Georgia Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

Finding the right legitimate document design can be quite a struggle. Of course, there are a variety of web templates available on the Internet, but how can you discover the legitimate kind you want? Use the US Legal Forms site. The service gives a huge number of web templates, including the Georgia Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp., that you can use for business and personal requires. All the forms are checked out by professionals and meet up with state and federal needs.

When you are already authorized, log in for your bank account and click on the Obtain key to have the Georgia Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.. Utilize your bank account to check with the legitimate forms you might have acquired formerly. Check out the My Forms tab of the bank account and get yet another duplicate of your document you want.

When you are a whole new consumer of US Legal Forms, listed below are simple guidelines so that you can adhere to:

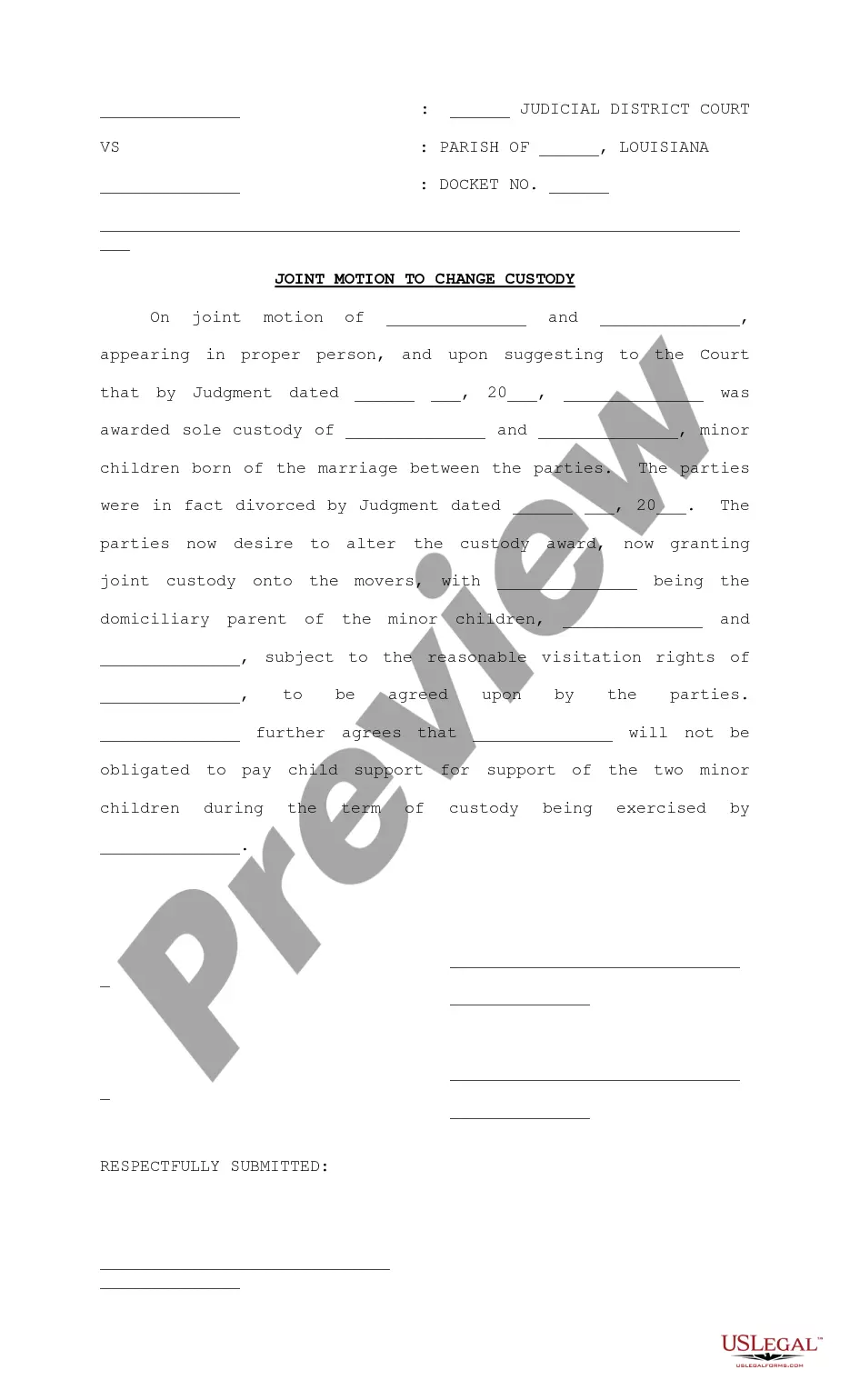

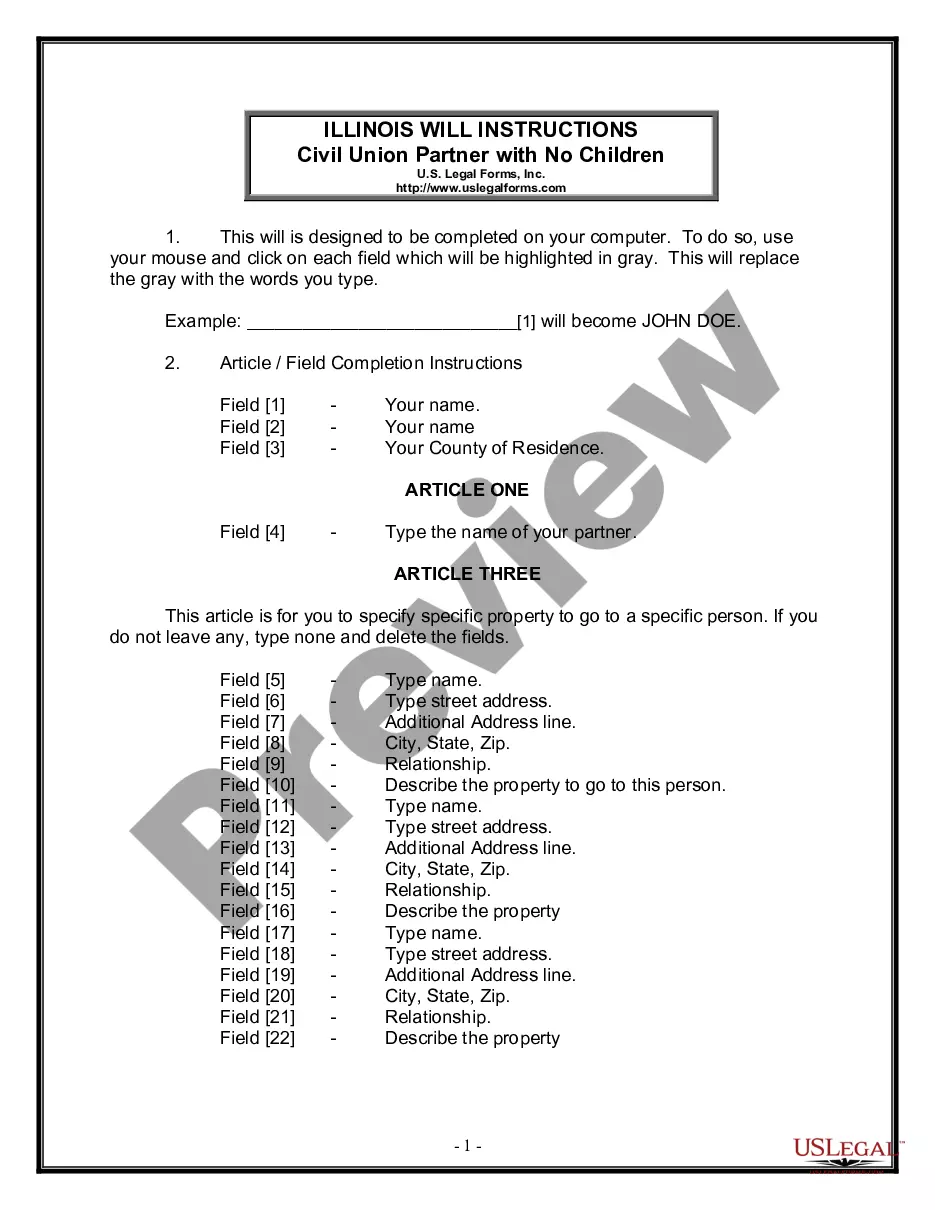

- Initial, make certain you have chosen the right kind to your area/state. It is possible to check out the form using the Preview key and study the form information to ensure it is the best for you.

- In the event the kind fails to meet up with your preferences, utilize the Seach field to discover the appropriate kind.

- When you are certain that the form is proper, click the Purchase now key to have the kind.

- Select the prices strategy you desire and type in the essential information. Make your bank account and pay money for an order with your PayPal bank account or credit card.

- Select the file formatting and download the legitimate document design for your device.

- Full, revise and printing and indication the received Georgia Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp..

US Legal Forms is definitely the largest collection of legitimate forms where you will find a variety of document web templates. Use the service to download skillfully-made files that adhere to condition needs.