileage reimbursement rates are $. 56/mile for Tier 1 mileage and $. 16/mile for Tier 2 mileage. Georgia College considers all travel within Georgia Tier 1 mileage.