Georgia Authorize Sale of fractional shares

Description

How to fill out Authorize Sale Of Fractional Shares?

It is possible to devote hours on-line trying to find the legitimate file format which fits the federal and state demands you want. US Legal Forms offers a huge number of legitimate kinds which are reviewed by pros. You can actually acquire or printing the Georgia Authorize Sale of fractional shares from the assistance.

If you have a US Legal Forms account, it is possible to log in and click on the Obtain option. Following that, it is possible to total, modify, printing, or indicator the Georgia Authorize Sale of fractional shares. Each and every legitimate file format you buy is yours eternally. To have yet another version of any purchased develop, proceed to the My Forms tab and click on the related option.

If you are using the US Legal Forms site the first time, stick to the simple instructions under:

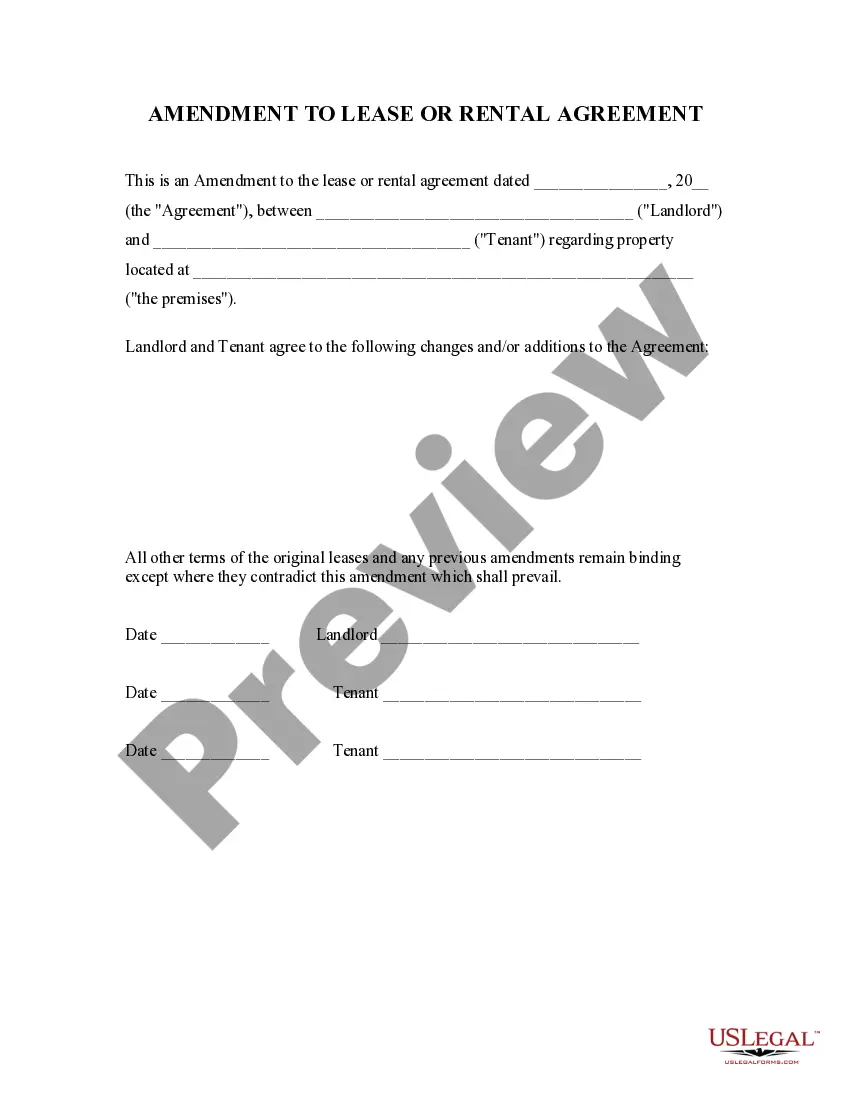

- Initially, make certain you have selected the best file format for that region/town of your liking. Look at the develop description to make sure you have selected the right develop. If readily available, take advantage of the Preview option to look from the file format at the same time.

- If you would like find yet another version from the develop, take advantage of the Look for field to obtain the format that meets your requirements and demands.

- Upon having identified the format you desire, click on Buy now to proceed.

- Select the pricing plan you desire, enter your qualifications, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal account to fund the legitimate develop.

- Select the file format from the file and acquire it for your device.

- Make alterations for your file if needed. It is possible to total, modify and indicator and printing Georgia Authorize Sale of fractional shares.

Obtain and printing a huge number of file templates making use of the US Legal Forms website, which offers the largest collection of legitimate kinds. Use expert and condition-distinct templates to deal with your company or person demands.

Form popularity

FAQ

Related Content. The fractions of shares to which shareholders are entitled on a rights issue or open offer when their entitlement is not a whole number.

There are no major drawbacks to fractional shares. But it is worth taking into account the fact that this does not really increase profit potential by itself. A larger investment in a single share that goes up in value is of more benefit than a smaller one in multiple stocks that do not go anywhere or that go down.

For the purpose of taxes, fractional share rewards are considered in the same way as all of your other investments in your Public account. What that means is that if you sell your free slices of stock and realize a capital gain, that must be reported as taxable income.

The fractions of shares to which shareholders are entitled on a rights issue or open offer when their entitlement is not a whole number.

In this case, the individual would only receive 5 shares (5*5 = 25) of the new company XYZ, leaving them with 4 shares of the old company ABC (29-25). As a result, the individual would be entitled to a fractional share of 0.8 (4 shares / 5 = 0.8) of XYZ.

Shares issued by a corporation that equal less than one full share of stock. Fractional shares are often issued in connection with stock-for-stock mergers, stock dividends, reverse stock splits, and other similar corporate actions. Corporations may, but are not required, to issue fractional shares.

The only way to sell fractional shares is through a major brokerage firm, which can join them with other fractional shares until a whole share is attained. If the selling stock does not have a high demand in the marketplace, selling the fractional shares might take longer than hoped.

As far as money received in respect of fractional entitlement of shares is concerned, since the fractional shares are not sold by you and as such STT is not paid in respect of such fractional shares, the same cannot be taxed under Section 112A which is applicable if STT has been paid.