Title: Understanding the "Georgia Sample Before" Adverse Action Letter": Types and Detailed Description Introduction: When it comes to adverse actions taken against an individual based on their background or credit history, the "Georgia Sample Before" Adverse Action Letter plays a crucial role. This document serves as a legal notification to the affected individual, informing them of the reason behind the adverse action, such as denial of credit, employment, or housing opportunities. In this article, we will provide a comprehensive overview of the Georgia Sample Before Adverse Action Letter, its purpose, and highlight various types of adverse actions mandated by Georgia law. 1. What is a Georgia Sample Before Adverse Action Letter? The Georgia Sample Before Adverse Action Letter is a legal document that allows employers, landlords, or lenders to inform individuals about adverse actions taken against them based on their background check or credit report. It serves as a required notification under Georgia's Fair Business Practices Act and provides the recipient an opportunity to address any errors, dispute information, or offer an explanation. 2. Key Elements of a Georgia Sample Before Adverse Action Letter: a. Clear identification of the recipient: The letter should clearly identify the person affected by the adverse action. b. Explanation of the adverse action: The letter should outline the specific reasons why the adverse action has been taken, such as employment denial, credit denial, or housing denial. c. Disclosure of the source: The letter must disclose the source of the information used to make the adverse decision, which could be a credit reporting agency, tenant screening company, or background check provider. d. Contact information: The letter should include the name, address, and contact information of the entity responsible for the adverse action, allowing the recipient to inquire or dispute the decision. e. Reference to the Fair Credit Reporting Act (FCRA): The Georgia Sample Before Adverse Action Letter often references the FCRA, which provides additional rights and processes for the individual receiving the letter. 3. Types of Georgia Sample Before Adverse Action Letters: a. Employment Adverse Action Letter: Employers in Georgia may send this letter to individuals when taking adverse actions, such as declining their job application, promoting them, or terminating their employment due to background or credit check findings. b. Credit Adverse Action Letter: Creditors or financial institutions may use this letter to notify individuals of their credit denial, unfavorable loan terms, or credit limit reductions based on negative credit history. c. Housing Adverse Action Letter: Landlords or property management companies may send this letter to inform individuals of their rental application denial, termination of their lease, or denial of housing opportunities due to negative background or credit check results. Conclusion: In compliance with Georgia's Fair Business Practices Act, the Georgia Sample Before Adverse Action Letter is a crucial document protecting the rights of individuals subjected to adverse actions. By providing a detailed explanation of the adverse action and offering an opportunity to address any inaccuracies, this letter ensures transparency and fairness in the decision-making process. Employers, creditors, and landlords must adhere to the guidelines outlined in this letter to avoid noncompliance and potential legal consequences.

Georgia Sample "Before" Adverse Action Letter

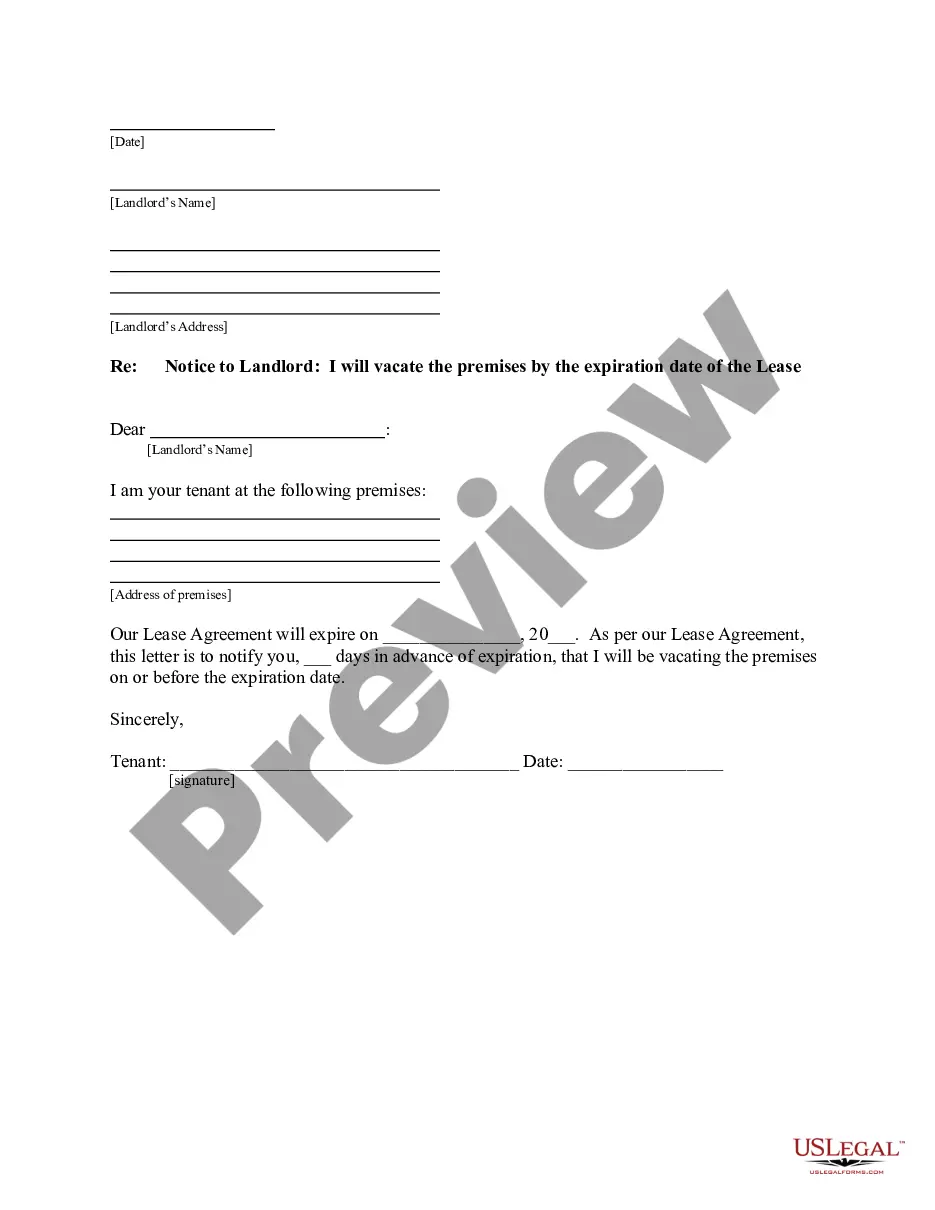

Description

How to fill out Georgia Sample "Before" Adverse Action Letter?

Discovering the right legal record web template might be a have a problem. Needless to say, there are tons of layouts available on the net, but how do you obtain the legal type you want? Take advantage of the US Legal Forms website. The service delivers 1000s of layouts, like the Georgia Sample Before" Adverse Action Letter", which you can use for enterprise and personal demands. All the varieties are checked out by experts and fulfill state and federal demands.

When you are previously authorized, log in for your accounts and click on the Download key to get the Georgia Sample Before" Adverse Action Letter". Use your accounts to look from the legal varieties you have purchased previously. Proceed to the My Forms tab of your respective accounts and get one more version of the record you want.

When you are a new user of US Legal Forms, listed below are easy directions that you should stick to:

- Very first, ensure you have chosen the right type to your area/county. You may look over the form utilizing the Review key and browse the form outline to ensure this is the best for you.

- In case the type is not going to fulfill your expectations, take advantage of the Seach industry to obtain the appropriate type.

- Once you are certain the form is acceptable, select the Get now key to get the type.

- Select the rates prepare you would like and type in the essential details. Build your accounts and purchase the order utilizing your PayPal accounts or charge card.

- Opt for the document structure and download the legal record web template for your device.

- Complete, modify and printing and indicator the received Georgia Sample Before" Adverse Action Letter".

US Legal Forms is definitely the biggest collection of legal varieties for which you will find a variety of record layouts. Take advantage of the company to download professionally-created files that stick to status demands.