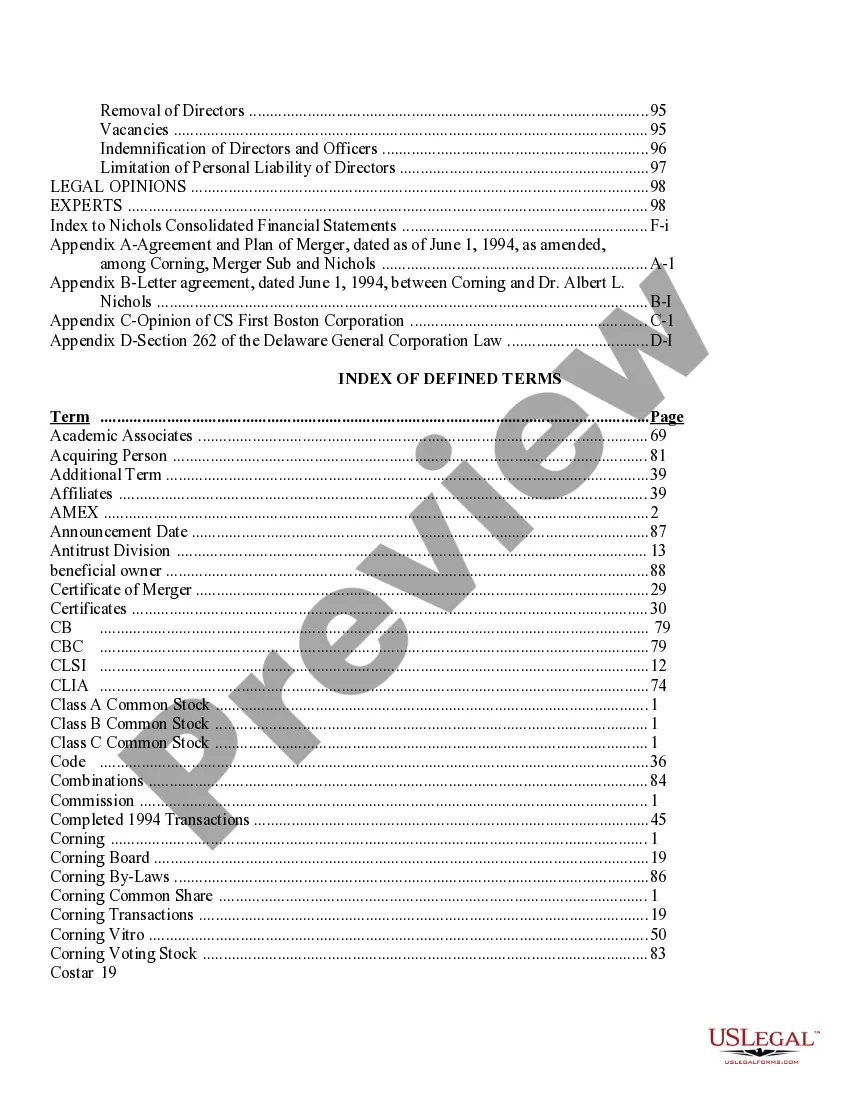

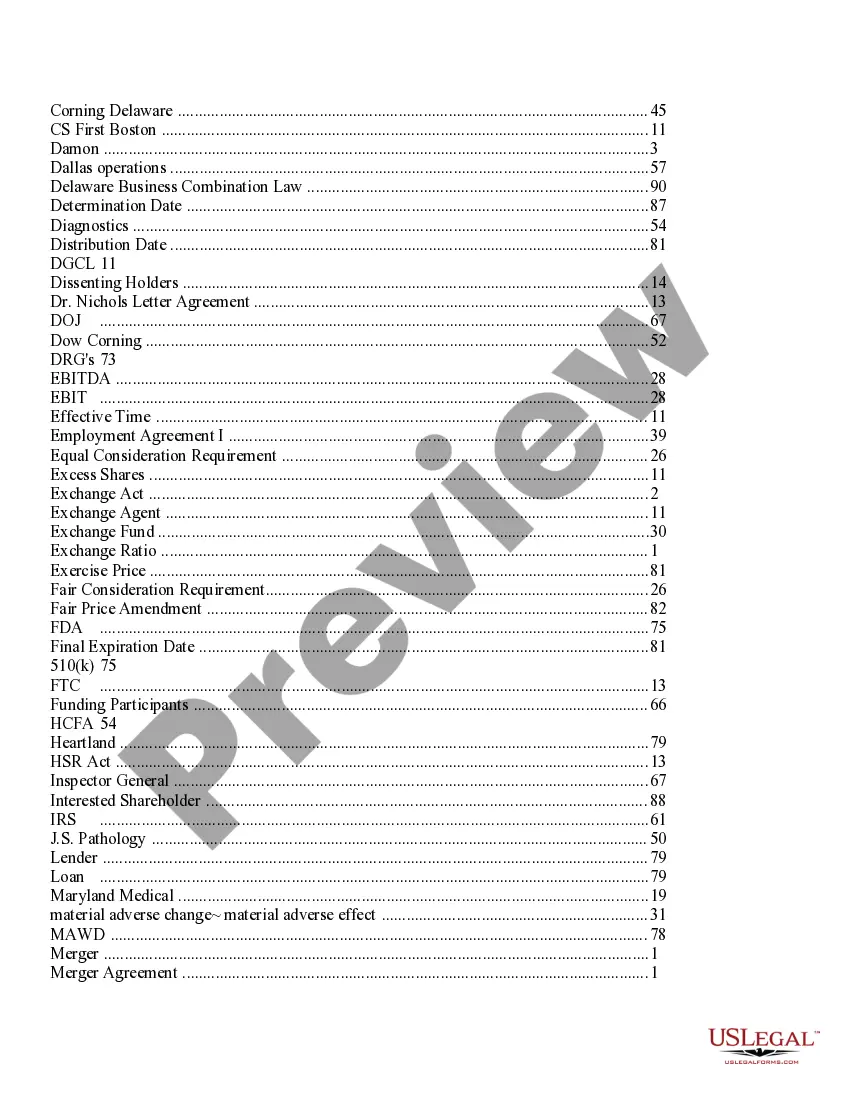

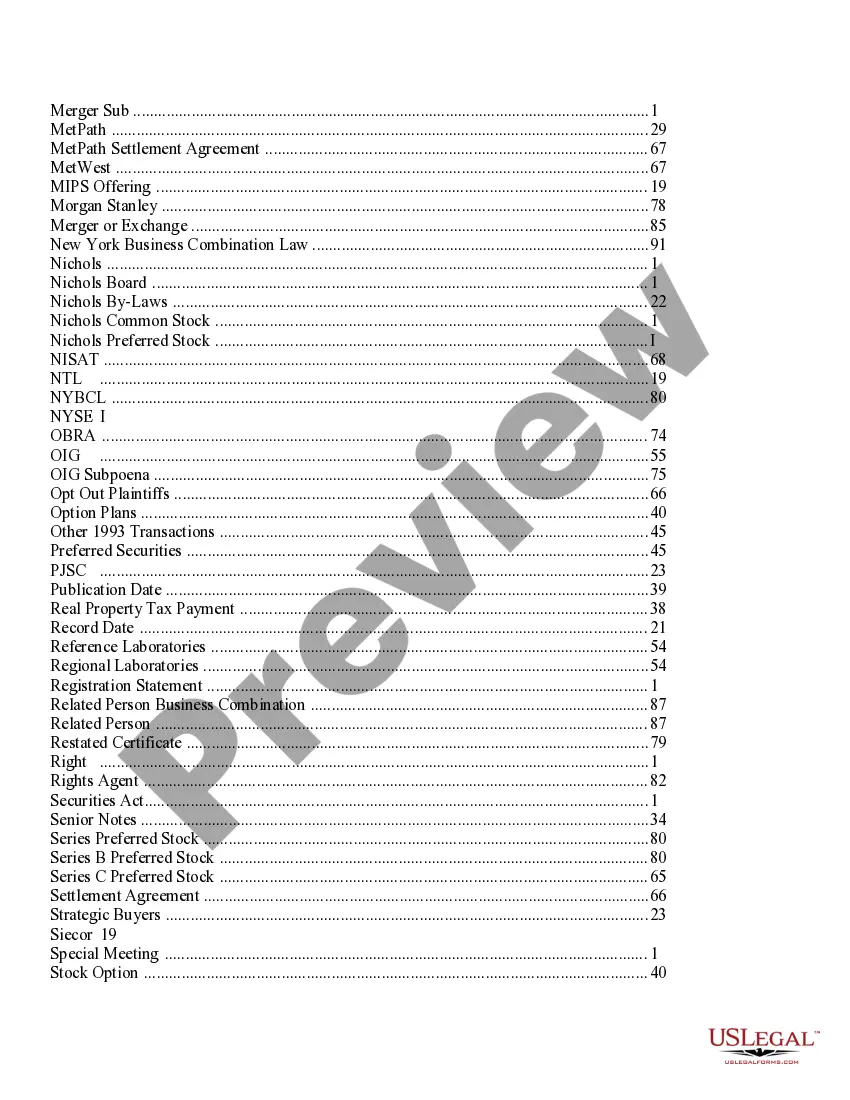

Georgia Proxy Statement — Prospectus of Corning Incorporated provides important information about the company's corporate governance, executive compensation, and other matters that shareholders need to consider before voting in the upcoming annual meeting. A proxy statement is a legal document filed with the Securities and Exchange Commission (SEC) by a publicly traded company to provide shareholders with information necessary for voting on corporate matters. In the Georgia Proxy Statement — Prospectus of Corning Incorporated without appendices, shareholders will find detailed information about the company's board of directors, including their qualifications and experience. The statement outlines the responsibilities and functions of the board, as well as the composition of its committees. This includes details about the board's Audit Committee, Compensation Committee, and Nominating and Governance Committee. Executive compensation plays a crucial role in the proxy statement. It provides a comprehensive breakdown of the compensation packages for Corning Incorporated's top executives, including salaries, bonuses, stock options, and other benefits. Shareholders can assess the alignment of executive pay with the company's performance, as well as compare it to industry benchmarks. Additionally, the Georgia Proxy Statement — Prospectus of Corning Incorporated without appendices covers the company's equity compensation plans, such as stock option plans and employee stock purchase plans. These plans allow employees to purchase company stock at a discounted price, providing an incentive for performance and alignment with shareholder interests. Shareholders can assess the potential dilution of their holdings resulting from these plans. Moreover, the proxy statement details any shareholder proposals submitted for consideration at the annual meeting. It provides information about the proponents of these proposals and the company's response to each proposal. Shareholders can review the arguments for and against these proposals to make an informed decision when voting. It is important to note that Georgia Proxy Statement — Prospectus of Corning Incorporated without appendices may vary in content depending on the specific year or circumstances. Each year, as new information arises or regulations change, the company may update the proxy statement accordingly. Therefore, it is advisable for shareholders to carefully review each year's proxy statement to stay informed about the most recent developments related to Corning Incorporated's corporate governance and executive compensation practices. In summary, the Georgia Proxy Statement — Prospectus of Corning Incorporated without appendices provides shareholders with essential information to make informed voting decisions. It covers topics such as corporate governance, executive compensation, equity compensation plans, and shareholder proposals. By reviewing this document, shareholders can better understand Corning Incorporated's operations and determine whether they align with their investment objectives.

Georgia Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out Georgia Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Choosing the right lawful record format might be a struggle. Naturally, there are plenty of web templates available on the net, but how can you obtain the lawful form you want? Use the US Legal Forms site. The assistance gives 1000s of web templates, for example the Georgia Proxy Statement - Prospectus of Corning Incorporated without appendices, which can be used for organization and private needs. Every one of the varieties are checked out by pros and meet state and federal requirements.

Should you be previously registered, log in in your accounts and click on the Obtain switch to have the Georgia Proxy Statement - Prospectus of Corning Incorporated without appendices. Make use of your accounts to look through the lawful varieties you may have bought earlier. Go to the My Forms tab of the accounts and acquire one more duplicate from the record you want.

Should you be a whole new user of US Legal Forms, listed here are easy recommendations for you to stick to:

- Initial, make sure you have selected the right form for your city/area. You are able to look over the form while using Preview switch and study the form outline to ensure it is the best for you.

- When the form does not meet your needs, utilize the Seach field to get the right form.

- Once you are sure that the form would work, click the Purchase now switch to have the form.

- Choose the prices prepare you desire and enter the needed info. Make your accounts and buy your order using your PayPal accounts or bank card.

- Choose the submit formatting and down load the lawful record format in your gadget.

- Comprehensive, revise and printing and indication the acquired Georgia Proxy Statement - Prospectus of Corning Incorporated without appendices.

US Legal Forms is definitely the largest catalogue of lawful varieties where you can discover a variety of record web templates. Use the service to down load skillfully-made documents that stick to express requirements.