Title: Georgia Letter to Stockholders: Authorization, Sale of Preferred Stock, and Stock Transfer Restriction to Protect Tax Benefits Keywords: Georgia, Letter to Stockholders, authorization, sale, preferred stock, stock transfer restriction, tax benefits. Introduction: Dear Georgia Stockholders, We hope this letter finds you well. We are writing to inform you about the recent developments regarding the authorization and sale of preferred stock, along with the implementation of stock transfer restrictions in order to protect valuable tax benefits for our company. Please read the following information carefully to understand the implications of these actions. Part 1: Authorization and Sale of Preferred Stock: In line with our company's growth and financial objectives, we are excited to announce the authorization and sale of preferred stock in Georgia. This move aims to raise necessary capital to fund expansion plans, research and development efforts, and other corporate initiatives while offering certain advantages to our valued stockholders. Preferred stockholders will enjoy priority rights to dividends, typically receiving a fixed dividend amount before common stockholders. In the event of liquidation, preferred stockholders will also be given precedence over common stockholders. Additionally, convertible preferred stockholders may have the option to convert their shares into common stock if specified conditions are met. Part 2: Stock Transfer Restriction to Protect Tax Benefits: To safeguard significant tax benefits associated with our preferred stock issuance, we have implemented stock transfer restrictions. These restrictions are designed to maintain compliance with relevant tax regulations and protect the financial wellbeing of the company. The stock transfer restriction entails limitations on the transfer or sale of preferred stock within a specified time frame. This ensures that stockholders will retain their shares for an initial period, safeguarding the associated tax benefits. After this period, stockholders may have the flexibility to trade or sell their shares subject to any remaining restrictions. Different Types of Georgia Letter to Stockholders regarding Authorization and Sale of Preferred Stock and Stock Transfer Restriction to Protect Tax Benefits: 1. Georgia Letter to Stockholders: Preferred Stock Subscription Opportunity: This letter focuses primarily on informing stockholders about the opportunity to subscribe and purchase preferred stock. It highlights the benefits of becoming a preferred stockholder and the associated tax advantages. 2. Georgia Letter to Stockholders: Update on Authorized Preferred Stock and Stock Transfer Restriction: This letter provides an update to existing stockholders regarding the authorization and sale of preferred stock, emphasizing the introduction of stock transfer restrictions. It explains the purpose of these restrictions and the importance of complying with tax regulations. Conclusion: In conclusion, the Georgia Letter to Stockholders serves as a critical communication tool to notify stockholders about the authorization and sale of preferred stock as well as the implementation of stock transfer restrictions to protect tax benefits. It aims to ensure transparency and understanding among stockholders regarding the company's financial decisions and their potential impact. We appreciate your continued support and remain committed to enhancing shareholder value while maintaining compliance with relevant regulations. Sincerely, [Your Name] [Company Name]

Georgia Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

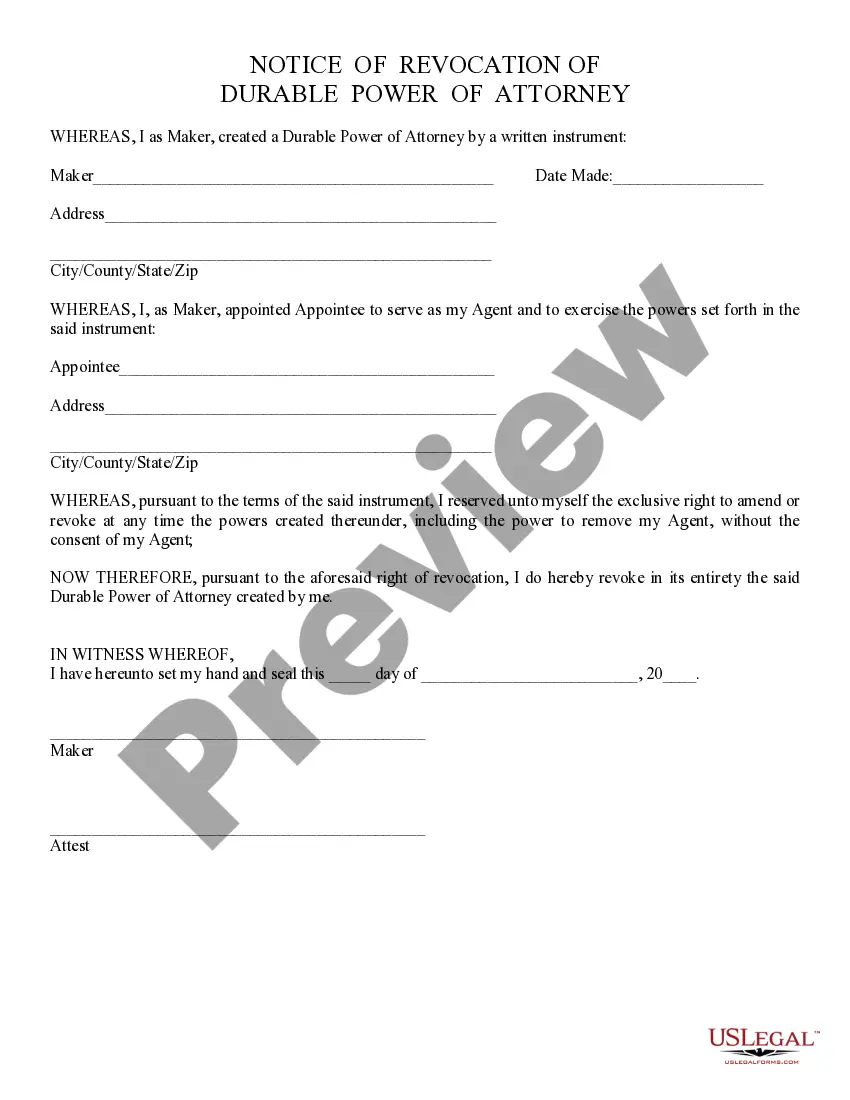

How to fill out Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

Finding the right authorized record format could be a have a problem. Naturally, there are plenty of templates accessible on the Internet, but how would you obtain the authorized kind you want? Use the US Legal Forms web site. The support provides 1000s of templates, such as the Georgia Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, which you can use for business and private requires. All of the varieties are checked by experts and meet up with federal and state requirements.

Should you be currently registered, log in to the profile and click the Down load switch to obtain the Georgia Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits. Utilize your profile to check from the authorized varieties you might have purchased previously. Check out the My Forms tab of the profile and acquire another copy of your record you want.

Should you be a new end user of US Legal Forms, listed here are easy recommendations that you can comply with:

- First, make certain you have selected the right kind for your city/state. You may look through the shape making use of the Review switch and read the shape explanation to make certain this is the best for you.

- In case the kind will not meet up with your expectations, use the Seach field to discover the right kind.

- Once you are sure that the shape is acceptable, click the Get now switch to obtain the kind.

- Choose the prices plan you would like and enter the necessary details. Build your profile and pay money for your order utilizing your PayPal profile or charge card.

- Choose the data file file format and download the authorized record format to the system.

- Full, revise and print and indication the attained Georgia Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits.

US Legal Forms may be the biggest local library of authorized varieties where you can find numerous record templates. Use the service to download professionally-manufactured paperwork that comply with express requirements.

Form popularity

FAQ

A stock transfer restriction is essentially a contract between the shareholders of the corporation or members of the LLC. Therefore, the owners have the ability to be extremely creative in crafting a stock transfer restriction that meets their specific wants and needs.

Consideration refers to the value of what is paid for the stocks and shares. You need to state the amount if the person buying the shares pays cash. If there is zero consideration, this must be recorded. Consideration can also include other stocks or satisfaction of a debt.

A stock restriction agreement or SRA refers to the agreement made between a company and its founder for allotment of stock that places certain restrictions on its transfer.

Restrictions on Transferability means, as applied to the property or assets (or the income or profits therefrom) of any Person, in each case whether the same is consensual or nonconsensual or arises by contract, operation of law, legal process or otherwise, any material condition to, or restriction on, the ability of ...

A company whose shares are restricted in transfer is called a privately held company. Restriction on transfer of shares means that shares cannot be transferred without the approval of the board of directors or the general meeting of shareholders.

Risk tolerance: Common stocks are considered a riskier investment because of their tendency to fluctuate in value. Additionally, if a company goes bankrupt, common shareholders receive their payout last?if they receive anything at all.

A preferred stock is a class of stock that is granted certain rights that differ from common stock. Namely, preferred stock often possesses higher dividend payments, and a higher claim to assets in the event of liquidation.

A private corporation has 50 shareholders or less, restricts the right to transfer shares, and prohibits the sale of shares to the public.