Georgia Directors and officers liability insurance

Description

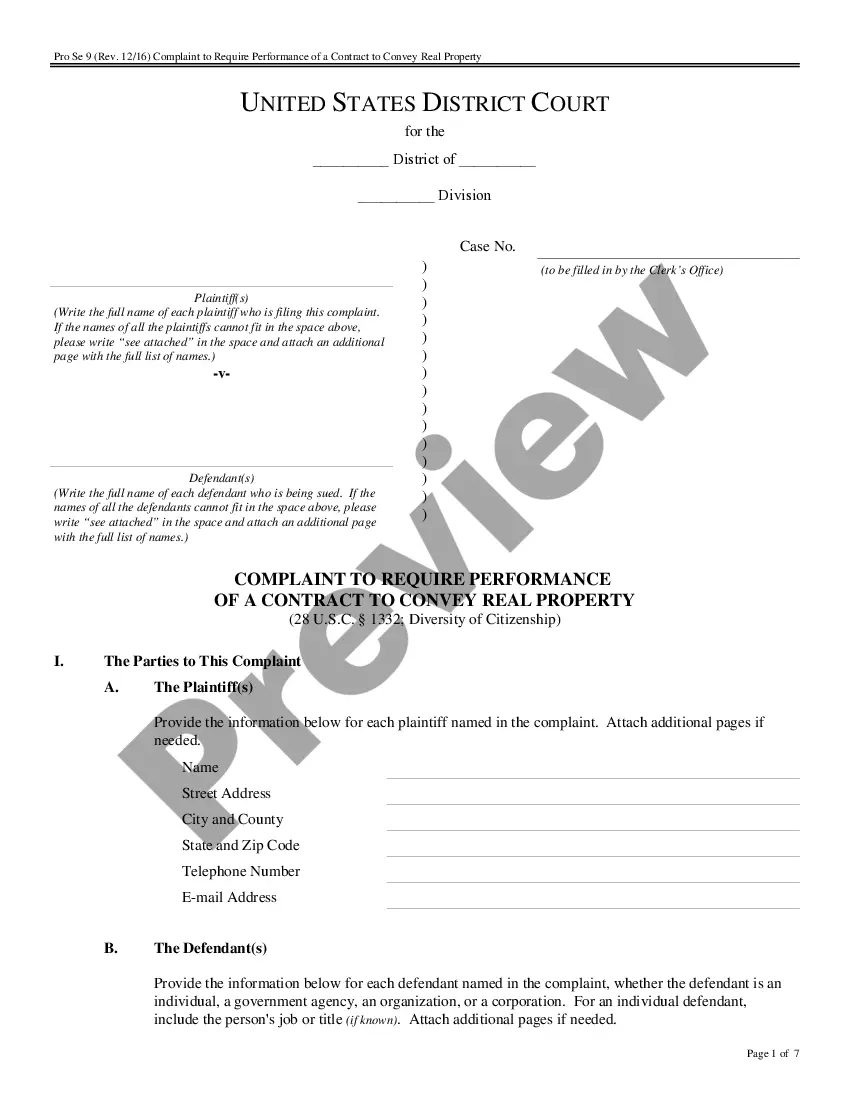

How to fill out Directors And Officers Liability Insurance?

Have you been in a situation where you will need files for possibly organization or specific functions almost every time? There are a lot of lawful document web templates available on the Internet, but locating types you can depend on isn`t simple. US Legal Forms gives a large number of kind web templates, just like the Georgia Directors and officers liability insurance, which can be created to meet state and federal requirements.

When you are already informed about US Legal Forms website and also have your account, simply log in. Afterward, it is possible to download the Georgia Directors and officers liability insurance design.

If you do not provide an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is for your right area/region.

- Make use of the Preview option to analyze the form.

- Look at the explanation to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you are looking for, utilize the Search industry to discover the kind that suits you and requirements.

- If you discover the right kind, simply click Acquire now.

- Select the costs plan you need, fill out the specified details to make your bank account, and purchase your order using your PayPal or credit card.

- Choose a convenient document formatting and download your duplicate.

Find all of the document web templates you possess bought in the My Forms menus. You can get a further duplicate of Georgia Directors and officers liability insurance any time, if required. Just click on the essential kind to download or print the document design.

Use US Legal Forms, the most comprehensive collection of lawful types, to save lots of some time and stay away from blunders. The service gives skillfully made lawful document web templates which you can use for a range of functions. Generate your account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Further, officers and directors who participate in or authorize the commission of wrongful acts that are prohibited by statute, even if the acts are done on behalf of the corporation, may be held personally liable. Officers and directors may also be liable to the corporation or its shareholders.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Usually purchased in conjunction with directors and officers insurance (D&O), crime insurance policies (also known as fidelity coverage) provide organizations balance sheet protection for damages arising from: Funds transfer fraud. Theft of clients' property. Employee theft and employee fraud.

Is directors' and officers' insurance the same as a fidelity bond? No, they are not the same thing. D&O insurance will cover claims made against directors and officers of a company for acts such as neglect, breach of trust, making misleading statements or breach of duty.

Directors' and officers' liability insurance ? also known as D&O insurance ? covers the cost of compensation claims made against your business's directors and key managers (officers) for alleged wrongful acts. Wrongful acts include: breach of trust. breach of duty. neglect.

However, D&O is a product designed to protect the personal assets of company directors and officers in the event they were sued while acting in their capacity as a director or officer. Management liability protects the company as well as its directors and officers against legal liabilities and statutory obligations.

D&O insurance specifically covers members on a board of directors and officers. Professional liability insurance, on the other hand, covers professionals (of nearly any position within a company) that offer specialized services.

Directors and Officers (D&O) liability insurance is a type of professional liability or errors and omissions (E&O) insurance that protects company executives and board members when they are sued for mismanagement, misrepresentation, or other breaches of duty or regulations.