Georgia Ratification of stock bonus plan of First West Chester Corp.

Description

How to fill out Ratification Of Stock Bonus Plan Of First West Chester Corp.?

Have you been in a position that you require files for sometimes business or person reasons almost every day? There are plenty of legal document templates available online, but finding versions you can rely on is not simple. US Legal Forms delivers 1000s of type templates, much like the Georgia Ratification of stock bonus plan of First West Chester Corp., that are published to satisfy state and federal demands.

Should you be already familiar with US Legal Forms website and get a merchant account, basically log in. Afterward, you can down load the Georgia Ratification of stock bonus plan of First West Chester Corp. format.

Should you not have an bank account and want to start using US Legal Forms, follow these steps:

- Get the type you need and ensure it is for that proper area/county.

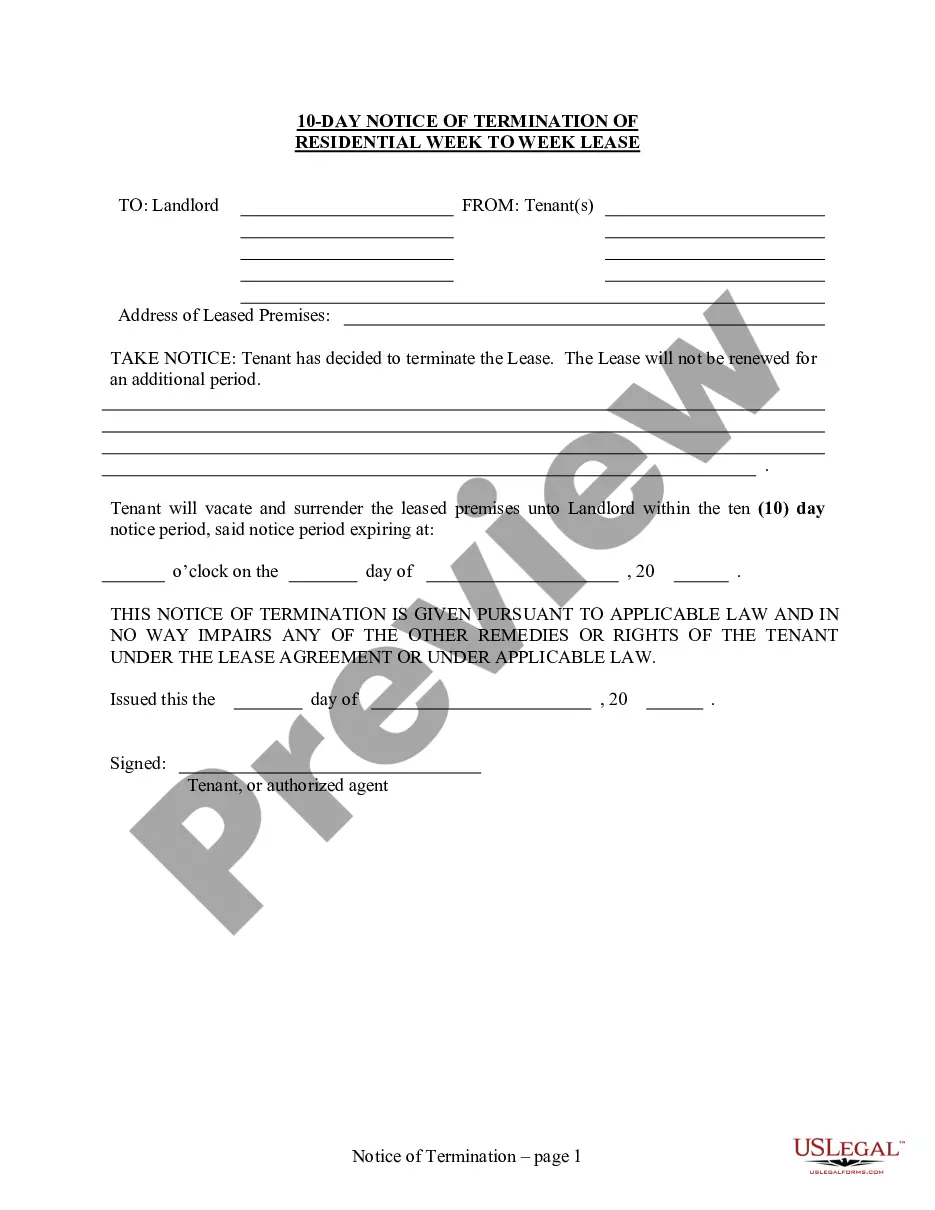

- Use the Preview button to check the shape.

- See the outline to ensure that you have chosen the proper type.

- In case the type is not what you are searching for, take advantage of the Research discipline to find the type that meets your needs and demands.

- Whenever you get the proper type, click on Get now.

- Choose the prices plan you want, fill out the specified info to make your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Pick a convenient document format and down load your backup.

Find all the document templates you may have purchased in the My Forms food selection. You can obtain a more backup of Georgia Ratification of stock bonus plan of First West Chester Corp. anytime, if needed. Just click the essential type to down load or printing the document format.

Use US Legal Forms, the most comprehensive selection of legal kinds, in order to save efforts and prevent mistakes. The service delivers skillfully manufactured legal document templates that can be used for a selection of reasons. Generate a merchant account on US Legal Forms and initiate creating your way of life easier.