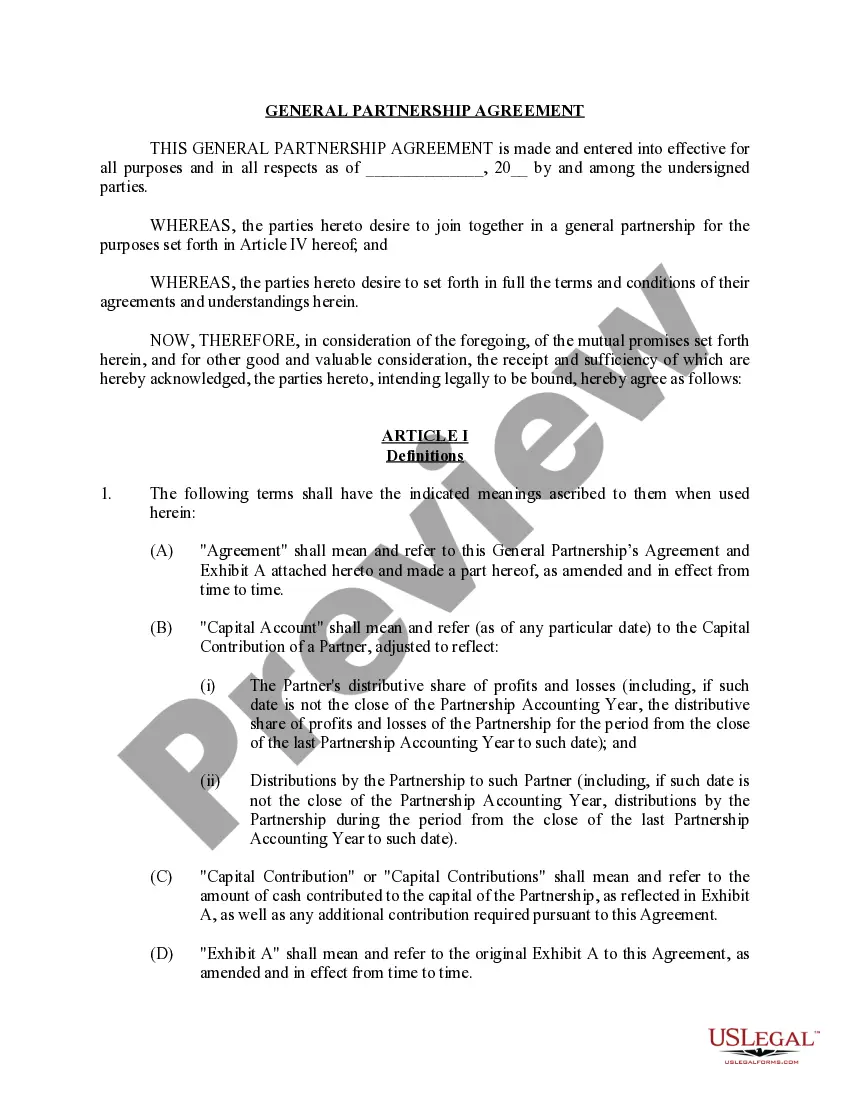

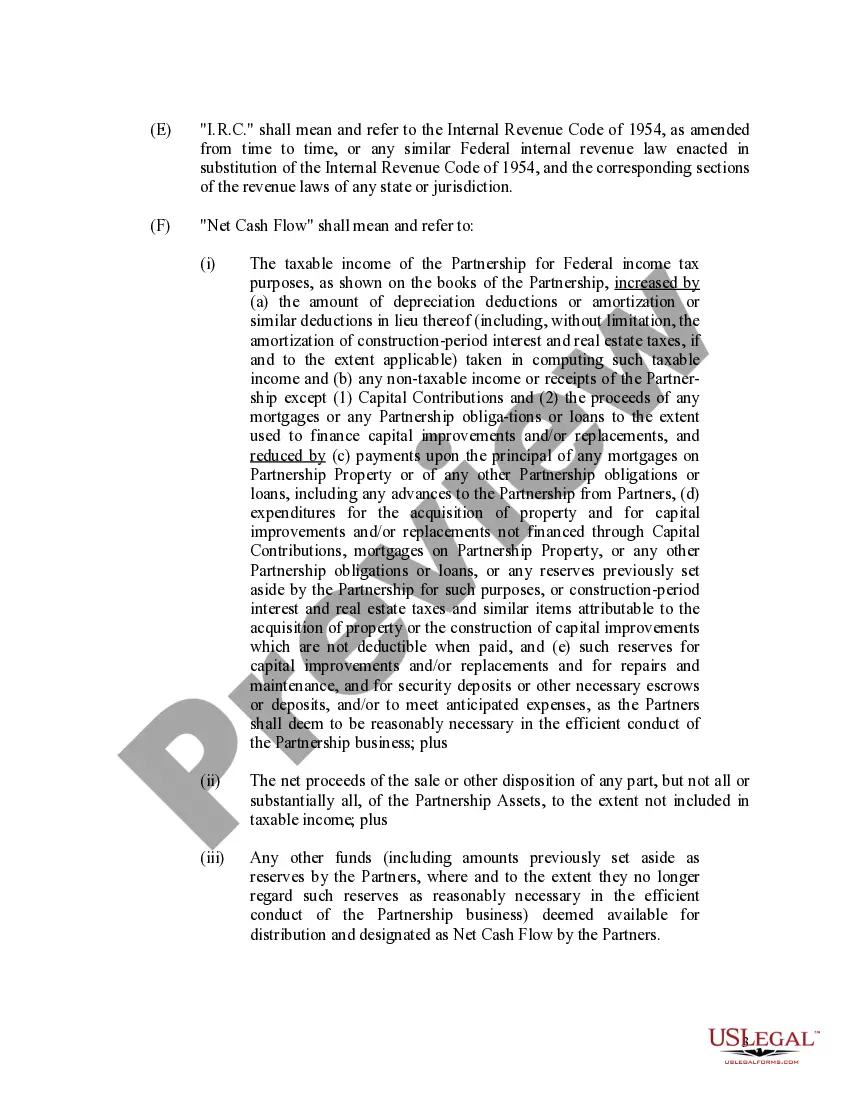

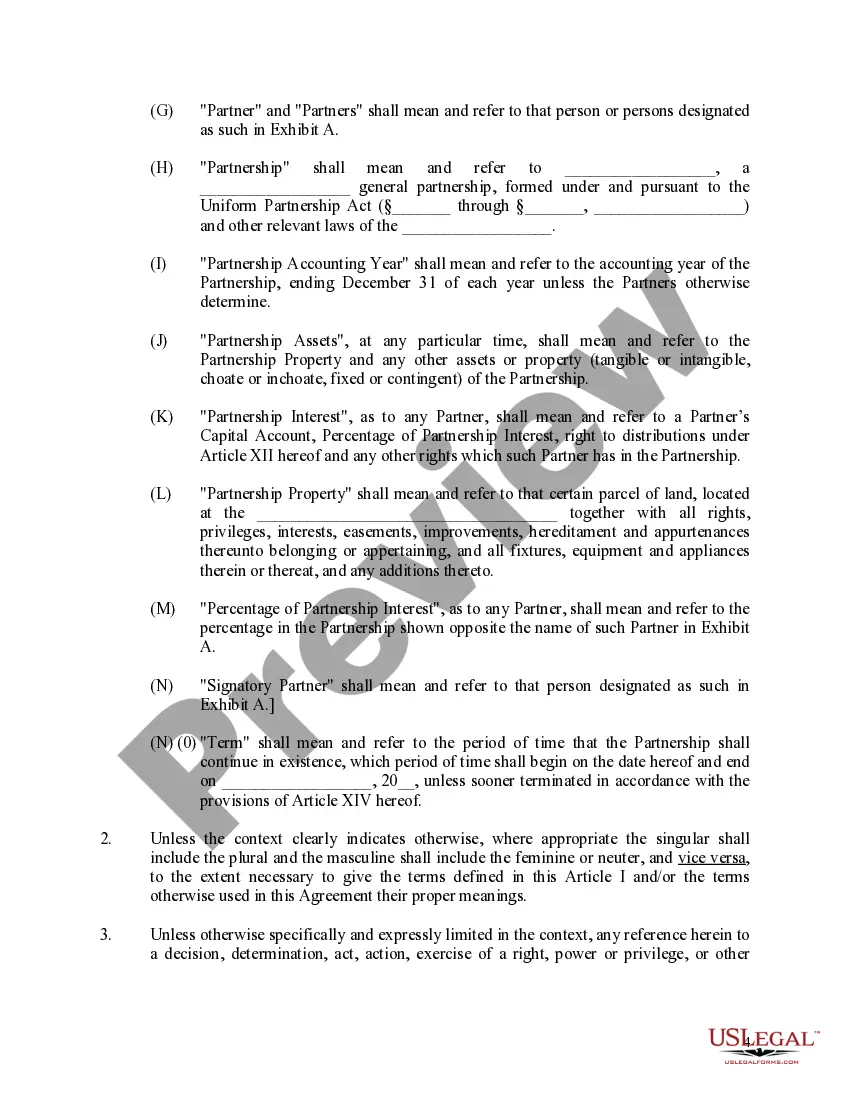

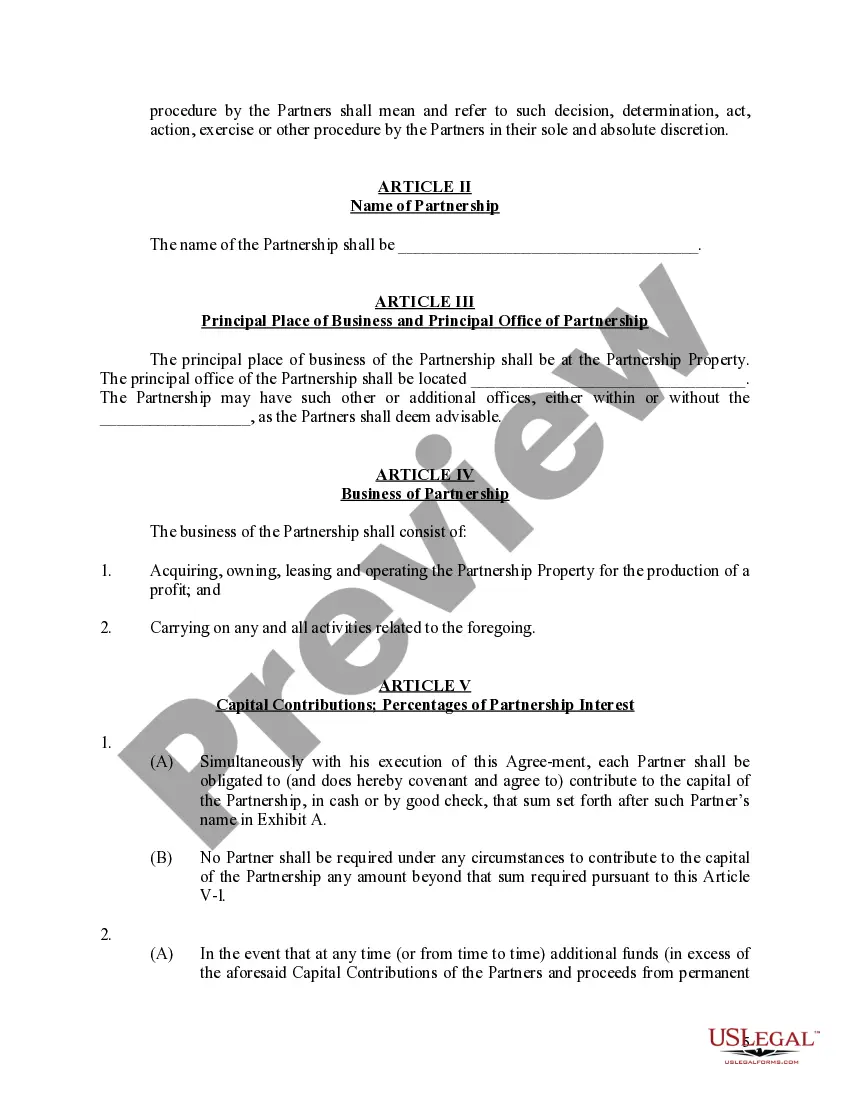

Georgia General Partnership for Business is a legal structure that allows two or more individuals or entities to engage in a business venture together. This type of partnership is based on a written or oral agreement and does not require formal registration with the state. However, it is highly recommended having a written partnership agreement to avoid future conflicts. In a Georgia General Partnership, each partner shares equal responsibility, liability, and authority in managing the business. This means that all partners contribute to the business operations, including investment, decision-making, and sharing profits and losses. It is crucial for partners to establish clear roles and responsibilities to ensure smooth functioning of the partnership. When establishing a Georgia General Partnership for Business, there are certain keywords to keep in mind: 1. Partnership Agreement: This is a legal document that outlines the rights and obligations of each partner in the general partnership. It should include provisions on profit sharing, decision-making, dispute resolution, and exit strategies. 2. Unlimited Liability: In a general partnership, partners have unlimited personal liability for the partnership's debts and obligations. This means that their personal assets can be used to cover business debts, and they can be held personally responsible for any legal issues arising from the partnership. 3. Shared Authority: All partners have the power to make decisions on behalf of the partnership unless otherwise specified in the partnership agreement. It is crucial to have open communication and consensus-building processes to prevent conflicts and disagreements. 4. Pass-Through Taxation: General partnerships do not pay taxes at the entity level. Instead, the profits or losses of the partnership are "passed through" to the individual partners, who report them on their personal tax returns. 5. Joint and Several liabilities: Partners in a Georgia General Partnership have joint and several liabilities, which means that they are collectively and individually responsible for the partnership's debts and obligations. Creditors can pursue any or all partners to recover their owed amounts. Types of Georgia General Partnership for Business: 1. General Partnership by Default: When two or more people engage in a business activity without any formal partnership agreement, they are automatically considered a general partnership. It is essential to create a written agreement to establish the terms and conditions, as well as clarify the partnership's nature and goals. 2. Limited Liability Partnership (LLP): In Georgia, a general partnership can opt to become an LLP to limit individual partners' liability for the actions of other partners. However, at least one partner must assume unlimited liability, typically referred to as a general partner, while others can have limited liability. 3. Professional Partnership: Certain professions, such as lawyers, doctors, and accountants, can form professional partnerships. These partnerships are subject to additional regulations and licensing requirements imposed by relevant professional bodies. In conclusion, a Georgia General Partnership for Business is a legal structure wherein partners share equal responsibility, liability, and authority in running a business. It is essential to have a partnership agreement, establish clear roles, and understand the risks associated with unlimited personal liability. Additionally, Georgia offers the option for general partnerships to become Laps or professional partnerships based on the specific needs and nature of the business.

Georgia General Partnership for Business

Description

How to fill out General Partnership For Business?

Choosing the right lawful document template can be a have a problem. Naturally, there are tons of themes accessible on the Internet, but how would you get the lawful form you want? Utilize the US Legal Forms site. The services delivers 1000s of themes, such as the Georgia General Partnership for Business, which you can use for business and personal needs. All of the forms are checked out by specialists and meet federal and state requirements.

Should you be already authorized, log in to your bank account and click the Obtain key to find the Georgia General Partnership for Business. Utilize your bank account to appear from the lawful forms you have bought previously. Visit the My Forms tab of your respective bank account and have yet another version from the document you want.

Should you be a new user of US Legal Forms, here are straightforward directions that you should follow:

- Initially, make certain you have selected the appropriate form for your personal metropolis/region. You may look over the shape using the Review key and browse the shape explanation to guarantee it is the best for you.

- In the event the form does not meet your requirements, utilize the Seach field to discover the right form.

- Once you are certain the shape would work, go through the Acquire now key to find the form.

- Pick the rates prepare you would like and type in the necessary information. Build your bank account and pay money for an order utilizing your PayPal bank account or Visa or Mastercard.

- Select the document formatting and download the lawful document template to your gadget.

- Comprehensive, revise and printing and indicator the obtained Georgia General Partnership for Business.

US Legal Forms is the greatest local library of lawful forms that you can find various document themes. Utilize the company to download skillfully-manufactured documents that follow condition requirements.

Form popularity

FAQ

Download and fill out the Transmittal Form Limited Partnership (246) from the Georgia Secretary of State website. Submit the completed Certificate of Limited Partnership, transmittal form, and $110 filing fee to the Secretary of State's Corporations Division.

Create & File RegistrationRegister online. Visit the Secretary of State's online services page. Select create or register a business.Register by mail. Draft the limited partnership's Certificate of Limited Partnership.Register in person. Registering in person provides you with additional expediting options.

General Partnerships (GP) In Georgia, there is no formal filing requirement for general partnerships. All you need is an agreement to run the business with the other partners and you are set.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

While there are no formal filing or registration requirements needed to create a partnership, partnerships must comply with registration, filing, and tax requirements applicable to any business.

A general partnership is a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business.

To form a partnership in Georgia, you should take the following steps:Choose a business name.File a trade name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Easy to establish. Similar to establishing a sole proprietorship, you don't need to file any forms with the state to start a general partnership; all you need is a verbal agreement with your partners. Because you don't have to file paperwork, setting up a general partnership is relatively inexpensive.

A general partnership must satisfy the following conditions: The partnership must minimally include two people. All partners must agree to any liability that their partnership may incur. The partnership should ideally be memorialized in a formal written partnership agreement, though oral agreements are valid.

All partnerships, corporations, and LLCs that are registering with the Department must register as a new business using the Georgia Tax Center (GTC). Sole Proprietors have a different registration process.