Georgia Approval of savings plan for employees

Description

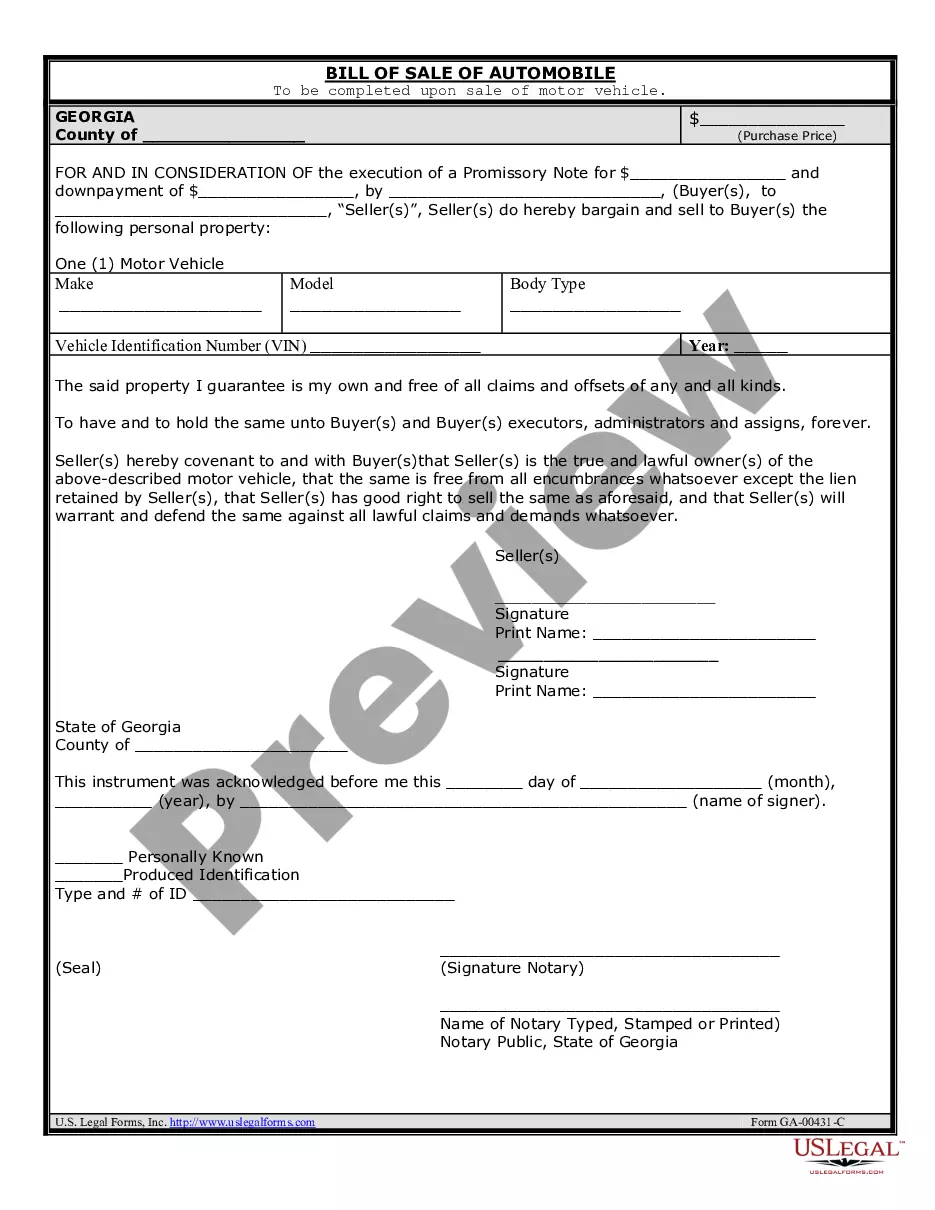

How to fill out Approval Of Savings Plan For Employees?

If you have to full, obtain, or print legitimate document web templates, use US Legal Forms, the most important collection of legitimate types, that can be found online. Utilize the site`s simple and easy convenient look for to find the files you will need. A variety of web templates for organization and personal purposes are sorted by types and suggests, or key phrases. Use US Legal Forms to find the Georgia Approval of savings plan for employees within a couple of clicks.

Should you be previously a US Legal Forms buyer, log in in your profile and click on the Acquire button to get the Georgia Approval of savings plan for employees. Also you can access types you in the past saved inside the My Forms tab of your own profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for that right city/country.

- Step 2. Use the Preview choice to examine the form`s content. Don`t neglect to read the information.

- Step 3. Should you be unsatisfied using the form, take advantage of the Search field at the top of the display to discover other versions of the legitimate form design.

- Step 4. When you have found the form you will need, go through the Acquire now button. Pick the rates strategy you like and add your accreditations to register for an profile.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Find the formatting of the legitimate form and obtain it on your gadget.

- Step 7. Complete, modify and print or sign the Georgia Approval of savings plan for employees.

Each legitimate document design you get is the one you have for a long time. You might have acces to each form you saved inside your acccount. Go through the My Forms section and pick a form to print or obtain once again.

Compete and obtain, and print the Georgia Approval of savings plan for employees with US Legal Forms. There are many skilled and condition-certain types you can utilize for the organization or personal needs.

Form popularity

FAQ

The employer must make at least either: A matching contribution of 100 percent for salary deferrals up to 1 percent of compensation and a 50 percent match for all salary deferrals above 1 percent but no more than 6 percent of compensation; or. A nonelective contribution of 3 percent of compensation to all participants.

Get inVESTED with TRS Once you are 60 years old with at least 10 years of service credit or achieve 30 years of service credit, you are eligible to retire.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to ...

Vesting is 10 years minimum creditable service. *Average of the highest 24 consecutive calendar months of salary while a member of the retirement system.

Member must have an active account to retire. Member is not eligible for his/her first cost-of-living adjustment (COLA) until such time that he/she would have attained 30 years of service or reaches 60 years of age, whichever occurs first. Member is NOT eligible for a PLOP distribution.

Generally, a plan may require an employee to be at least 21 years old and to have a year of service with the company before the employee can participate in a plan. However, plans may allow employees to begin participation before reaching age 21 or completing one year of service.

At least age 21 and. Have at least 1 year of service. a plan other than a 401(k) plan can require an employee to accrue 2 years of service, but if it does, then the employee is immediately vested in their accrued benefit)