Georgia Determining Self-Employed Contractor Status is a crucial process for both individuals and businesses operating in the state. It involves identifying whether a worker should be classified as an employee or a self-employed contractor. The determination is necessary to ensure compliance with labor laws, tax regulations, and other legal obligations. One of the key factors in determining self-employed contractor status in Georgia is the level of control exercised over the worker. If the hiring party has the right to control and direct the worker's tasks, methods, and schedules, it is likely that the worker should be classified as an employee. On the other hand, if the worker has more independence and control over their work, they may be classified as a self-employed contractor. Another crucial aspect is the existence of a written contract between the parties. While the absence of a written agreement does not automatically make a worker an employee, having a clear contract can help establish the intention of both parties, outlining expectations and terms of the business relationship. Georgia also considers the worker's ability to realize a profit or loss based on their own efforts as a determining factor. If a worker has the opportunity to earn a profit or incur a loss based on their performance, investments, or business decisions, it implies a level of independence typically associated with self-employed contractors. Furthermore, the permanency of the working relationship plays a role in the determination. If a worker is engaged in an ongoing and indefinite relationship with the hiring party, it may indicate an employer-employee relationship. Conversely, a clearly defined project or task with a specific start and end date suggests a self-employed contractor arrangement. In Georgia, there are various types of self-employed contractor statuses that may be recognized. These can include: 1. Independent Contractors: Generally, these are individuals who enter into a contract with a business to perform specific services. They work outside the control and direction of the hiring party, and the relationship is often project-based or task-oriented. 2. Freelancers: These are self-employed individuals who offer their skills or services to multiple clients on a project-by-project basis. They usually have expertise in a particular field and operate independently, negotiating their contracts and rates. 3. Consultants: These individuals are hired for their specialized knowledge or expertise in a particular area. They may work independently or as part of consulting firms, offering their services to businesses or organizations seeking guidance or problem-solving. It is important for both workers and businesses operating in Georgia to understand the specific criteria for determining self-employed contractor status accurately. Failing to properly classify a worker can lead to legal and financial consequences, including unpaid taxes, potential labor law violations, or penalties. Seeking legal advice or consulting with professionals familiar with Georgia's laws can ensure compliance and mitigate any potential risks.

Georgia Determining Self-Employed Contractor Status

Description

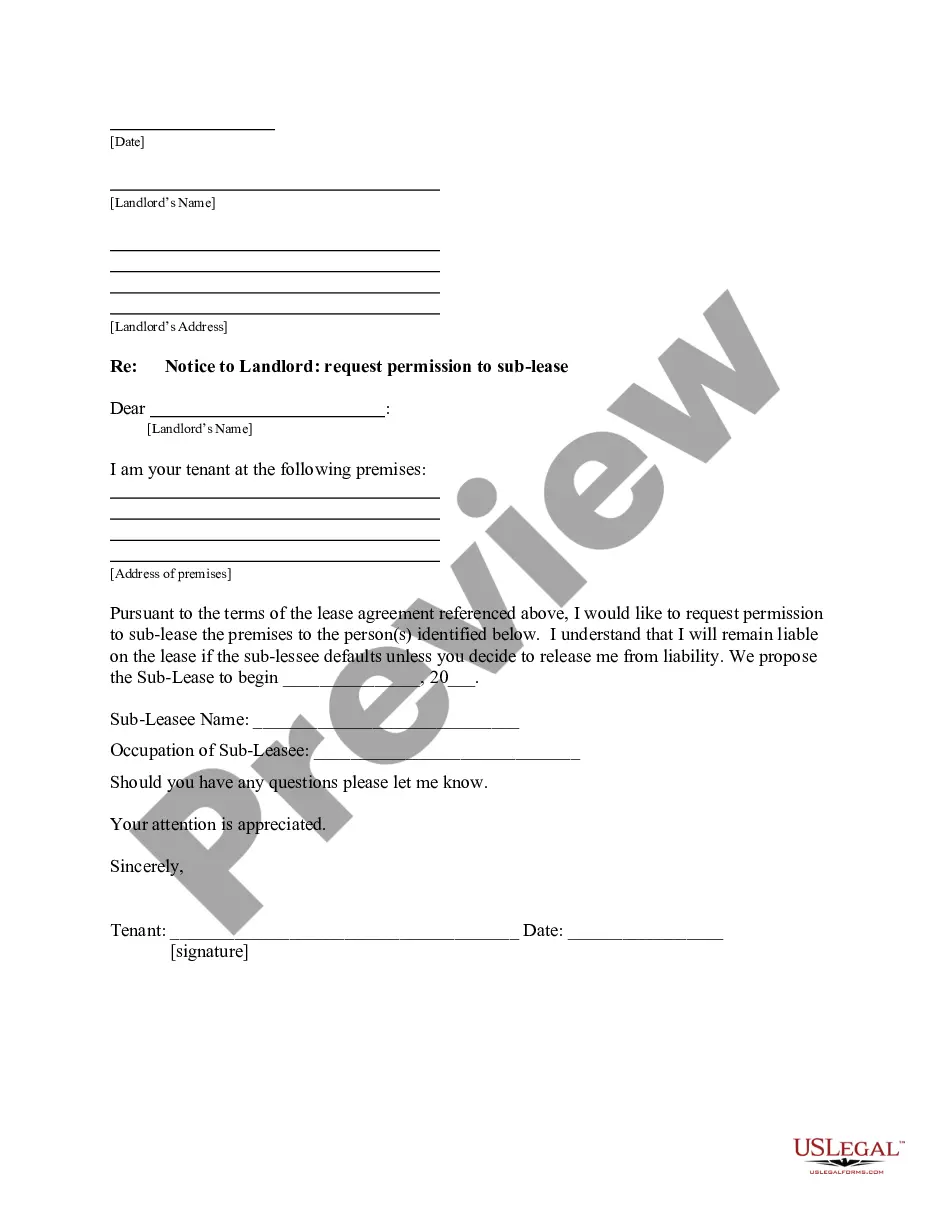

How to fill out Georgia Determining Self-Employed Contractor Status?

Finding the right legal file web template can be a have a problem. Needless to say, there are plenty of templates accessible on the Internet, but how do you discover the legal form you will need? Take advantage of the US Legal Forms web site. The assistance delivers 1000s of templates, including the Georgia Determining Self-Employed Contractor Status, that can be used for business and private needs. All of the kinds are inspected by professionals and satisfy state and federal requirements.

When you are previously authorized, log in to the bank account and click the Acquire button to get the Georgia Determining Self-Employed Contractor Status. Use your bank account to look through the legal kinds you have ordered earlier. Visit the My Forms tab of your bank account and have an additional duplicate of your file you will need.

When you are a whole new customer of US Legal Forms, here are straightforward directions that you should follow:

- Initially, make sure you have selected the correct form for the town/state. You are able to look over the shape while using Review button and read the shape explanation to ensure it will be the best for you.

- If the form is not going to satisfy your expectations, take advantage of the Seach field to get the proper form.

- When you are sure that the shape is acceptable, select the Purchase now button to get the form.

- Choose the costs plan you desire and type in the needed information and facts. Make your bank account and pay money for your order utilizing your PayPal bank account or Visa or Mastercard.

- Opt for the submit structure and download the legal file web template to the product.

- Comprehensive, revise and produce and indicator the received Georgia Determining Self-Employed Contractor Status.

US Legal Forms will be the largest library of legal kinds in which you can find a variety of file templates. Take advantage of the company to download professionally-manufactured documents that follow status requirements.