The Georgia Stock Purchase Assistance Plan is a comprehensive program offered by Gilbert Associates, Inc. to assist individuals and businesses in acquiring stocks in the state of Georgia. This plan aims to promote investment opportunities and economic growth in Georgia by providing financial assistance and support to potential stockholders. There are several types of Georgia Stock Purchase Assistance Plans available through Gilbert Associates, Inc., each designed to cater to specific needs and requirements. These plans include: 1. Individual Stock Purchase Assistance: This plan is designed for individuals who are interested in purchasing stocks of Georgia-based companies. It provides assistance in the form of financial advice, market analysis, and connections with reputable stockbrokers. The goal is to guide individuals through the stock acquisition process and help them make informed investment decisions. 2. Business Stock Purchase Assistance: This plan is specifically tailored for businesses looking to expand their portfolios by investing in stocks of Georgia-based companies. It offers expert consultation, strategic planning, and financial resources to facilitate the stock purchase process. By leveraging the expertise of Gilbert Associates, Inc., businesses can navigate the complex stock market and maximize their investment potential. 3. Employee Stock Ownership Plans (Sops): Gilbert Associates, Inc. also offers ESOP services, which allow companies to establish employee stock ownership plans. Sops are employee benefit plans that provide employees with an ownership interest in the company they work for. These plans can enhance employee loyalty, motivation, and engagement while providing a platform for employees to share in the company's growth and success. 4. Stock Purchase Financing Assistance: For those faced with funding challenges, Gilbert Associates, Inc. provides stock purchase financing assistance. This plan helps individuals and businesses secure the necessary capital to invest in Georgia stocks. Through its vast network of financial institutions and investors, Gilbert Associates, Inc. facilitates access to funding options and works closely with clients to develop tailored financing solutions. 5. Stock Market Research and Analysis: Along with the various assistance plans, Gilbert Associates, Inc. also conducts extensive stock market research and analysis. This includes analyzing market trends, evaluating the performance of Georgia-based companies, and identifying potential investment opportunities. The research findings are then shared with clients, enabling them to make well-informed decisions about their stock purchases. The Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc. serves as a vital resource for individuals and businesses, guiding them through the complexities of stock acquisition in Georgia. With its range of assistance plans and expertise, Gilbert Associates, Inc. is committed to fostering economic growth, encouraging investment, and facilitating stock ownership in the state.

Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc.

Description

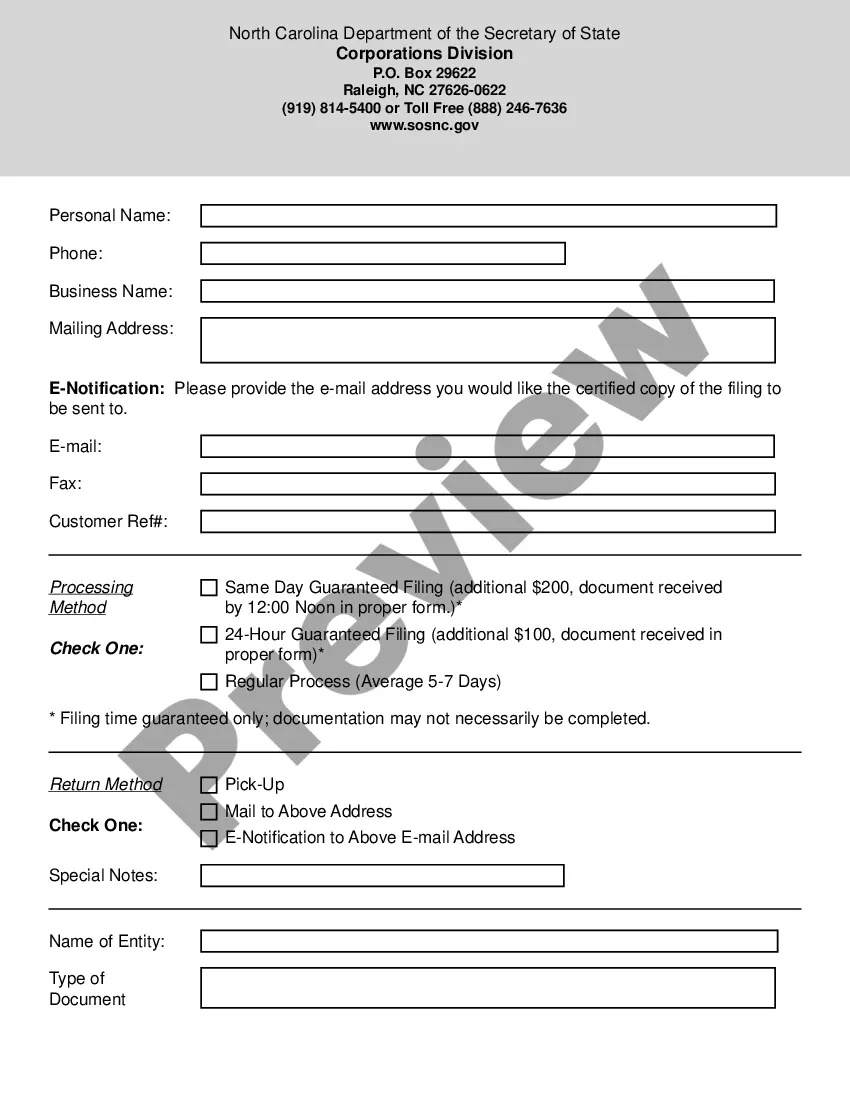

How to fill out Georgia Stock Purchase Assistance Plan Of Gilbert Associates, Inc.?

If you have to full, obtain, or printing legal papers templates, use US Legal Forms, the largest selection of legal types, which can be found online. Make use of the site`s simple and convenient research to find the papers you will need. Different templates for enterprise and personal uses are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc. in just a handful of click throughs.

When you are currently a US Legal Forms customer, log in to your account and click the Download option to get the Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc.. You can also access types you formerly downloaded from the My Forms tab of the account.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form to the proper metropolis/nation.

- Step 2. Use the Review solution to check out the form`s content material. Do not forget about to read the description.

- Step 3. When you are unsatisfied with all the kind, take advantage of the Search area near the top of the monitor to locate other versions of the legal kind format.

- Step 4. After you have located the form you will need, click the Acquire now option. Choose the costs prepare you like and put your qualifications to register for the account.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Choose the file format of the legal kind and obtain it in your gadget.

- Step 7. Total, revise and printing or sign the Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc..

Each and every legal papers format you acquire is yours for a long time. You may have acces to every single kind you downloaded with your acccount. Select the My Forms segment and select a kind to printing or obtain yet again.

Be competitive and obtain, and printing the Georgia Stock Purchase Assistance Plan of Gilbert Associates, Inc. with US Legal Forms. There are millions of expert and state-distinct types you may use for your enterprise or personal needs.