Georgia Determining Self-Employed Independent Contractor Status In Georgia, as in many other states, it is crucial for both employers and workers to accurately determine the employment status of individuals. This determination ensures compliance with labor laws and helps determine tax obligations. Georgia follows the general principles established by the Internal Revenue Service (IRS) in determining whether an individual is considered a self-employed independent contractor or an employee. Key Factors in Determining Self-Employed Independent Contractor Status in Georgia: 1. Behavioral Control: An important factor in determining employment status is the level of control the employer has over the worker. If the employer has the right to control what the worker does, when, and how they do it, the worker is likely an employee. Conversely, if the worker has more control over the work processes and methods, they are more likely to be considered a self-employed independent contractor. 2. Financial Control: Another crucial aspect is the degree of financial control exercised by the worker. Independent contractors typically have the freedom to make a profit or suffer a loss based on their business decisions. They often invest in their own tools, equipment, or materials required to perform the job. On the other hand, employees are generally provided with the necessary tools and materials by their employers. 3. Type of Relationship: The overall nature of the working relationship is also a key factor. If the worker receives benefits such as health insurance, retirement plans, or paid leave, they are more likely to be classified as employees. Independent contractors, on the other hand, do not typically receive these benefits. The presence of a written contract specifying the intentions of both parties can also be influential in determining the worker's status. Different types of self-employed independent contractor status in Georgia: 1. Gig Workers and Freelancers: Individuals who take on short-term, project-based work independently are often considered self-employed independent contractors. This category includes freelancers, consultants, and those working in the gig economy, such as ride-share drivers or delivery personnel. 2. Professional Service Providers: Individuals who provide specialized professional services, such as doctors, lawyers, accountants, or architects, may often work as self-employed independent contractors, offering their expertise on a contractual basis to various clients or organizations. 3. Tradespeople and Skilled Workers: Skilled workers, such as carpenters, electricians, plumbers, and painters, who operate their own businesses and provide services to different clients or contractors, are commonly categorized as self-employed independent contractors. It is worth noting that accurately determining employment status is essential for compliance with tax obligations, eligibility for certain benefits, and adherence to labor laws. Employers and workers in Georgia are advised to consult legal professionals or refer to the Georgia Department of Labor for further guidance and specific criteria regarding self-employed independent contractor status.

Georgia Determining Self-Employed Independent Contractor Status

Description

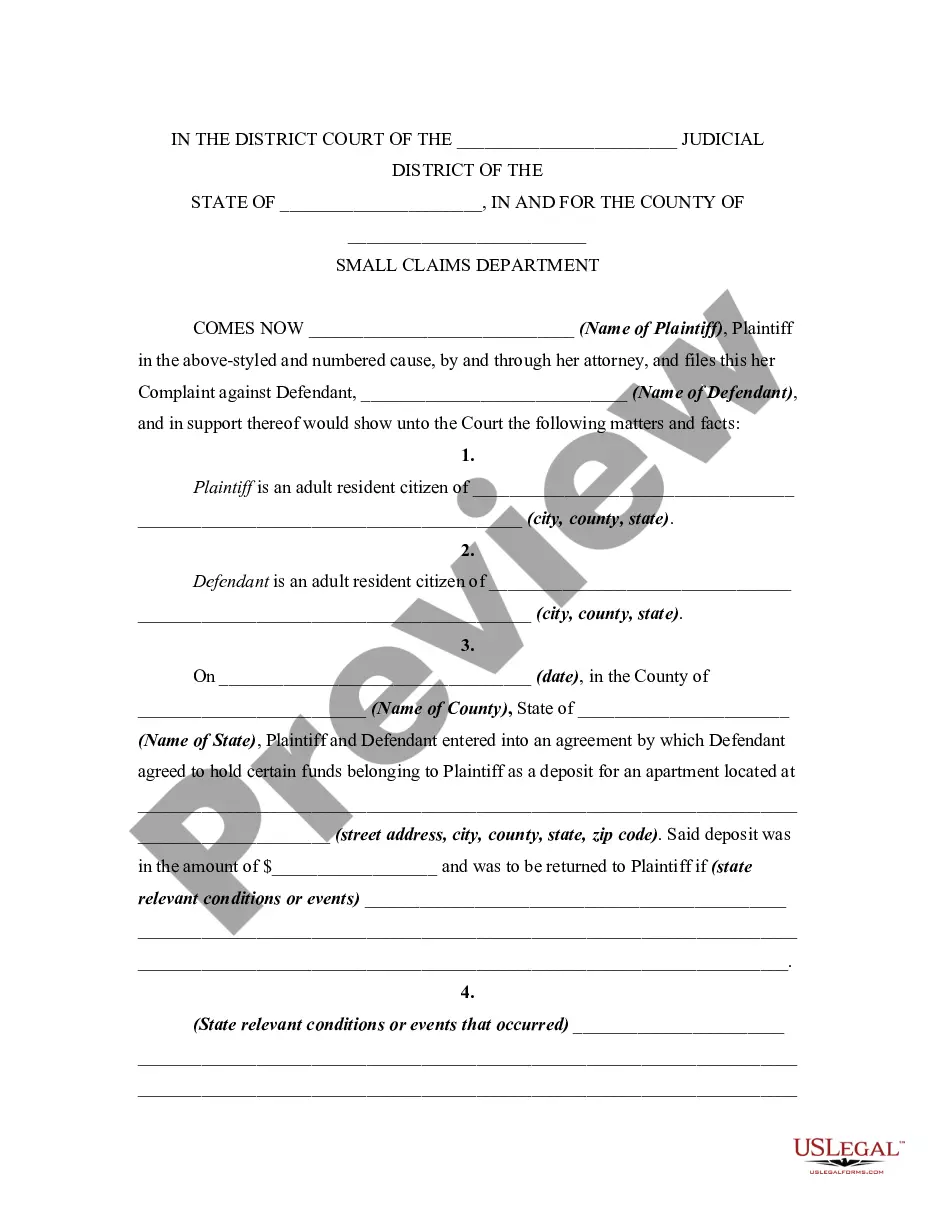

How to fill out Georgia Determining Self-Employed Independent Contractor Status?

You may spend several hours on-line attempting to find the lawful record web template that meets the state and federal demands you want. US Legal Forms provides thousands of lawful varieties which are evaluated by experts. It is simple to acquire or printing the Georgia Determining Self-Employed Independent Contractor Status from my service.

If you already have a US Legal Forms accounts, you can log in and click on the Obtain button. Afterward, you can comprehensive, change, printing, or signal the Georgia Determining Self-Employed Independent Contractor Status. Every lawful record web template you purchase is your own property eternally. To acquire another backup for any acquired form, visit the My Forms tab and click on the corresponding button.

If you use the US Legal Forms website the first time, follow the basic recommendations under:

- Initially, make certain you have chosen the proper record web template for that area/city of your choice. Browse the form explanation to make sure you have selected the appropriate form. If offered, use the Review button to appear with the record web template as well.

- If you would like locate another variation of the form, use the Lookup area to obtain the web template that meets your requirements and demands.

- Once you have found the web template you want, click Get now to carry on.

- Select the prices prepare you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your charge card or PayPal accounts to pay for the lawful form.

- Select the structure of the record and acquire it to your product.

- Make alterations to your record if needed. You may comprehensive, change and signal and printing Georgia Determining Self-Employed Independent Contractor Status.

Obtain and printing thousands of record web templates making use of the US Legal Forms site, which provides the largest selection of lawful varieties. Use professional and status-distinct web templates to handle your business or specific requires.

Form popularity

FAQ

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

An independent contractor is a worker who contracts services to a business. An independent contractor, also known as a "1099 contractor," is not an employee even though he or she provides services to the employer.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To receive your contractors license, you will need to pass your licensing exams. A Georgia Contractors License requires two exams to be passed: the Construction Exam and the Business and Law exam. This is for residential light commercial, residential, and general contractors.

For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors. To determine whether a person is an employee or an independent contractor, the company weighs factors to identify the degree of control it has in the relationship with the person.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.