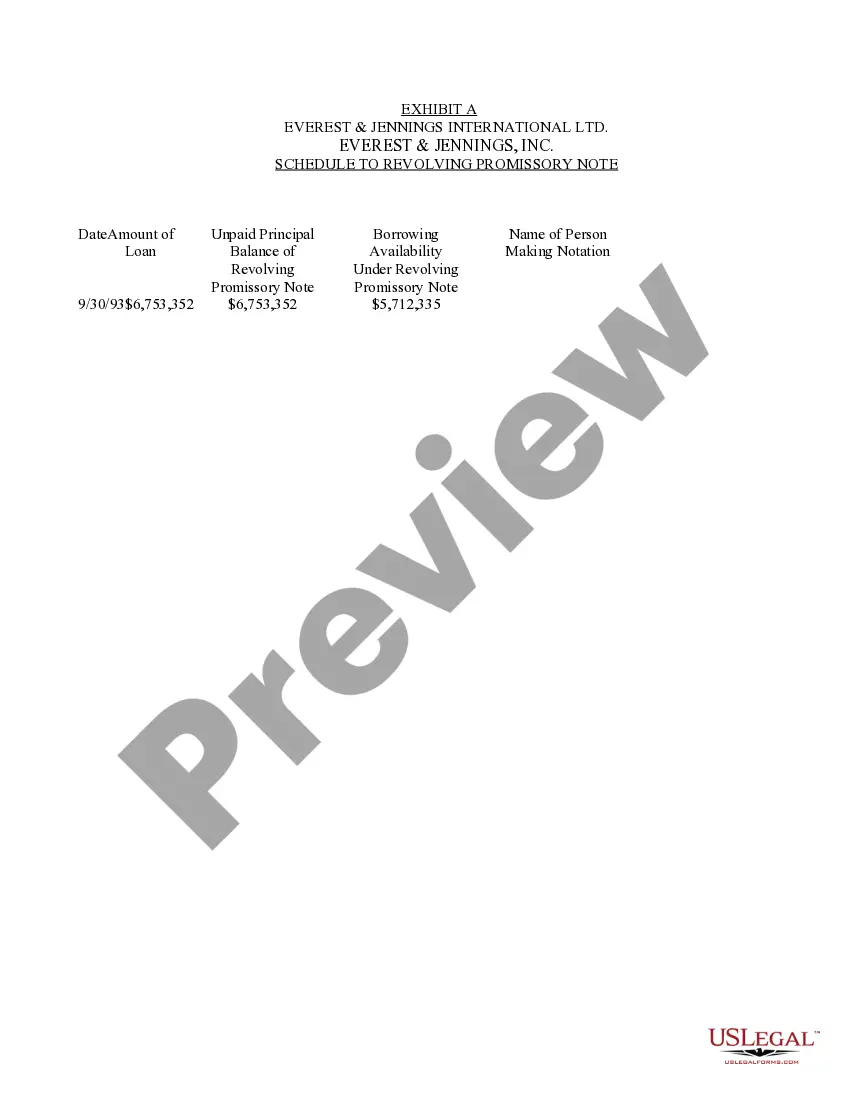

Description: A Georgia Form of Revolving Promissory Note is a legally binding document that establishes a loan agreement between a borrower and a lender in the state of Georgia. This note outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and any other relevant factors. Keywords: Georgia, Form of Revolving Promissory Note, loan agreement, borrower, lender, terms and conditions, repayment schedule, interest rate. There are different types of Georgia Form of Revolving Promissory Notes, each serving specific purposes and accommodating various needs. Some notable variations include: 1. Traditional Revolving Promissory Note: This type of note allows the borrower to access a predetermined amount of funds over a specific period. The borrower can repay and reuse the funds as needed, thereby creating a revolving credit line. 2. Line of Credit Revolving Promissory Note: Similar to the traditional revolving note, this type establishes a line of credit for the borrower. The borrower can access the funds whenever necessary, up to a specified credit limit. 3. Business Revolving Promissory Note: Specifically designed for business purposes, this note allows companies to maintain a revolving credit arrangement. It is often used to support operational expenses or finance short-term projects. 4. Personal Revolving Promissory Note: This type of note is commonly used for personal loans, such as credit card debt consolidation or home improvement projects. It provides flexibility to borrowers by allowing them to pay back and re-borrow funds. 5. Unsecured Revolving Promissory Note: Unlike a secured note that requires collateral, an unsecured revolving promissory note does not require any specific asset as security. This type of note is typically based on the borrower's creditworthiness. 6. Secured Revolving Promissory Note: In contrast to an unsecured note, a secured revolving promissory note requires the borrower to pledge collateral to secure the loan. The collateral may include real estate, vehicles, or other valuable assets. By using a Georgia Form of Revolving Promissory Note, both borrowers and lenders can maintain transparency, establish clear obligations, and protect their interests. It is essential to consult with legal professionals when drafting and executing such notes to ensure compliance with applicable laws and regulations in Georgia.

Georgia Form of Revolving Promissory Note

Description

How to fill out Georgia Form Of Revolving Promissory Note?

Are you in the placement the place you need to have papers for both business or individual reasons nearly every day time? There are a variety of authorized document templates accessible on the Internet, but getting kinds you can rely isn`t simple. US Legal Forms gives a large number of develop templates, like the Georgia Form of Revolving Promissory Note, that happen to be published in order to meet federal and state specifications.

If you are presently knowledgeable about US Legal Forms website and have a free account, just log in. Afterward, you are able to acquire the Georgia Form of Revolving Promissory Note template.

Unless you come with an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you will need and make sure it is for your correct metropolis/area.

- Utilize the Preview button to review the form.

- Look at the explanation to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you are looking for, utilize the Lookup area to obtain the develop that meets your needs and specifications.

- If you find the correct develop, click on Buy now.

- Select the prices prepare you need, fill in the desired information and facts to create your bank account, and pay for an order with your PayPal or charge card.

- Choose a practical document formatting and acquire your copy.

Find each of the document templates you might have purchased in the My Forms menus. You can get a additional copy of Georgia Form of Revolving Promissory Note anytime, if possible. Just click the necessary develop to acquire or print out the document template.

Use US Legal Forms, by far the most substantial collection of authorized kinds, to save time as well as stay away from mistakes. The support gives expertly created authorized document templates which you can use for a selection of reasons. Produce a free account on US Legal Forms and start creating your life a little easier.