Georgia Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

How to fill out Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

Finding the right lawful file template can be quite a have difficulties. Of course, there are a variety of templates available on the net, but how will you obtain the lawful kind you will need? Make use of the US Legal Forms web site. The assistance provides a large number of templates, for example the Georgia Nonqualified and Incentive Stock Option Plan of Intercargo Corp., which can be used for company and private needs. All the types are checked by experts and fulfill federal and state requirements.

Should you be previously authorized, log in to the accounts and then click the Obtain button to have the Georgia Nonqualified and Incentive Stock Option Plan of Intercargo Corp.. Utilize your accounts to appear with the lawful types you possess purchased previously. Visit the My Forms tab of your own accounts and obtain an additional version of the file you will need.

Should you be a fresh end user of US Legal Forms, here are easy instructions that you can stick to:

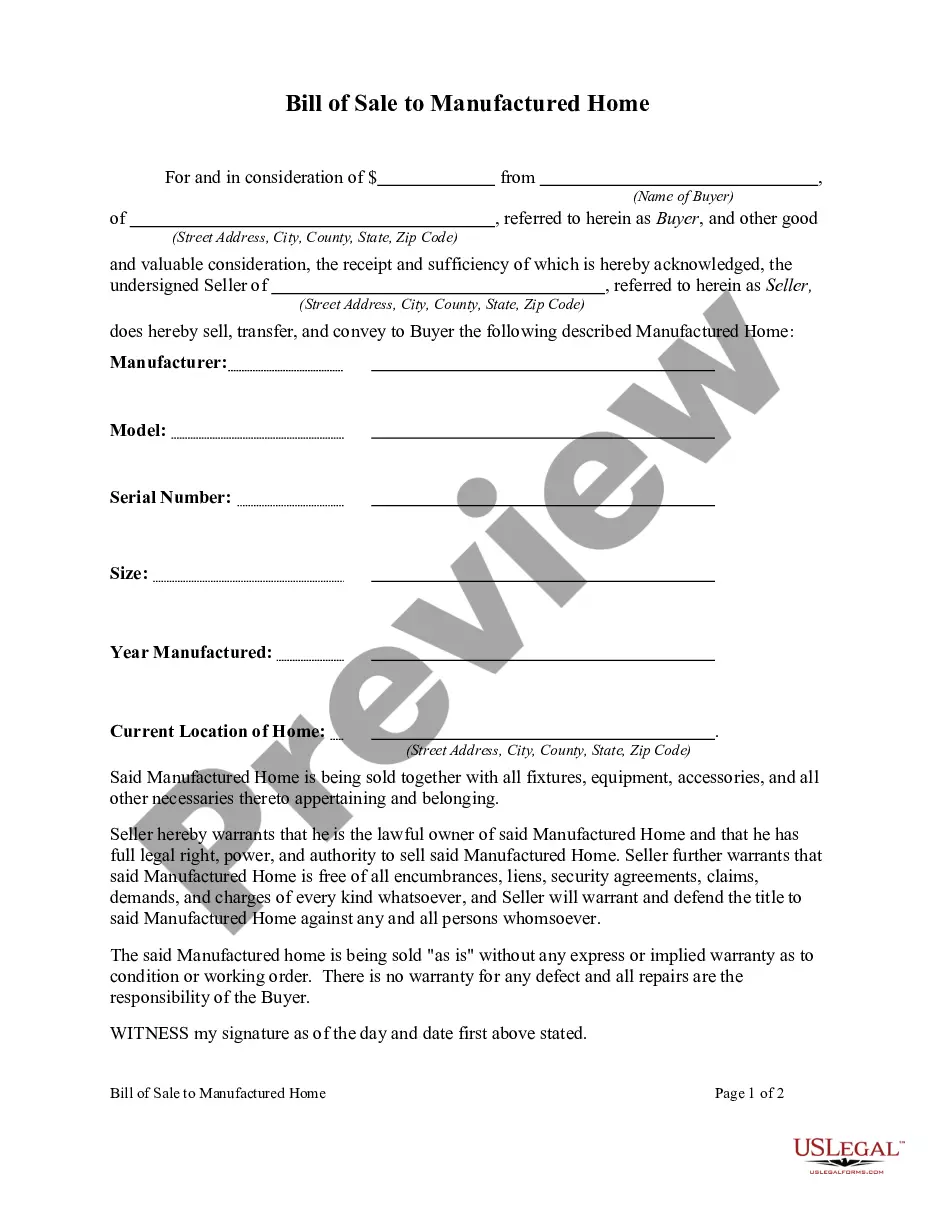

- Initially, ensure you have selected the right kind for the metropolis/county. You may look through the shape utilizing the Review button and browse the shape outline to make sure it is the best for you.

- In case the kind does not fulfill your needs, utilize the Seach industry to discover the correct kind.

- When you are certain the shape is suitable, click on the Purchase now button to have the kind.

- Choose the pricing strategy you need and enter in the required information. Create your accounts and buy an order using your PayPal accounts or credit card.

- Opt for the submit formatting and acquire the lawful file template to the gadget.

- Full, edit and printing and sign the received Georgia Nonqualified and Incentive Stock Option Plan of Intercargo Corp..

US Legal Forms will be the greatest catalogue of lawful types that you will find various file templates. Make use of the company to acquire skillfully-made paperwork that stick to state requirements.

Form popularity

FAQ

NQSOs can be offered to employees and others, such as contractors, advisors, etc. ISOs are only available to employees. Your ability to exercise remaining vested options will be subject to the terms in your employment agreement, which may offer a post-termination exercise window or options expiration date.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

The main difference between ISOs and NSOs is that ISOs come with no tax liability on exercise, but come with a set of requirements, whereas NSOs come with tax liability on exercise, but do not have the same requirements.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

Only employees can receive ISOs, whereas NSOs may be granted to any service providers (e.g., employees, directors, consultants, and advisors). ISOs must be exercised within three months following termination of employment (even if the holder continues providing services in some other capacity).

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.