Georgia Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 is a crucial document used in bankruptcy cases in the state of Georgia. This form is specifically designed to outline the monthly expenses of individual debtors, providing an overview of their financial situation to the court and creditors. It helps gauge the debtor's ability to repay debts and assists in determining the appropriate bankruptcy plan. The Georgia Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 contains various sections to categorize and report different types of expenditures. These may include but are not limited to: 1. Housing Expenses: This section captures details regarding the debtor's mortgage or rent payments, property taxes, homeowners' association fees, home insurance, and necessary maintenance or repairs. It is important to provide accurate information about the current market rates and norms for similar properties in the debtor's area. 2. Utilities: This segment includes monthly expenses for electricity, gas, water, garbage collection, and any other essential utility bills. 3. Transportation: Debtors need to disclose their vehicle-related expenses like monthly car payments, insurance premiums, fuel costs, vehicle maintenance, and public transportation expenses if applicable. 4. Food, Clothing, and Personal Care: This section encompasses monthly expenses for groceries, dining out, clothing, shoes, personal care products, and services like haircuts or spa treatments. 5. Medical and Health Care: Debtors must list all medical and health-related expenses, including health insurance premiums, prescription medications, doctor visits, dental care, and any other out-of-pocket medical costs. 6. Insurance: This category covers insurance policies other than home or vehicle insurance, such as life insurance, disability insurance, and any other necessary types of coverage. 7. Taxes: Debtors are required to report their state and federal income tax obligations, along with any other applicable taxes, such as personal property taxes. 8. Domestic Support Obligations: If the debtor is responsible for paying child support, spousal support, or any other domestic support obligations, this section should provide accurate details about the payments. 9. Expenses for Operation of a Business, Profession, or Farm: This section is only applicable if the debtor operates a business, profession, or farm, and outlines the necessary monthly expenses associated with maintaining and running those ventures. 10. Charitable Contributions: If the debtor regularly contributes to recognized charitable organizations, this section should include an accurate representation of those expenses. It's important to note that every debtor's financial situation is unique, and the specific expenses listed on Georgia Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 will vary accordingly. Debtors must provide truthful and complete information to ensure a fair assessment of their financial standing during bankruptcy proceedings.

Georgia Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Georgia Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

You are able to invest time on the Internet trying to find the authorized file design which fits the state and federal needs you want. US Legal Forms offers a huge number of authorized kinds that are reviewed by pros. It is possible to download or print out the Georgia Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 from the support.

If you have a US Legal Forms accounts, you are able to log in and then click the Acquire option. Following that, you are able to full, change, print out, or indication the Georgia Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005. Each and every authorized file design you purchase is your own property forever. To obtain an additional duplicate of the purchased type, check out the My Forms tab and then click the related option.

If you use the US Legal Forms internet site for the first time, follow the simple guidelines below:

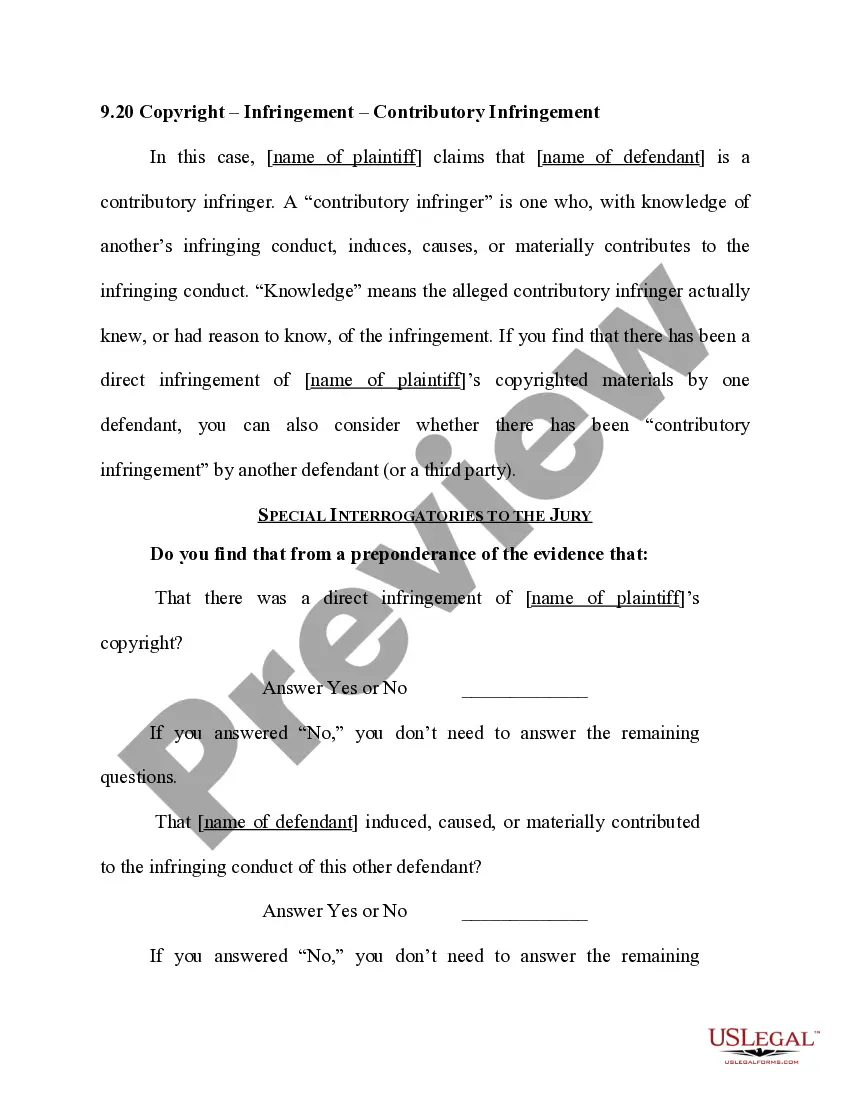

- First, be sure that you have chosen the proper file design for that county/town of your liking. Read the type information to make sure you have picked the correct type. If offered, make use of the Review option to look with the file design at the same time.

- In order to locate an additional variation of your type, make use of the Lookup discipline to get the design that meets your requirements and needs.

- Upon having discovered the design you would like, click Buy now to continue.

- Find the prices program you would like, key in your references, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You should use your charge card or PayPal accounts to fund the authorized type.

- Find the structure of your file and download it to your gadget.

- Make modifications to your file if necessary. You are able to full, change and indication and print out Georgia Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

Acquire and print out a huge number of file templates utilizing the US Legal Forms site, which offers the greatest assortment of authorized kinds. Use professional and condition-particular templates to deal with your business or person needs.