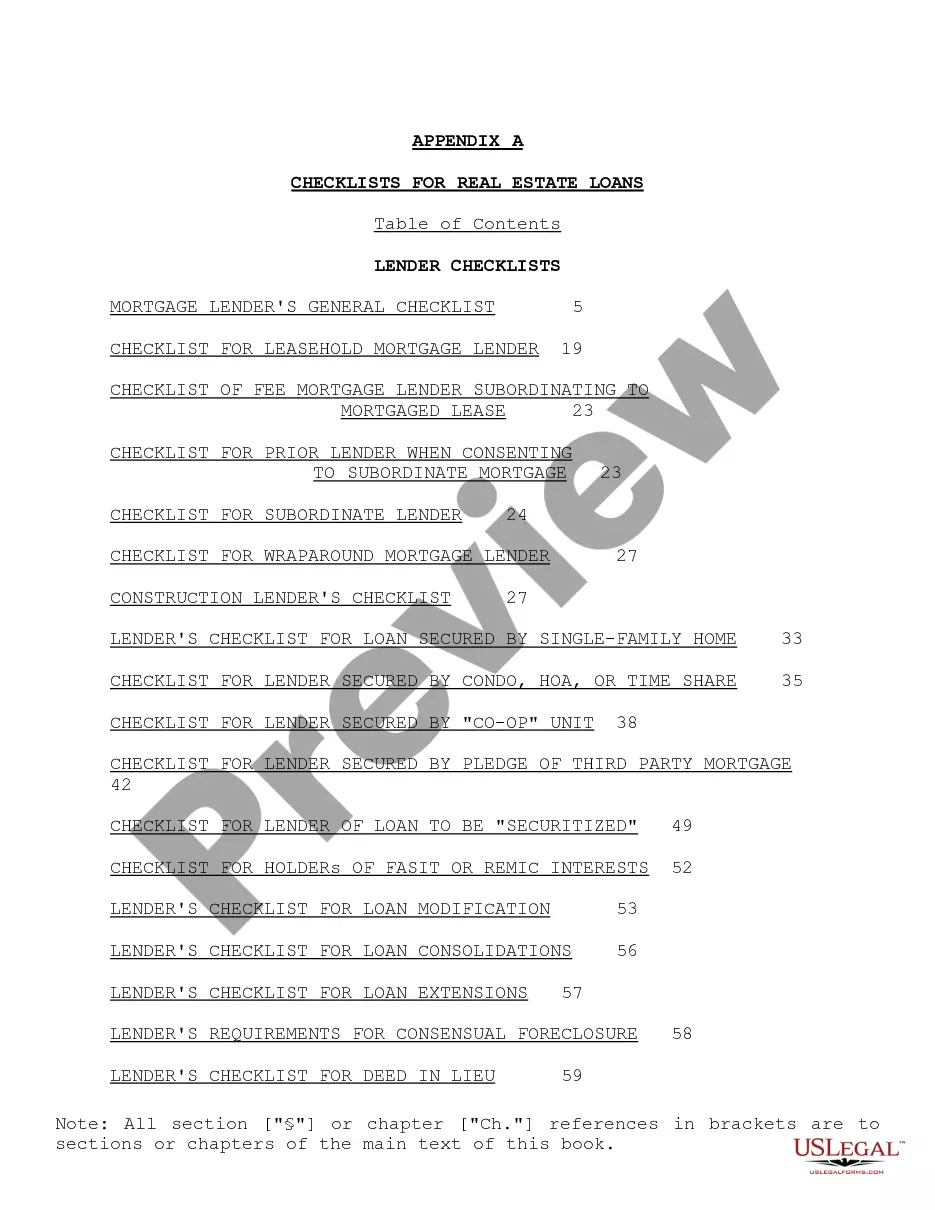

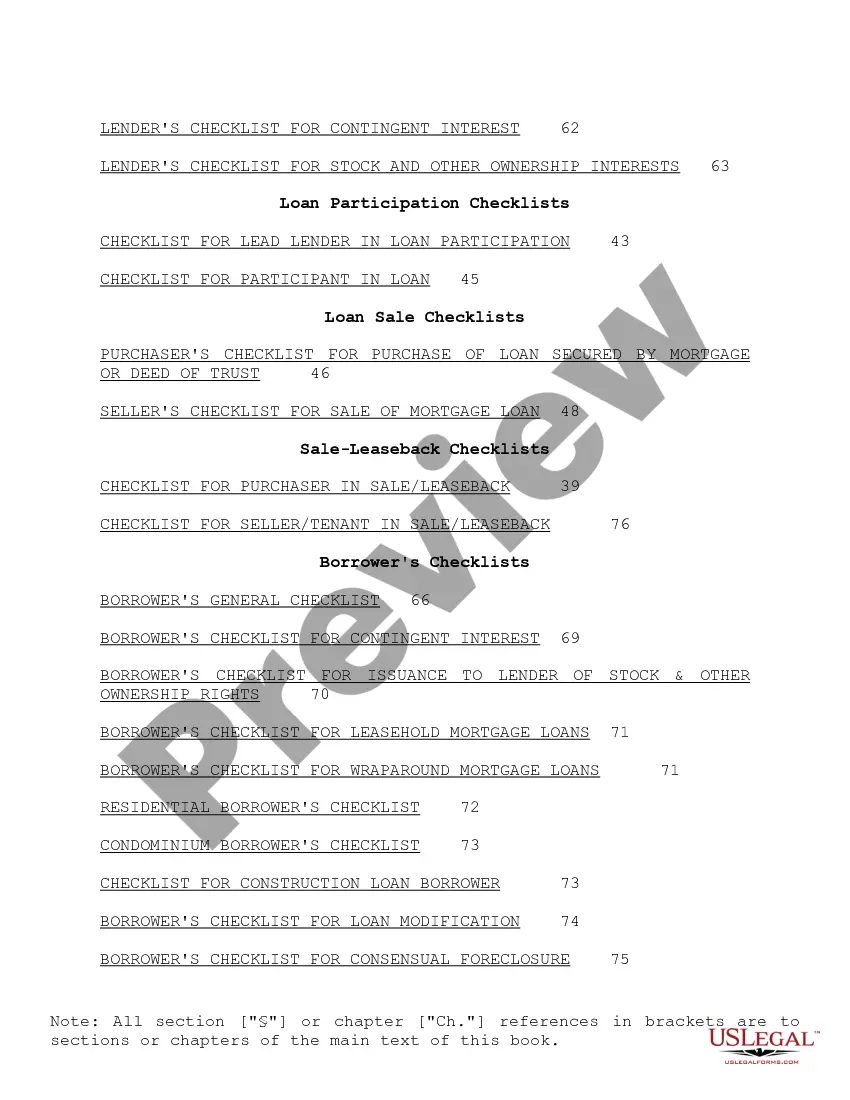

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

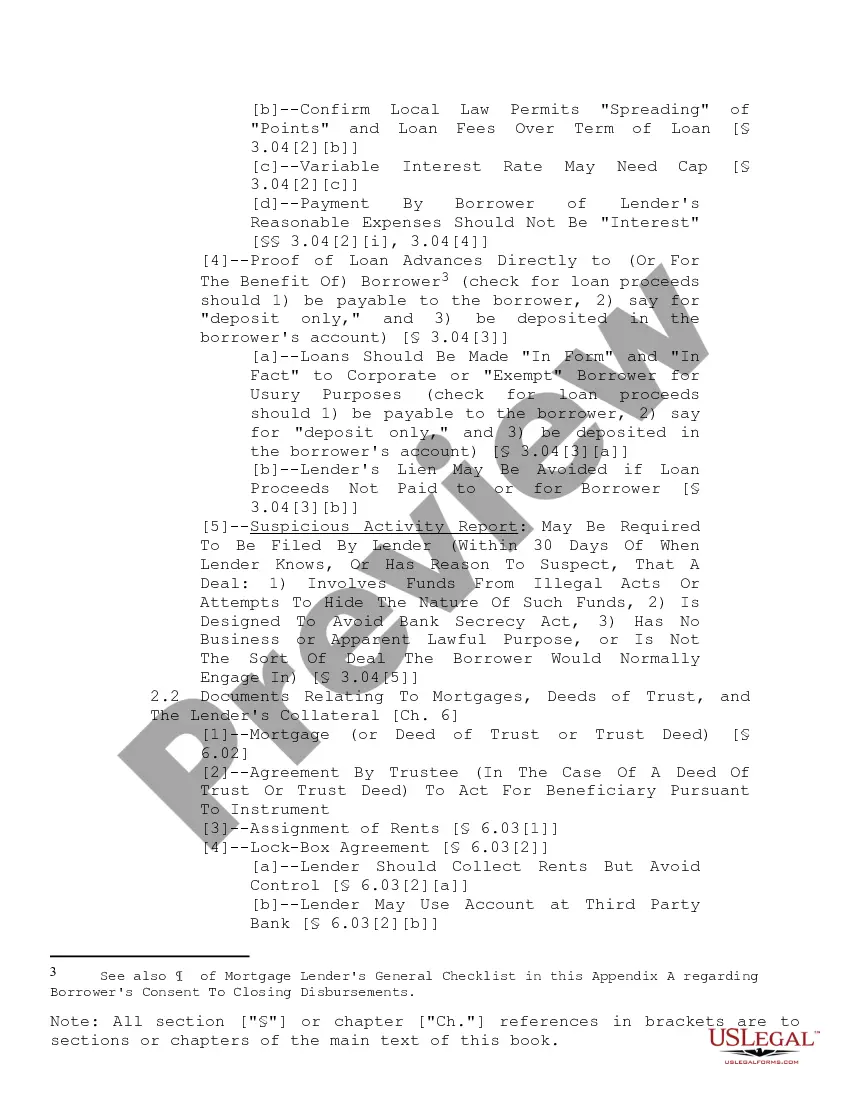

A Georgia Checklist for Real Estate Loans acts as a comprehensive guide for lenders and borrowers, ensuring that all necessary documents and requirements are met during the loan application and approval process. This checklist helps both parties navigate the complex world of real estate financing in Georgia, resulting in a smoother and more efficient transaction. Here are some essential components that may appear on a Georgia Checklist for Real Estate Loans: 1. Applicant Information: The checklist begins by gathering crucial details about the borrower, such as their full legal name, contact information, social security number, and employment history. This information is necessary for conducting credit checks and verifying the borrower's ability to repay the loan. 2. Property Details: This section requires a comprehensive description of the property being financed, including its physical address, legal description, and any relevant appraisals or property inspections. It ensures that the lender has accurate information about the collateral. 3. Loan Application: The checklist includes a thorough review of the loan application, including the completed loan application form, which outlines the borrower's requested loan amount, payment terms, and other relevant financial information. Any additional documents required for the application, such as income verification, tax returns, or financial statements, are also listed in this section. 4. Credit History: Lenders need access to the borrower's credit history to assess their creditworthiness. The checklist may require copies of the borrower's credit reports from major credit bureaus, along with any explanations or justifications for previous credit issues or outstanding debts. 5. Income and Employment Verification: This section emphasizes the need for proof of the borrower's income and employment stability. It may include documents such as pay stubs, employment contracts, W-2 forms, or proof of self-employment income. The lender needs assurance that the borrower can meet the financial obligations associated with the loan. 6. Financial Statements: For certain types of real estate loans, such as commercial or investment properties, the checklist may require the submission of detailed financial statements. These statements include statements of assets and liabilities, bank statements, profit and loss statements, and balance sheets. Such documents provide a clear picture of the borrower's financial health and their ability to manage the loan. 7. Insurance Coverage: This section ensures that the property being financed is adequately insured. The checklist may include requirements for comprehensive property insurance, liability coverage, and flood insurance, if applicable. Proof of insurance is typically required to protect the lender's interests should any unforeseen damages occur. 8. Legal Documentation: This element encompasses various legal documents related to the transaction, including the sales contract, title search, title insurance, and any other relevant legal agreements. These documents verify the legal ownership of the property, identify any liens or encumbrances, and ensure a clear transfer of ownership to the borrower upon loan approval. Different types of Georgia Checklists for Real Estate Loans may exist depending on the purpose and complexity of the loan. Types could include Residential Mortgage Loan Checklist, Commercial Real Estate Loan Checklist, Land Acquisition Loan Checklist, Construction Loan Checklist, and Investment Property Loan Checklist. Each type of loan may have additional requirements specific to its nature and purpose. Overall, a Georgia Checklist for Real Estate Loans is a valuable tool for both lenders and borrowers, ensuring that all necessary documentation and requirements are accounted for during the loan application and approval process. By following such a checklist, the loan process becomes more transparent, efficient, and ultimately contributes to a successful real estate financing experience.A Georgia Checklist for Real Estate Loans acts as a comprehensive guide for lenders and borrowers, ensuring that all necessary documents and requirements are met during the loan application and approval process. This checklist helps both parties navigate the complex world of real estate financing in Georgia, resulting in a smoother and more efficient transaction. Here are some essential components that may appear on a Georgia Checklist for Real Estate Loans: 1. Applicant Information: The checklist begins by gathering crucial details about the borrower, such as their full legal name, contact information, social security number, and employment history. This information is necessary for conducting credit checks and verifying the borrower's ability to repay the loan. 2. Property Details: This section requires a comprehensive description of the property being financed, including its physical address, legal description, and any relevant appraisals or property inspections. It ensures that the lender has accurate information about the collateral. 3. Loan Application: The checklist includes a thorough review of the loan application, including the completed loan application form, which outlines the borrower's requested loan amount, payment terms, and other relevant financial information. Any additional documents required for the application, such as income verification, tax returns, or financial statements, are also listed in this section. 4. Credit History: Lenders need access to the borrower's credit history to assess their creditworthiness. The checklist may require copies of the borrower's credit reports from major credit bureaus, along with any explanations or justifications for previous credit issues or outstanding debts. 5. Income and Employment Verification: This section emphasizes the need for proof of the borrower's income and employment stability. It may include documents such as pay stubs, employment contracts, W-2 forms, or proof of self-employment income. The lender needs assurance that the borrower can meet the financial obligations associated with the loan. 6. Financial Statements: For certain types of real estate loans, such as commercial or investment properties, the checklist may require the submission of detailed financial statements. These statements include statements of assets and liabilities, bank statements, profit and loss statements, and balance sheets. Such documents provide a clear picture of the borrower's financial health and their ability to manage the loan. 7. Insurance Coverage: This section ensures that the property being financed is adequately insured. The checklist may include requirements for comprehensive property insurance, liability coverage, and flood insurance, if applicable. Proof of insurance is typically required to protect the lender's interests should any unforeseen damages occur. 8. Legal Documentation: This element encompasses various legal documents related to the transaction, including the sales contract, title search, title insurance, and any other relevant legal agreements. These documents verify the legal ownership of the property, identify any liens or encumbrances, and ensure a clear transfer of ownership to the borrower upon loan approval. Different types of Georgia Checklists for Real Estate Loans may exist depending on the purpose and complexity of the loan. Types could include Residential Mortgage Loan Checklist, Commercial Real Estate Loan Checklist, Land Acquisition Loan Checklist, Construction Loan Checklist, and Investment Property Loan Checklist. Each type of loan may have additional requirements specific to its nature and purpose. Overall, a Georgia Checklist for Real Estate Loans is a valuable tool for both lenders and borrowers, ensuring that all necessary documentation and requirements are accounted for during the loan application and approval process. By following such a checklist, the loan process becomes more transparent, efficient, and ultimately contributes to a successful real estate financing experience.