Georgia Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

Are you presently in the position where you need documents for either organization or person functions virtually every time? There are tons of lawful file web templates accessible on the Internet, but discovering ones you can rely isn`t effortless. US Legal Forms offers a large number of develop web templates, much like the Georgia Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company, which are composed in order to meet state and federal demands.

In case you are already knowledgeable about US Legal Forms site and possess a merchant account, simply log in. Following that, it is possible to acquire the Georgia Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company template.

Unless you come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for that appropriate town/state.

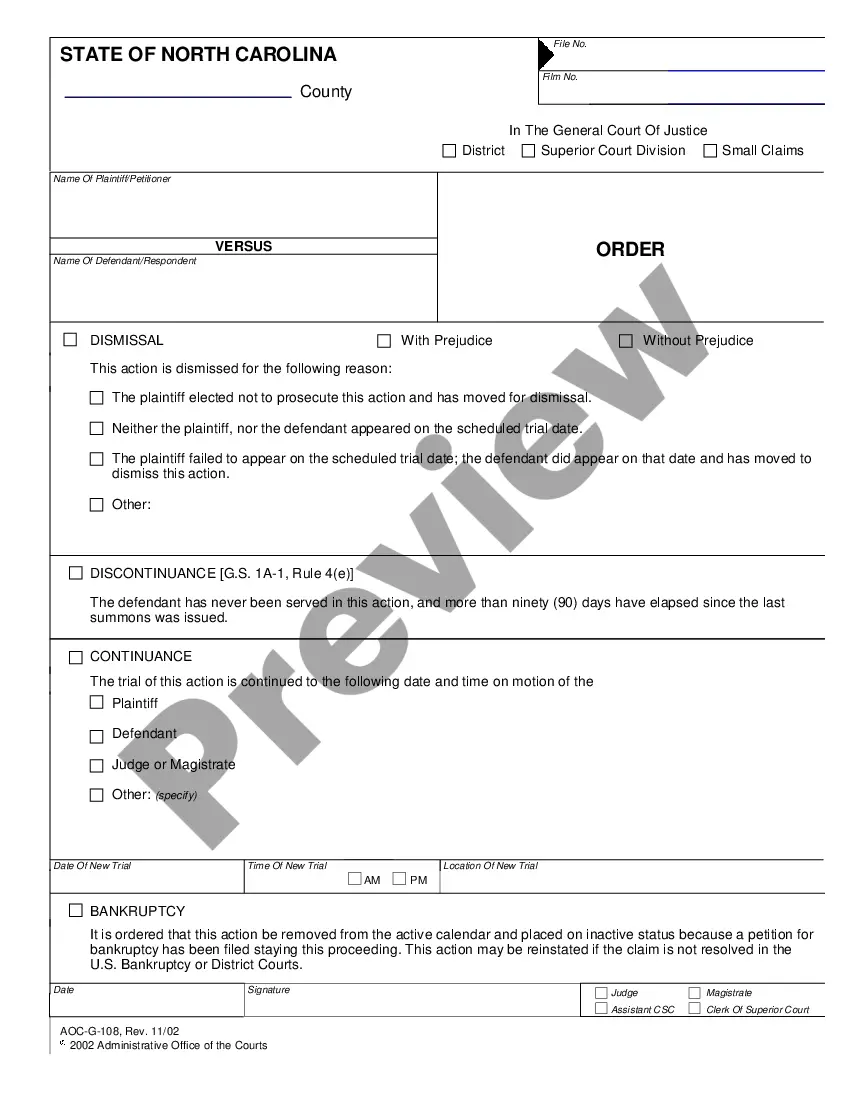

- Utilize the Review button to review the form.

- Browse the information to actually have selected the right develop.

- If the develop isn`t what you`re seeking, utilize the Research field to get the develop that fits your needs and demands.

- Whenever you get the appropriate develop, just click Get now.

- Pick the rates program you need, fill out the required information to generate your account, and buy the transaction utilizing your PayPal or bank card.

- Choose a convenient data file formatting and acquire your copy.

Get all of the file web templates you have purchased in the My Forms menu. You can obtain a additional copy of Georgia Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company whenever, if necessary. Just click on the necessary develop to acquire or print the file template.

Use US Legal Forms, the most substantial collection of lawful forms, to save time and prevent errors. The service offers skillfully manufactured lawful file web templates which you can use for a range of functions. Create a merchant account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

An agreement in which a hostile bidder agrees to limit its holdings in a target company. A standstill agreement stops the takeover bid from progressing for a period of time.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

Example: if a party, in a trade agreement, commits to allowing 30% foreign ownership in domestic companies and later on decides unilaterally to allow 40%, the party can re-introduce the original level of 30% whenever it wishes (but it cannot restrict further below 30%).

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).