Georgia Comprehensive Special Tax Notice Regarding Plan Payments is a document that provides important information regarding tax rules and regulations related to plan payments in the state of Georgia. This notice is particularly relevant for individuals who are enrolled in comprehensive special tax plans and are required to make regular payments toward their plan. The purpose of this notice is to ensure that participants of comprehensive special tax plans understand their tax obligations and the impact of these payments on their overall tax situation. By providing detailed information about plan payments, this notice helps Georgia residents make informed decisions and fulfill their tax obligations effectively. Some key topics covered in the Georgia Comprehensive Special Tax Notice Regarding Plan Payments include: 1. Plan Payment Overview: This section provides a brief explanation of the purpose and requirements of comprehensive special tax plans in Georgia. It outlines the obligations of plan participants and the importance of making timely and accurate plan payments. 2. Payment Calculation: The notice offers a detailed explanation of how plan payments are calculated, taking into account various factors such as income, deductions, and tax credits. Participants can find instructions on how to determine the correct payment amount to be made. 3. Payment Schedule: This section outlines the frequency and due dates for plan payments. It emphasizes the importance of adhering to the specified schedule to avoid penalties or additional charges. 4. Tax Consequences: The notice highlights the tax implications associated with plan payments. It explains how these payments affect an individual's overall tax liability, potential deductions, and eligibility for tax credits. Participants are advised to consult with a tax professional for personalized guidance. 5. Exceptional Circumstances: In cases where participants encounter financial hardships or unforeseen circumstances, the notice provides information on the possibility of requesting an adjustment to their plan payments. It outlines the required documentation and procedures for making such adjustments. It is important to note that variations of the Georgia Comprehensive Special Tax Notice Regarding Plan Payments may exist, tailored to specific tax plans or situations. Some common types include the Georgia Comprehensive Special Tax Notice for Income-Based Plans, Georgia Comprehensive Special Tax Notice for Property-Based Plans, and Georgia Comprehensive Special Tax Notice for Business-Related Plans. These variations address specific aspects of the tax plans and cater to the unique needs of different participants. In conclusion, the Georgia Comprehensive Special Tax Notice Regarding Plan Payments is an essential document that informs plan participants about their tax obligations and responsibilities. By providing comprehensive information on calculations, schedules, consequences, and potential adjustments, this notice ensures that participants understand the importance of timely and accurate plan payments.

Georgia Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out Georgia Comprehensive Special Tax Notice Regarding Plan Payments?

US Legal Forms - one of many biggest libraries of authorized forms in America - delivers a variety of authorized record templates you are able to acquire or print. Utilizing the web site, you can get a huge number of forms for business and specific purposes, categorized by categories, states, or search phrases.You will discover the most recent versions of forms like the Georgia Comprehensive Special Tax Notice Regarding Plan Payments within minutes.

If you currently have a monthly subscription, log in and acquire Georgia Comprehensive Special Tax Notice Regarding Plan Payments from your US Legal Forms library. The Acquire button will show up on every single form you see. You have accessibility to all formerly saved forms in the My Forms tab of your own accounts.

In order to use US Legal Forms initially, allow me to share simple guidelines to help you started off:

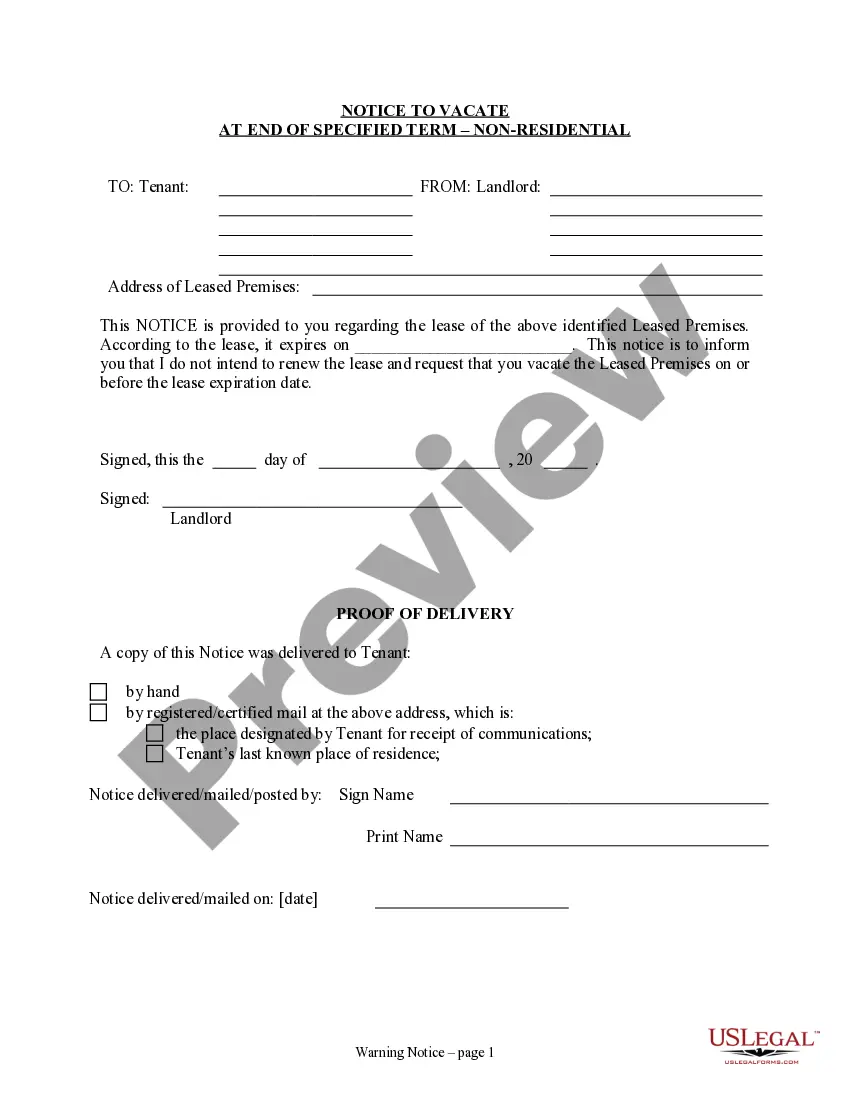

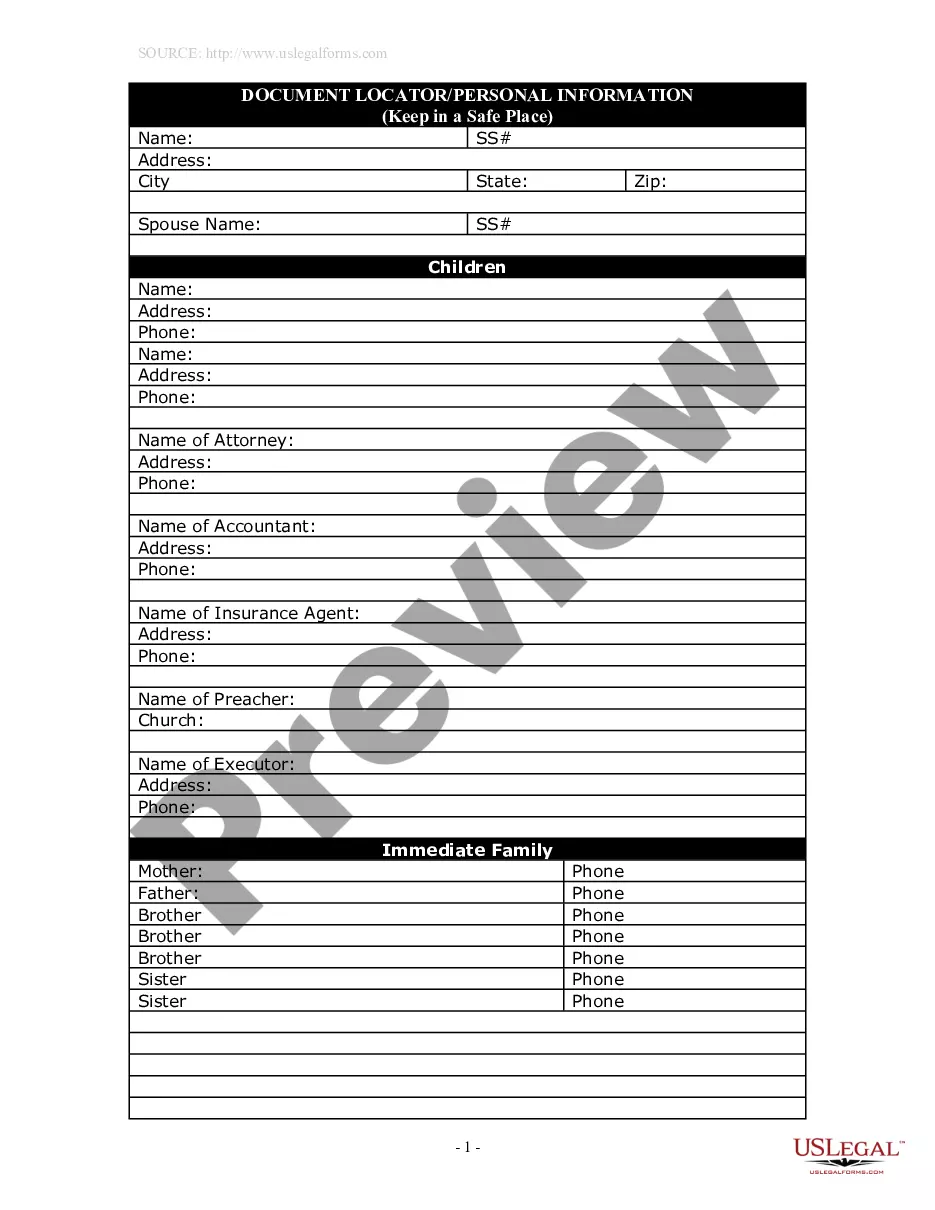

- Ensure you have picked out the best form for the area/region. Click on the Review button to examine the form`s content. Look at the form description to actually have selected the correct form.

- If the form doesn`t fit your requirements, take advantage of the Research discipline on top of the screen to find the one that does.

- In case you are satisfied with the form, affirm your option by clicking the Acquire now button. Then, select the costs prepare you prefer and offer your references to sign up for an accounts.

- Method the transaction. Make use of your charge card or PayPal accounts to perform the transaction.

- Pick the file format and acquire the form in your system.

- Make adjustments. Fill up, change and print and sign the saved Georgia Comprehensive Special Tax Notice Regarding Plan Payments.

Each design you added to your bank account lacks an expiration day which is your own for a long time. So, if you would like acquire or print one more copy, just go to the My Forms portion and then click about the form you want.

Gain access to the Georgia Comprehensive Special Tax Notice Regarding Plan Payments with US Legal Forms, the most comprehensive library of authorized record templates. Use a huge number of expert and express-particular templates that meet up with your business or specific requires and requirements.

Form popularity

FAQ

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

Part of the rationale for the special tax treatment on long-term capital gains, is to act as an incentive and reward for risking capital. To repeal or diminish this special treatment would serve as a penalty for taking risks.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

Under the special rule, the net unrealized appreciation on the stock included in the earnings in the payment will not be taxed when distributed to you from the Plan and will be taxed at capital gain rates when you sell the stock.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.