A Georgia Stock Option Plan is a comprehensive employee benefit plan that allows a company to grant employees various types of stock options. These options include Incentive Stock Options (SOS), Nonqualified Stock Options (SOS), and Exchange Options. Let's explore each type of option in more detail: 1. Incentive Stock Options (SOS): These options are usually offered to key employees or top executives and provide favorable tax treatment. SOS can only be granted to employees and have strict eligibility requirements. They offer the potential for long-term capital gains tax rates on the eventual sale of the stock. 2. Nonqualified Stock Options (SOS): SOS are more flexible in terms of eligibility and can be granted to any employee, including executives, directors, and consultants. Unlike SOS, SOS do not have to meet specific tax qualification criteria, allowing companies greater flexibility in granting options. However, SOS are subject to ordinary income tax rates upon exercise. 3. Exchange Options: Exchange options provide an innovative feature within a Georgia Stock Option Plan. These options allow employees to exchange their existing stock options for new options with different terms or strike prices. This enables employees to potentially reconfigure their stock holdings to align better with their investment objectives or market conditions. Georgia Stock Option Plans are designed to incentivize employees and align their interests with the company's performance and growth. They offer a valuable benefit for employees, as they provide the opportunity to participate in the company's success and potentially share in its financial rewards. By granting stock options, companies can motivate and retain talented individuals while fostering a sense of ownership and commitment among employees. Companies in Georgia may choose to customize their Stock Option Plans based on their specific needs and objectives. They can design plans that are tailored to different employee groups or roles within the organization. The flexibility of Georgia Stock Option Plans allows companies to attract and retain top talent by offering incentives that align with employees' interests and goals. In summary, a Georgia Stock Option Plan is a comprehensive employee benefit plan that includes various types of stock options, such as Incentive Stock Options (SOS), Nonqualified Stock Options (SOS), and Exchange Options. These options provide employees with the opportunity to participate in the company's success and financial growth while aligning their interests with the company's objectives.

Georgia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

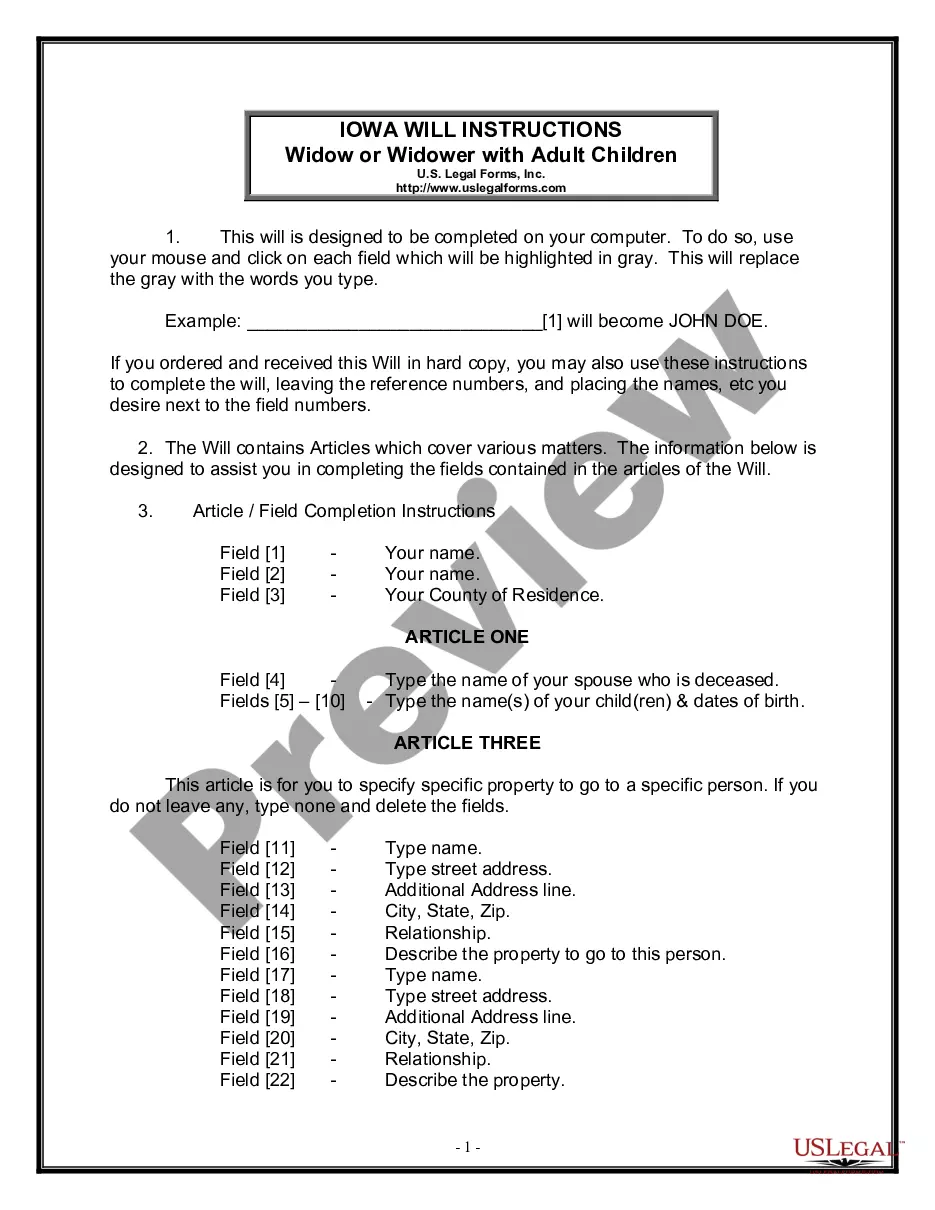

How to fill out Georgia Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Have you been in a situation that you require papers for possibly organization or specific purposes nearly every working day? There are a variety of lawful papers layouts accessible on the Internet, but discovering versions you can rely is not easy. US Legal Forms provides a large number of type layouts, much like the Georgia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, that are created to fulfill federal and state needs.

Should you be presently acquainted with US Legal Forms web site and also have a merchant account, simply log in. Following that, you are able to download the Georgia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options template.

Unless you offer an profile and would like to begin using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is for the appropriate metropolis/state.

- Take advantage of the Preview switch to review the shape.

- Browse the description to actually have selected the right type.

- In case the type is not what you are looking for, utilize the Look for field to find the type that meets your requirements and needs.

- Once you obtain the appropriate type, just click Acquire now.

- Choose the prices strategy you want, fill in the desired details to make your account, and buy the order with your PayPal or bank card.

- Decide on a hassle-free paper formatting and download your duplicate.

Locate all the papers layouts you might have bought in the My Forms food selection. You can obtain a more duplicate of Georgia Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options at any time, if needed. Just go through the essential type to download or produce the papers template.

Use US Legal Forms, the most comprehensive assortment of lawful varieties, in order to save efforts and avoid faults. The services provides skillfully made lawful papers layouts that can be used for a variety of purposes. Produce a merchant account on US Legal Forms and start producing your way of life a little easier.