A Georgia Self-Employed Independent Contractor Agreement is a legally binding contract that outlines the terms and conditions between a self-employed individual and a hiring entity in the state of Georgia. This agreement establishes the relationship between the independent contractor and the hiring party, protecting the rights and responsibilities of both parties involved. Keywords: Georgia, Self-Employed, Independent Contractor Agreement, contract, terms and conditions, legally binding, relationship, rights, responsibilities. There can be various types of Georgia Self-Employed Independent Contractor Agreements, depending on the nature of the work and the specific requirements of the parties involved. Here are some common types: 1. General Independent Contractor Agreement: This is a broad agreement used for a wide range of self-employed individuals providing services or completing projects for a hiring entity. 2. Consulting Services Agreement: This type of agreement is used when an independent contractor provides consulting services, advice, or expertise to the hiring entity. It may include specific details about the scope of work, deliverables, and compensation. 3. Freelance Agreement: This agreement is commonly used when an independent contractor provides creative services, such as graphic design, writing, or photography. It may address intellectual property rights, revisions, and payment terms. 4. Construction Independent Contractor Agreement: This type of agreement is specific to contractors in the construction industry. It covers project requirements, timelines, safety protocols, and payment terms. 5. Non-Disclosure Agreement (NDA): While not strictly a type of Independent Contractor Agreement, an NDA is often included as a separate document or clause within the contract. An NDA ensures that any confidential information shared between the parties remains protected and not disclosed to third parties. These are just a few examples of the different types of Georgia Self-Employed Independent Contractor Agreements. The specific agreement required will depend on the nature of the work being performed and the unique circumstances of the parties involved. It's essential for both parties to carefully review and negotiate the terms of the contract to ensure mutual understanding and compliance with Georgia employment laws.

Georgia Self-Employed Independent Contractor Agreement

Description

How to fill out Georgia Self-Employed Independent Contractor Agreement?

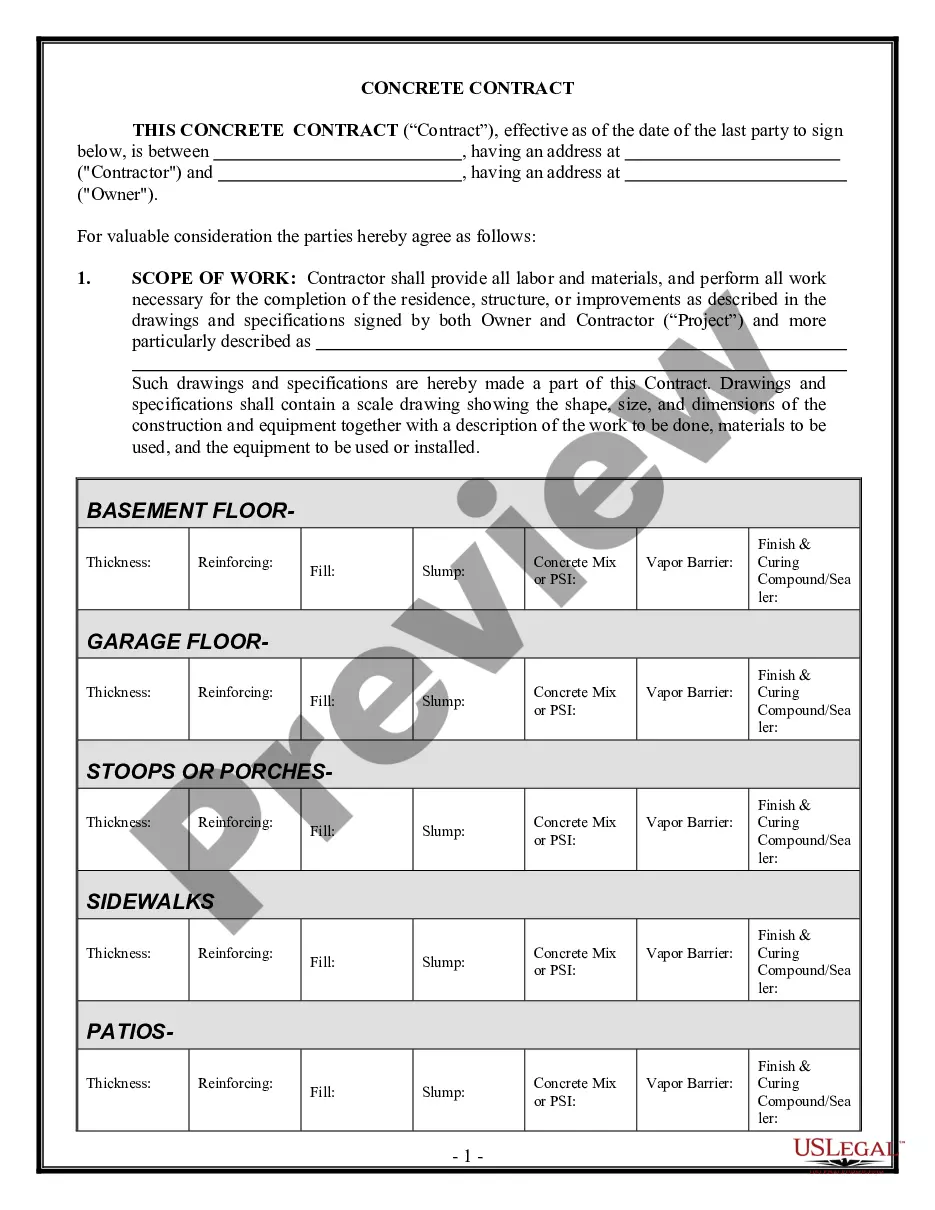

If you want to full, acquire, or print out authorized papers themes, use US Legal Forms, the largest collection of authorized kinds, that can be found on-line. Utilize the site`s basic and hassle-free lookup to get the paperwork you require. A variety of themes for enterprise and personal uses are categorized by categories and says, or search phrases. Use US Legal Forms to get the Georgia Self-Employed Independent Contractor Agreement within a few clicks.

If you are already a US Legal Forms buyer, log in to the account and click the Obtain button to get the Georgia Self-Employed Independent Contractor Agreement. You can also entry kinds you earlier downloaded within the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for the appropriate town/country.

- Step 2. Take advantage of the Review option to look over the form`s information. Don`t forget about to learn the description.

- Step 3. If you are unhappy together with the develop, take advantage of the Search area on top of the display to get other versions of the authorized develop template.

- Step 4. Once you have located the form you require, go through the Purchase now button. Choose the costs plan you like and include your references to register to have an account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal account to complete the financial transaction.

- Step 6. Choose the format of the authorized develop and acquire it in your device.

- Step 7. Comprehensive, modify and print out or indicator the Georgia Self-Employed Independent Contractor Agreement.

Every single authorized papers template you get is your own for a long time. You may have acces to each and every develop you downloaded within your acccount. Go through the My Forms portion and pick a develop to print out or acquire once more.

Be competitive and acquire, and print out the Georgia Self-Employed Independent Contractor Agreement with US Legal Forms. There are many expert and express-distinct kinds you can utilize for the enterprise or personal demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The state of Georgia does not require a general business license. Once you have obtained a valid business tax certificate, your business may legally operate throughout all of Georgia.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

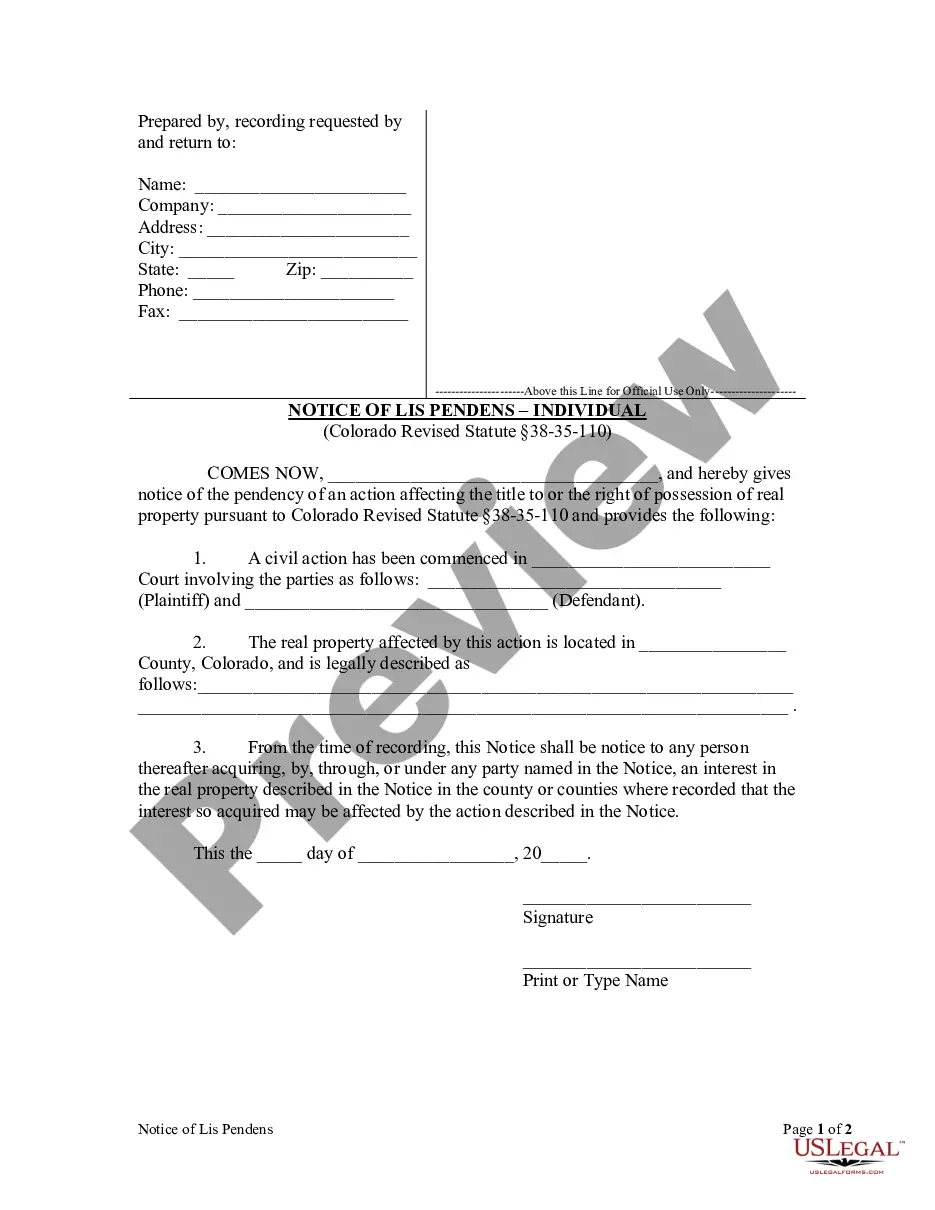

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Like many other states, you do indeed need a contracting license to work as a contractor in Georgia.

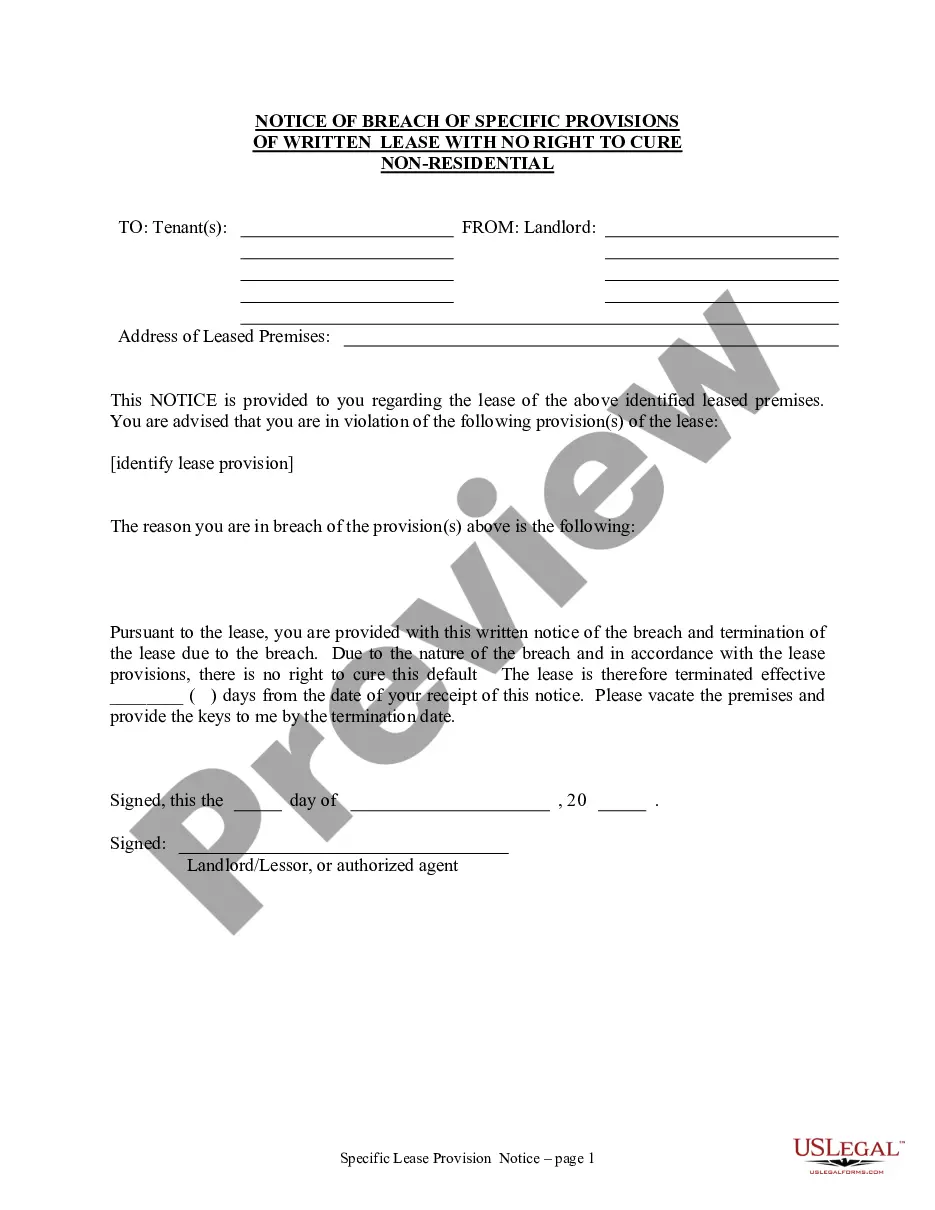

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Like many other states, you do indeed need a contracting license to work as a contractor in Georgia.