Georgia Bylaws of Great American Bank, FSB: A Comprehensive Guide The Georgia Bylaws of Great American Bank, FSB, outline the rules and regulations governing the operations and governance of this prominent financial institution. These bylaws provide clear guidelines for the bank's directors, officers, and shareholders, ensuring efficient functioning and compliance with relevant state laws. Here, we delve into various aspects of the Georgia Bylaws of Great American Bank, FSB, shedding light on its key features and different types. 1. General Provisions: The Georgia Bylaws of Great American Bank, FSB, commence with a comprehensive set of general provisions. These provisions lay the groundwork for the bank's operations and define its purpose, principal office location, and the authority granted to directors and officers. 2. Membership: The bylaws outline the membership provisions, defining the qualifications, rights, and responsibilities of the bank's shareholders. Various membership classes may exist depending on the bank's structure, with distinct requirements and privileges assigned to each class. 3. Board of Directors: The Georgia Bylaws highlight the structure and responsibilities of the Board of Directors governing Great American Bank, FSB. Details regarding director qualifications, election procedures, terms of office, and meeting protocols are elaborated. The bylaws may also address procedures for committee formation and the delegation of specific powers to these committees. 4. Officers and Management: This section outlines the duties, appointment procedures, and authority of the bank's officers, including the CEO, President, Chief Financial Officer, and others. It also describes the processes for their election or removal, as well as their compensation and indemnification in the case of legal actions. 5. Shareholder Meetings and Voting Rights: The bylaws provide insights into the regulations surrounding shareholder meetings, quorum requirements, and voting rights. Procedures for proxy voting, absentee ballots, and electronic participation may also be included, ensuring all shareholders have the opportunity to participate and express their opinions. 6. Amendments and Adoption: This section details the process for amending the bylaws and the required majority vote for approval. It ensures that any modifications to the bylaws are conducted in a transparent and lawful manner. Different types of Georgia Bylaws of Great American Bank, FSB, may exist depending on the specific needs and circumstances of the institution. For example: 1. Commercial Banking Bylaws: These bylaws predominantly focus on the traditional commercial banking operations of the Great American Bank, FSB. They highlight lending guidelines, loan portfolios, interest rates, and other aspects related to the bank's core financial services. 2. Mortgage Banking Bylaws: If Great American Bank, FSB, engages significantly in mortgage banking activities, specific bylaws may be established to address regulations related to loan origination, servicing, foreclosure processes, and compliance with state and federal mortgage laws. 3. Trust Department Bylaws: In the case of a trust department within Great American Bank, FSB, separate bylaws may govern their operations. These bylaws would specify the fiduciary duties, investment strategies, trust management procedures, and trustee powers exercised by the bank. It is important to consult the official Georgia Bylaws of Great American Bank, FSB, for a comprehensive understanding of the institution's operations and governance. These bylaws ensure that the bank operates ethically, adheres to industry standards, and fulfills its obligations to its shareholders and stakeholders.

Georgia Bylaws of Great American Bank, FSB

Description

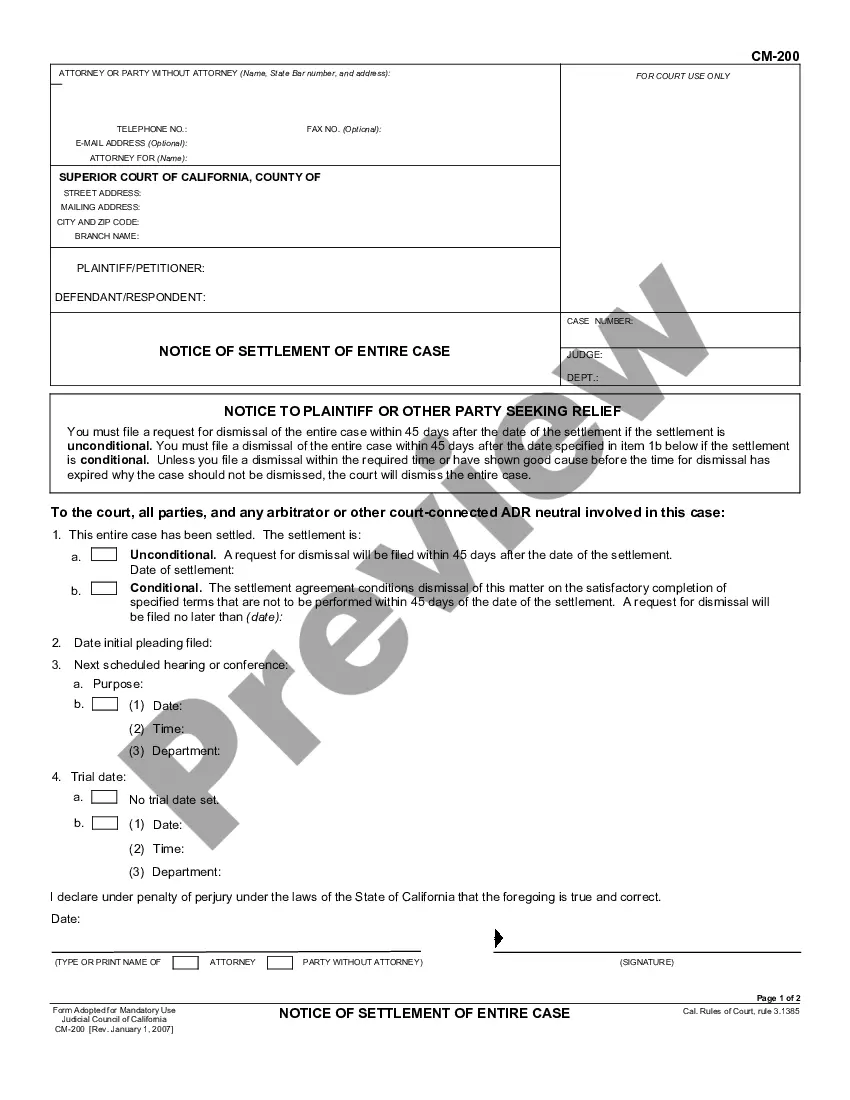

How to fill out Georgia Bylaws Of Great American Bank, FSB?

US Legal Forms - one of several biggest libraries of legal kinds in the USA - provides a wide range of legal file themes it is possible to download or printing. Using the web site, you can get thousands of kinds for company and person uses, categorized by categories, claims, or keywords and phrases.You can get the latest versions of kinds like the Georgia Bylaws of Great American Bank, FSB within minutes.

If you currently have a monthly subscription, log in and download Georgia Bylaws of Great American Bank, FSB from your US Legal Forms local library. The Acquire button will appear on every single develop you see. You have access to all formerly downloaded kinds from the My Forms tab of your profile.

In order to use US Legal Forms initially, allow me to share basic instructions to help you started out:

- Be sure to have chosen the best develop for your city/county. Click on the Review button to review the form`s articles. Look at the develop description to ensure that you have selected the correct develop.

- When the develop does not satisfy your specifications, use the Research industry near the top of the monitor to get the one who does.

- When you are satisfied with the form, confirm your decision by clicking the Purchase now button. Then, pick the pricing strategy you want and offer your qualifications to register for an profile.

- Approach the deal. Make use of credit card or PayPal profile to complete the deal.

- Pick the structure and download the form on the system.

- Make modifications. Load, revise and printing and indicator the downloaded Georgia Bylaws of Great American Bank, FSB.

Each and every design you added to your account lacks an expiration day and is your own property for a long time. So, if you would like download or printing an additional copy, just check out the My Forms area and click on on the develop you need.

Obtain access to the Georgia Bylaws of Great American Bank, FSB with US Legal Forms, by far the most considerable local library of legal file themes. Use thousands of expert and state-particular themes that meet up with your business or person requires and specifications.

Form popularity

FAQ

Federal savings bank, a class of bank in the United States.

BANKING, FINANCE, ECONOMICS. abbreviation for Financial Stability Board: a world organization that advises on safer financial and banking practices: The FSB recently published reports on the implementation of regulatory reforms for strengthening financial stability.

The FSB promotes global financial stability by coordinating the development of regulatory, supervisory and other financial sector policies and conducts outreach to non-member countries. It achieves cooperation and consistency through a three-stage process.

The Federation of Small Businesses.

Article Talk. The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established in the 2009 G20 Pittsburgh Summit as a successor to the Financial Stability Forum (FSF).

A savings and loan institution specializes in mortgage and home loans and may provide the same kinds of checking and savings accounts as a bank. A credit union is a not-for-profit financial institution with membership based on a common characteristic, such as place of employment.