Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

Georgia Insurers Rehabilitation and Liquidation Model Act

Description

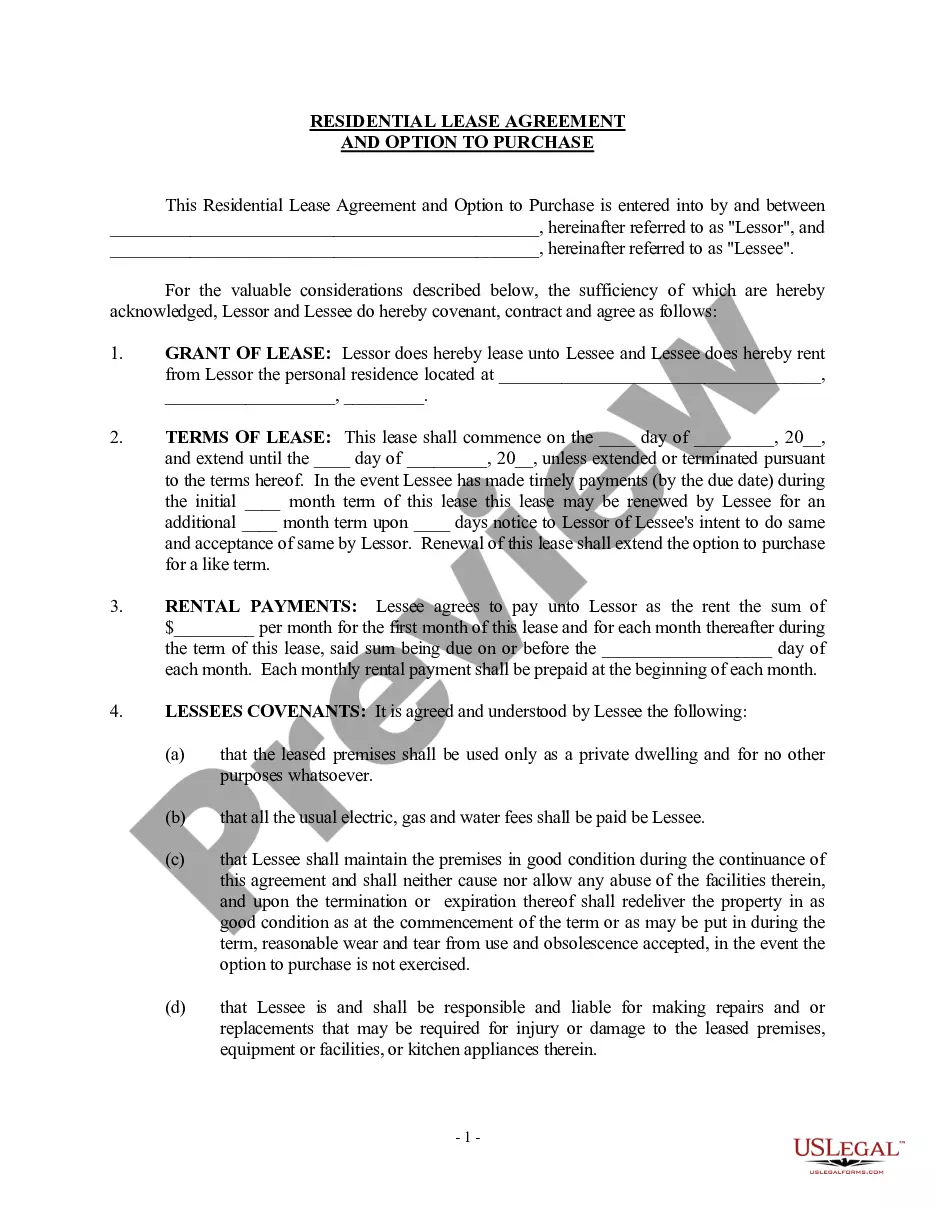

How to fill out Insurers Rehabilitation And Liquidation Model Act?

Are you currently in a position in which you need to have paperwork for possibly business or personal uses nearly every working day? There are plenty of legitimate papers web templates available on the net, but locating versions you can depend on isn`t effortless. US Legal Forms offers a huge number of develop web templates, like the Georgia Insurers Rehabilitation and Liquidation Model Act, which can be published in order to meet federal and state specifications.

In case you are already knowledgeable about US Legal Forms web site and possess your account, simply log in. Next, you may acquire the Georgia Insurers Rehabilitation and Liquidation Model Act format.

Should you not come with an account and would like to begin to use US Legal Forms, adopt these measures:

- Get the develop you require and ensure it is for the correct area/area.

- Use the Review key to review the shape.

- Browse the description to ensure that you have chosen the right develop.

- If the develop isn`t what you are looking for, utilize the Look for industry to obtain the develop that fits your needs and specifications.

- Whenever you obtain the correct develop, click on Purchase now.

- Opt for the prices program you desire, submit the desired info to make your bank account, and pay for the order with your PayPal or charge card.

- Choose a practical document structure and acquire your version.

Find every one of the papers web templates you possess bought in the My Forms menus. You can get a more version of Georgia Insurers Rehabilitation and Liquidation Model Act any time, if required. Just go through the needed develop to acquire or print out the papers format.

Use US Legal Forms, by far the most considerable assortment of legitimate types, to save lots of efforts and stay away from blunders. The services offers expertly produced legitimate papers web templates that can be used for a selection of uses. Generate your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

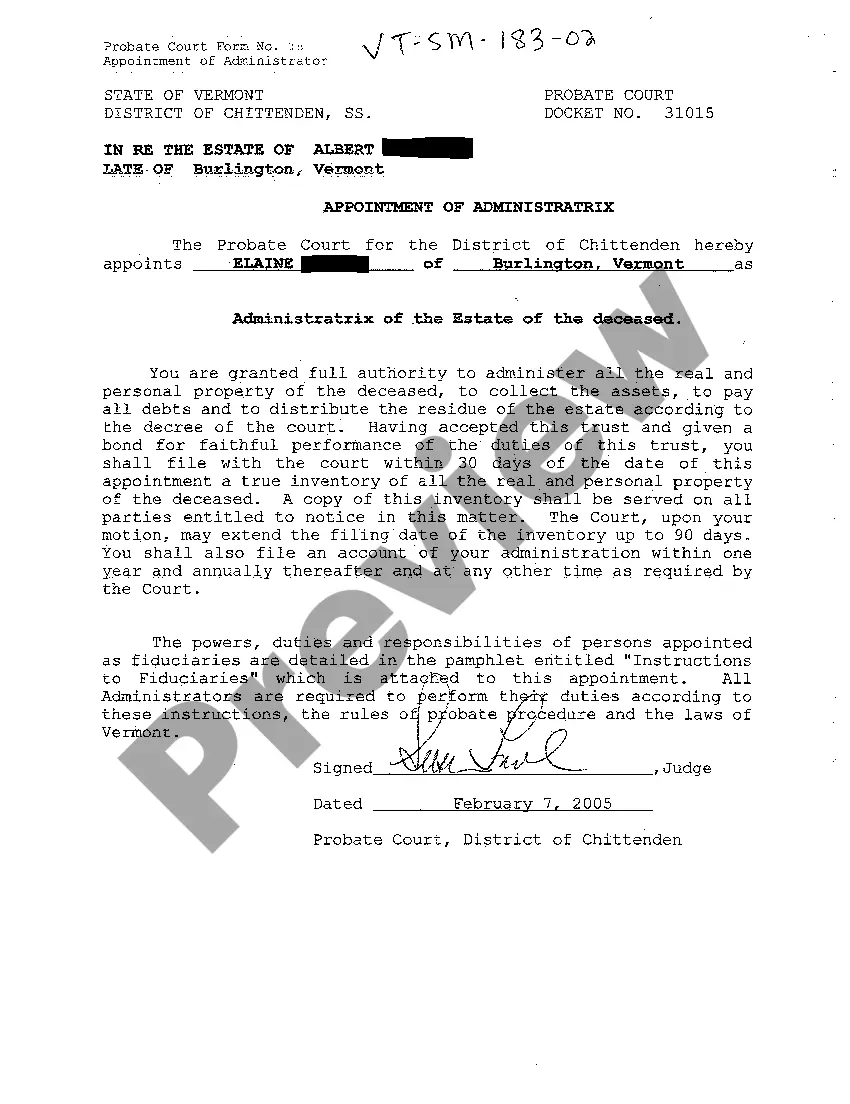

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

Rehabilitation is a court supervised process intended to remedy the company's financial deterioration for the benefit of policyholders and creditors. The Rehabilitator is charged with the protection of the company's policyholders, creditors and the public.

"Liquidation" is the process whereby the Commissioner, upon a Superior Court's order, terminates an insurance company's insurance business by canceling all insurance policies and by not issuing any new or renewal policies.

Every insurer authorized to write property or casualty insurance policies in this state shall be a mem- ber of the insolvency pool and shall be liable for assessments pursuant to Code Section 33-36-7 and shall also be responsible for the other obligations imposed pursuant to this chapter.

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).

"Liquidation" is the process whereby the Commissioner, upon a Superior Court's order, terminates an insurance company's insurance business by canceling all insurance policies and by not issuing any new or renewal policies.

When a company becomes insolvent, meaning that it can no longer meet its financial obligations, it undergoes liquidation. Liquidation is the process of closing a business and distributing its assets to claimants. The sale of assets is used to pay creditors and shareholders in the order of priority.