Georgia Authorization to increase bonded indebtedness

Description

How to fill out Authorization To Increase Bonded Indebtedness?

Finding the right authorized document template could be a have a problem. Obviously, there are a lot of web templates available on the net, but how do you discover the authorized type you require? Utilize the US Legal Forms internet site. The assistance gives 1000s of web templates, like the Georgia Authorization to increase bonded indebtedness, which can be used for enterprise and private demands. All the kinds are examined by experts and fulfill federal and state demands.

If you are already authorized, log in to the profile and then click the Acquire option to have the Georgia Authorization to increase bonded indebtedness. Use your profile to look throughout the authorized kinds you possess purchased earlier. Visit the My Forms tab of the profile and obtain yet another version from the document you require.

If you are a fresh end user of US Legal Forms, here are simple directions so that you can stick to:

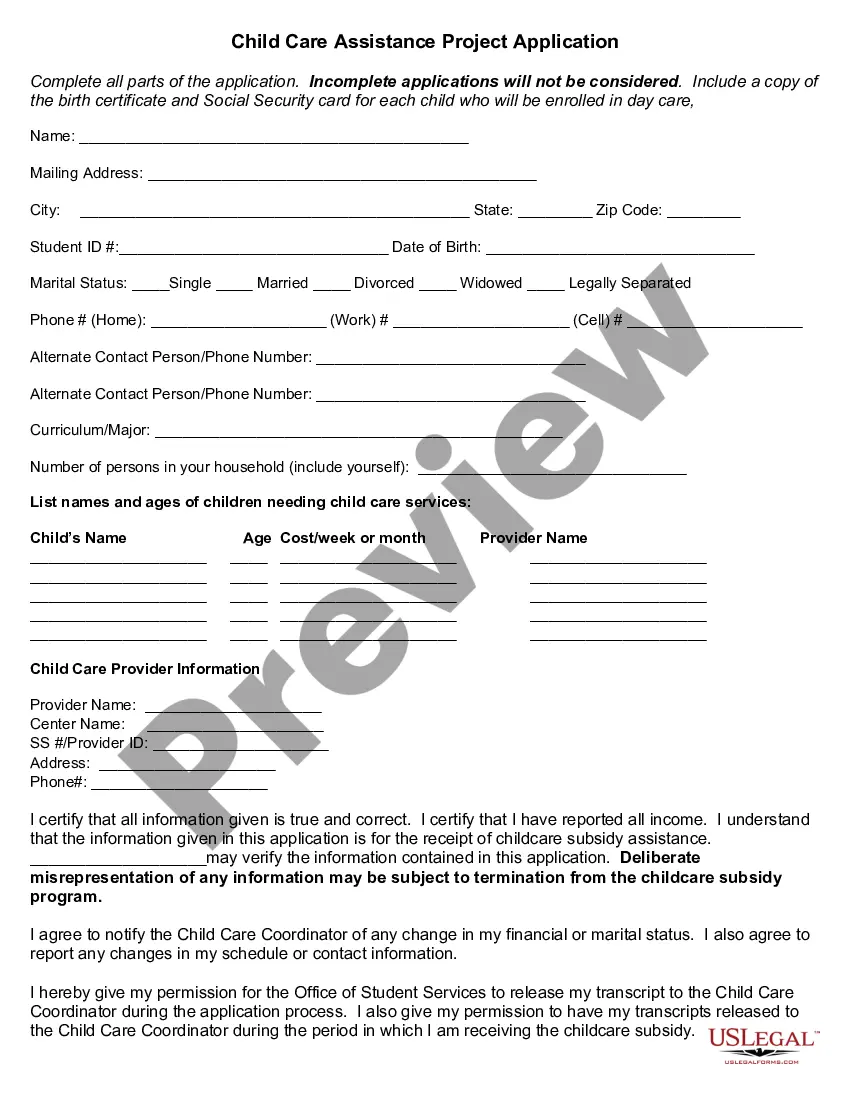

- Very first, make sure you have selected the proper type for your personal area/state. It is possible to examine the form making use of the Preview option and look at the form information to make sure it will be the best for you.

- If the type will not fulfill your preferences, take advantage of the Seach field to find the right type.

- Once you are positive that the form would work, select the Buy now option to have the type.

- Choose the rates strategy you would like and enter in the necessary information. Build your profile and pay for the order making use of your PayPal profile or charge card.

- Choose the submit file format and acquire the authorized document template to the device.

- Complete, change and produce and indicator the received Georgia Authorization to increase bonded indebtedness.

US Legal Forms is the greatest library of authorized kinds for which you can discover different document web templates. Utilize the company to acquire professionally-made files that stick to state demands.

Form popularity

FAQ

Georgia has a statewide surety bond requirement for general contractors. You can get the $25,000 bond for residential and general contractors for an annual premium of $125. In addition to this state-mandated bond, ten counties and municipalities in GA require local contractor bonds: Bibb County.

Understanding and obtaining the appropriate Georgia surety bond is essential for various industries. The cost of surety bonds ranges from 1-4% of the total bond amount, depending on factors such as the applicant's credit score and financial stability.

A surety bond protects you against the costs of claims about shoddy, incomplete work as well as theft and fraud. You may need to purchase a bond as a means of getting a business license or permit.

How much does a Georgia title bond cost? Georgia certificate of title bond costs start at $100. The exact cost will vary depending on the surety bond amount required by the Georgia Department of Revenue Motor Vehicle Division. Bond amounts from $5,000 to $50,000 cost $15 for every $1,000 of coverage, starting at $100.

U.S. state and local government debt in Georgia FY 1999-2027 In the fiscal year of 2021, Georgia's state debt stood at about 14.69 billion U.S. dollars. By 2027, the state debt is forecasted to increase to about 19.44 billion U.S. dollars.

Surety bond premiums (the amount you pay) are often calculated as a percentage of the total bond amount, usually between 0.5% and 5% of the bond amount for applicants with good credit, and between 5% up to as much as 20% of the bond amount for applicants with poor credit.