Georgia Adoption of Stock Option Plan of WSFS Financial Corporation is a comprehensive policy implemented by WSFS Financial Corporation to grant employees the opportunity to purchase company stock at a predetermined price within a specified timeframe. This plan aims to incentivize and reward employees for their contributions to the organization's growth and success. Under the Georgia Adoption of Stock Option Plan, eligible employees are granted stock options, which are rights to purchase a specific number of shares of WSFS Financial Corporation's common stock at a predetermined price, known as the exercise price or strike price. The exercise price is typically set at the fair market value of the stock on the grant date. By offering stock options, WSFS Financial Corporation motivates employees to work towards improving the company's performance, as their financial interests are directly aligned with the organization's success. There are different types of stock options that may be included in the Georgia Adoption of Stock Option Plan: 1. Non-Qualified Stock Options (Nests): These stock options provide employees with the flexibility to purchase company stock at a predetermined price, referred to as the exercise price. Upon exercise, employees may incur regular income tax on the difference between the exercise price and the fair market value of the stock. 2. Incentive Stock Options (SOS): SOS are exclusively granted to employees and offer unique tax advantages. If specific requirements are met, such as holding the stock for a certain period of time, employees may enjoy preferential tax treatment, where the difference between the exercise price and the fair market value upon exercise is taxed as a long-term capital gain. 3. Restricted Stock Units (RSS): While not technically stock options, RSS are an alternative form of equity compensation included in the Georgia Adoption of Stock Option Plan. RSS represents a promise to distribute a certain number of WSFS Financial Corporation's common stock to employees upon meeting vesting criteria, such as time-based or performance-based milestones. Once vested, employees receive the stock or its equivalent value. WSFS Financial Corporation's Georgia Adoption of Stock Option Plan aims to attract, retain, and motivate talented individuals by providing them with the opportunity to participate in the company's long-term success and growth. By aligning employees' financial incentives with the organization's performance, this plan fosters a sense of ownership and loyalty amongst the workforce, driving the overall success of WSFS Financial Corporation.

Georgia Adoption of Stock Option Plan of WSFS Financial Corporation

Description

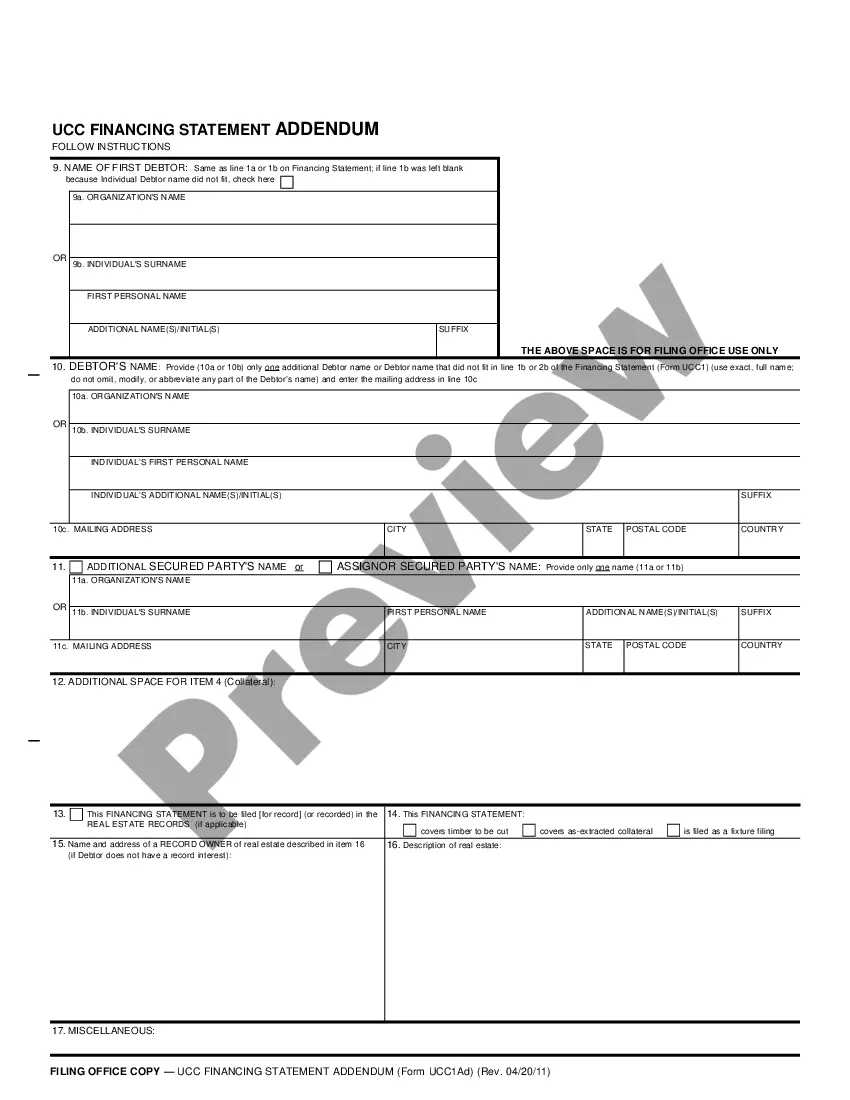

How to fill out Georgia Adoption Of Stock Option Plan Of WSFS Financial Corporation?

If you need to comprehensive, obtain, or printing legal papers layouts, use US Legal Forms, the greatest variety of legal types, that can be found online. Make use of the site`s simple and easy hassle-free research to discover the papers you require. A variety of layouts for organization and specific functions are sorted by categories and states, or search phrases. Use US Legal Forms to discover the Georgia Adoption of Stock Option Plan of WSFS Financial Corporation in just a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to the profile and click on the Down load button to have the Georgia Adoption of Stock Option Plan of WSFS Financial Corporation. You can also access types you formerly delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that appropriate town/land.

- Step 2. Use the Review solution to examine the form`s articles. Do not neglect to see the explanation.

- Step 3. Should you be unsatisfied with all the type, utilize the Lookup discipline near the top of the screen to get other models of your legal type format.

- Step 4. When you have identified the form you require, click the Get now button. Pick the rates program you like and add your references to register to have an profile.

- Step 5. Procedure the transaction. You can use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the formatting of your legal type and obtain it on the system.

- Step 7. Comprehensive, revise and printing or signal the Georgia Adoption of Stock Option Plan of WSFS Financial Corporation.

Each legal papers format you acquire is your own for a long time. You have acces to every type you delivered electronically with your acccount. Click the My Forms area and decide on a type to printing or obtain once again.

Contend and obtain, and printing the Georgia Adoption of Stock Option Plan of WSFS Financial Corporation with US Legal Forms. There are thousands of specialist and express-particular types you can use for the organization or specific needs.

Form popularity

FAQ

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.

WSFS Financial Corporation is a financial services company. Its primary subsidiary, WSFS Bank, a federal savings bank, is the largest and longest-standing locally managed bank and trust company headquartered in Delaware and the Greater Delaware Valley.

WSFS celebrated its 35th year of being a publicly traded company with Chairman, President and CEO Rodger Levenson, joined by members of the executive leadership team, Associates and friends of WSFS, ringing The Nasdaq Stock Market Opening Bell.

WSFS Financial Corp: Competitors Wells Fargo & Co Headquarters. 233,834. $82.9B. The Charles Schwab Corp Headquarters. 36,600. $22.3B. M&T Bank Corp Headquarters. 22,210. $8.6B. Fulton Financial Corp Headquarters. 3,300. $1.1B.