Georgia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

How to fill out Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

Are you currently within a place in which you require documents for sometimes organization or personal purposes just about every time? There are a variety of legal document web templates accessible on the Internet, but finding kinds you can rely is not easy. US Legal Forms offers a large number of type web templates, just like the Georgia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co, which can be written in order to meet state and federal demands.

When you are previously acquainted with US Legal Forms website and have a merchant account, simply log in. After that, it is possible to obtain the Georgia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co web template.

If you do not come with an account and want to begin to use US Legal Forms, adopt these measures:

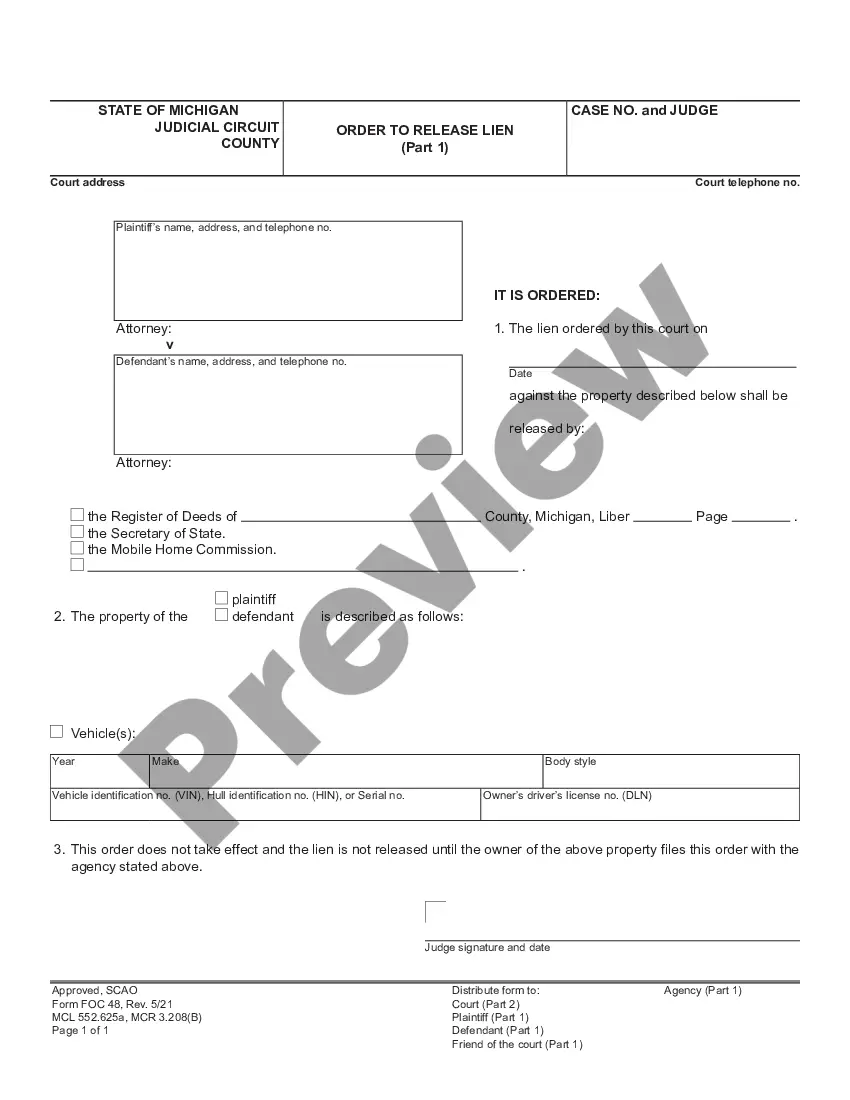

- Obtain the type you need and make sure it is for the right town/region.

- Take advantage of the Review switch to check the shape.

- Read the information to ensure that you have selected the appropriate type.

- In case the type is not what you are searching for, use the Search industry to discover the type that suits you and demands.

- Whenever you find the right type, click Acquire now.

- Select the pricing prepare you would like, complete the required information and facts to make your money, and buy the order with your PayPal or credit card.

- Pick a practical data file file format and obtain your backup.

Find all the document web templates you may have bought in the My Forms food list. You can aquire a extra backup of Georgia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co whenever, if needed. Just go through the essential type to obtain or produce the document web template.

Use US Legal Forms, by far the most considerable assortment of legal types, in order to save time as well as steer clear of errors. The support offers professionally manufactured legal document web templates which can be used for a selection of purposes. Generate a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

A "Merger Sub" is the term given in M&A documents of a new shell company formed by the Acquirer solely to complete its acquisition of a target company.

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

Buying an interest in a subsidiary usually requires a smaller investment on the part of the parent company than a merger would. Also unlike a merger, shareholder approval is not required to purchase or sell a subsidiary.