Title: Georgia Executive Director Loan Plan: Understanding Hathaway Instruments, Inc.'s Promissory Note Introduction: In this article, we will dive into the Georgia Executive Director Loan Plan offered by Hathaway Instruments, Inc. We will explore the details of this plan, including its purpose, terms, and benefits. Additionally, we'll discuss the different types of loan plans available under the Hathaway Instruments, Inc., umbrella. Article: Overview of Georgia Executive Director Loan Plan: The Georgia Executive Director Loan Plan by Hathaway Instruments, Inc. is a specialized financial program designed to support executive directors in the state of Georgia. This plan aims to provide financial assistance to qualified directors, allowing them to meet various personal and professional goals while simultaneously benefiting from flexible repayment options. Understanding the Promissory Note: The Promissory Note is an integral part of the Georgia Executive Director Loan Plan offered by Hathaway Instruments, Inc. It is a legally binding document that sets out the terms and conditions of the loan agreement between the executive director and the company. By signing the Promissory Note, the executive director acknowledges their responsibility to repay the loan amount within the agreed-upon timeframe. Key Features and Benefits: 1. Competitive Interest Rates: Hathaway Instruments, Inc. strives to offer executive directors favorable interest rates, ensuring the loan remains affordable and reduces financial burden. 2. Flexible Loan Amount: The loan amount under the Georgia Executive Director Loan Plan varies based on an individual's financial needs and eligibility criteria. 3. Customized Repayment Options: Hathaway Instruments, Inc. understands the unique financial circumstances of executive directors. Hence, they offer flexible repayment terms, such as monthly installments or tailored payment schedules, to accommodate their income streams and reduce financial strain. 4. No Penalties for Prepayment: Executive directors have the freedom to repay their loans ahead of schedule without any additional penalties. This feature helps borrowers save on interest payments and offers financial flexibility. Types of Georgia Executive Director Loan Plans: 1. General Loan Plan: The general loan plan suits executive directors with diverse financial requirements, including education expenses, home renovations, debt consolidation, or any personal expenses requiring immediate financial support. 2. Small Business Loan Plan: This type of loan plan is specifically designed to meet the financial needs of executive directors embarking on entrepreneurial ventures or seeking capital for expanding their existing small businesses. 3. Professional Development Loan Plan: Executive directors seeking to enhance their professional skills, attend training programs, or pursue higher education can benefit from this specialized loan plan. It supports continuing education, certifications, and professional growth. Conclusion: The Georgia Executive Director Loan Plan by Hathaway Instruments, Inc. offers executive directors in Georgia a range of loan options tailored to suit their unique financial needs. With competitive interest rates, flexible repayment options, and various loan plans, Hathaway Instruments, Inc. provides valuable financial support to executive directors while prioritizing their financial well-being and long-term success. By utilizing Hathaway Instruments, Inc.'s Promissory Note, eligible executive directors can enjoy access to the funds they need while establishing a secure path towards achieving their goals.

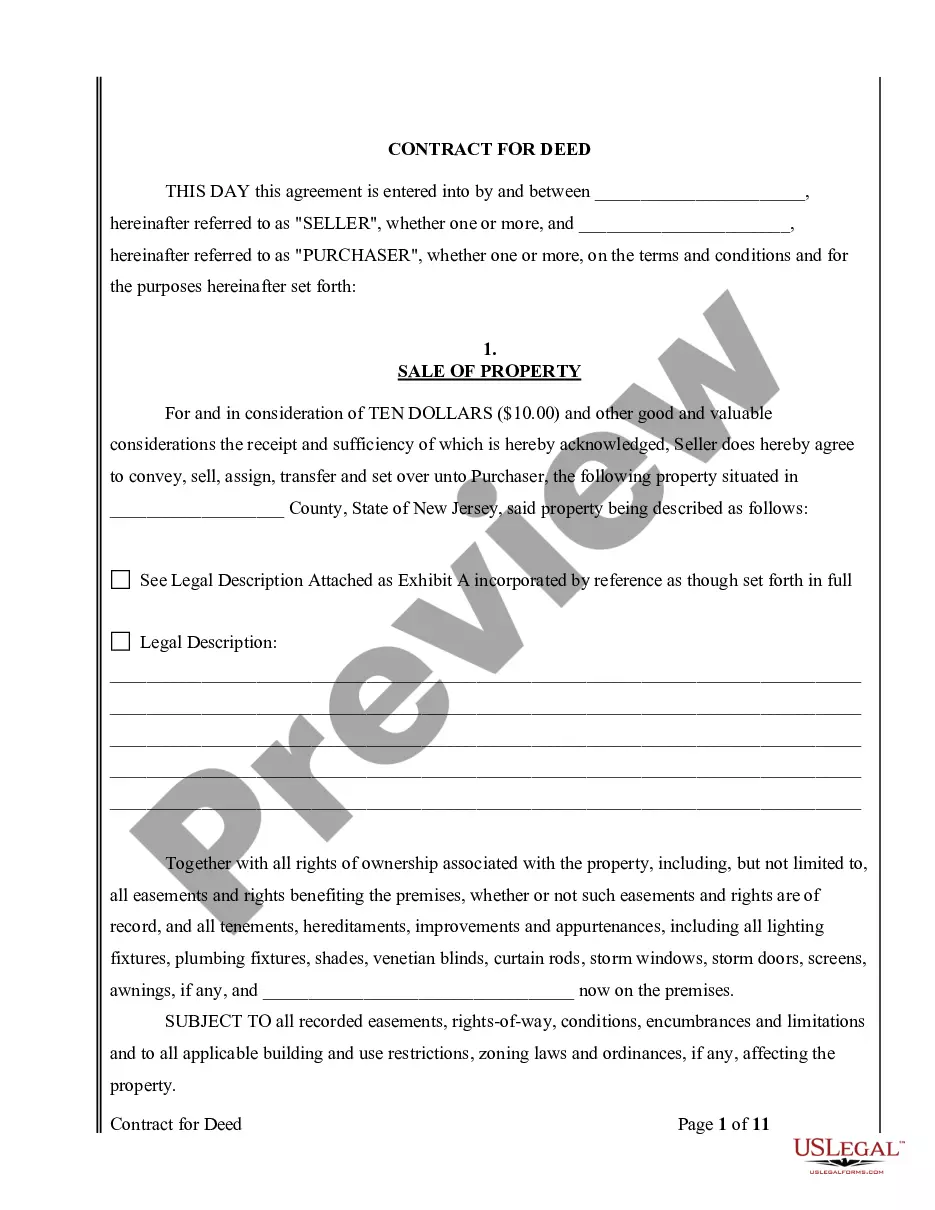

Georgia Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Georgia Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Are you within a position the place you require files for sometimes enterprise or personal functions virtually every time? There are tons of legal papers themes available on the Internet, but discovering kinds you can rely is not easy. US Legal Forms gives thousands of kind themes, like the Georgia Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., that are created to satisfy federal and state requirements.

If you are previously knowledgeable about US Legal Forms web site and have a free account, merely log in. Afterward, it is possible to acquire the Georgia Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. design.

Should you not have an profile and want to begin to use US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for your proper area/area.

- Take advantage of the Review option to review the shape.

- See the description to actually have chosen the correct kind.

- When the kind is not what you are seeking, utilize the Research area to obtain the kind that meets your needs and requirements.

- When you obtain the proper kind, just click Acquire now.

- Pick the prices strategy you would like, fill in the required information and facts to make your bank account, and purchase your order using your PayPal or Visa or Mastercard.

- Choose a practical data file structure and acquire your duplicate.

Discover each of the papers themes you possess bought in the My Forms food list. You can aquire a further duplicate of Georgia Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. at any time, if needed. Just click on the needed kind to acquire or print out the papers design.

Use US Legal Forms, one of the most comprehensive selection of legal forms, to save lots of time and avoid errors. The services gives professionally made legal papers themes that can be used for a range of functions. Create a free account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

Important details any promissory note should state include the following: Payor or borrower: Include the name of the party who promised to repay the stated debt. Payee or lender: Include the name of the lender, the person or entity, lending the money. Date: List the exact date the promise to repay is effective.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.