Georgia Employment Form

Description

How to fill out Employment Form?

If you desire to finish, acquire, or output authorized document templates, utilize US Legal Forms, the most extensive assortment of legal forms, available online.

Employ the site's straightforward and efficient search feature to find the documents you need.

Different templates for corporate and individual purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Download now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Employ US Legal Forms to obtain the Georgia Employment Form within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Georgia Employment Form.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

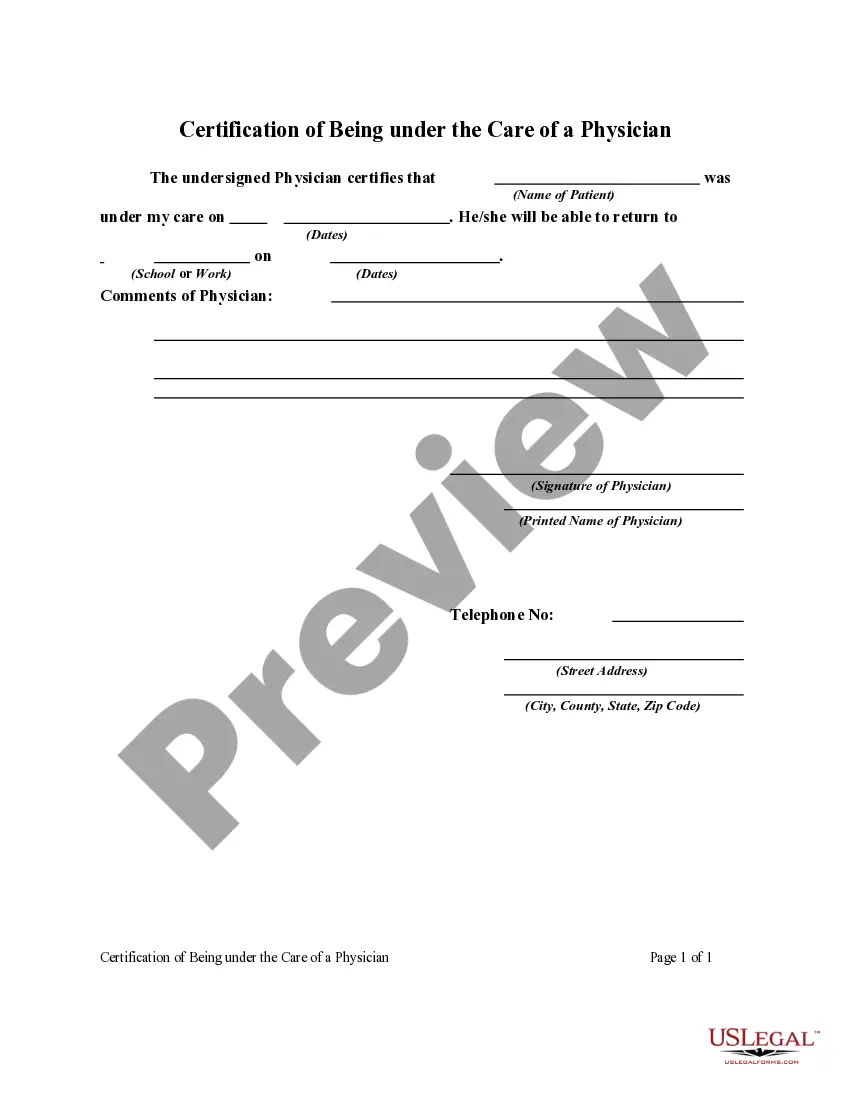

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other iterations of the legal form template.

Form popularity

FAQ

New Hire PaperworkForm 1 - Form I-9 Employment Eligibility Verification.Form 2 - Form W-4.Form 3 - Form G-4.Form 4 - Confidential Personal Information.Form 5 - Direct Deposit Authorization.Form 6 - Statement Concerning Your Employment in a Job Not Covered by Social Security.More items...

Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

When you apply online, an Income Verification Form is available to fax or mail, or you can upload your documents directly to your Georgia Gateway account. Existing Accounts: To continue your eligibility, your income will be verified every year. You will receive a letter when it is time to renew your account.

You must Contact a Career Center or UI Customer Service for assistance at Email Us to have your PIN reset.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

To locate your Department of Labor Account Number:Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N).Call the Department of Labor at the following number: 404-232-3180.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How to hire your first employee in GeorgiaQuick index.Make a hiring plan.Apply for your Employer Identification Number (EIN)Get your business ready for payroll taxes.Put together your employee handbook.Get workers' compensation and other employment coverages.Get ready to run payroll.Write your job description.More items...

Get the free wg15 form What is georgia employment form? Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

Expect at least 21 days or more to access your weekly benefit payment. Please expect at least 21 days or more to access your weekly benefit payment if you are eligible to receive benefits.