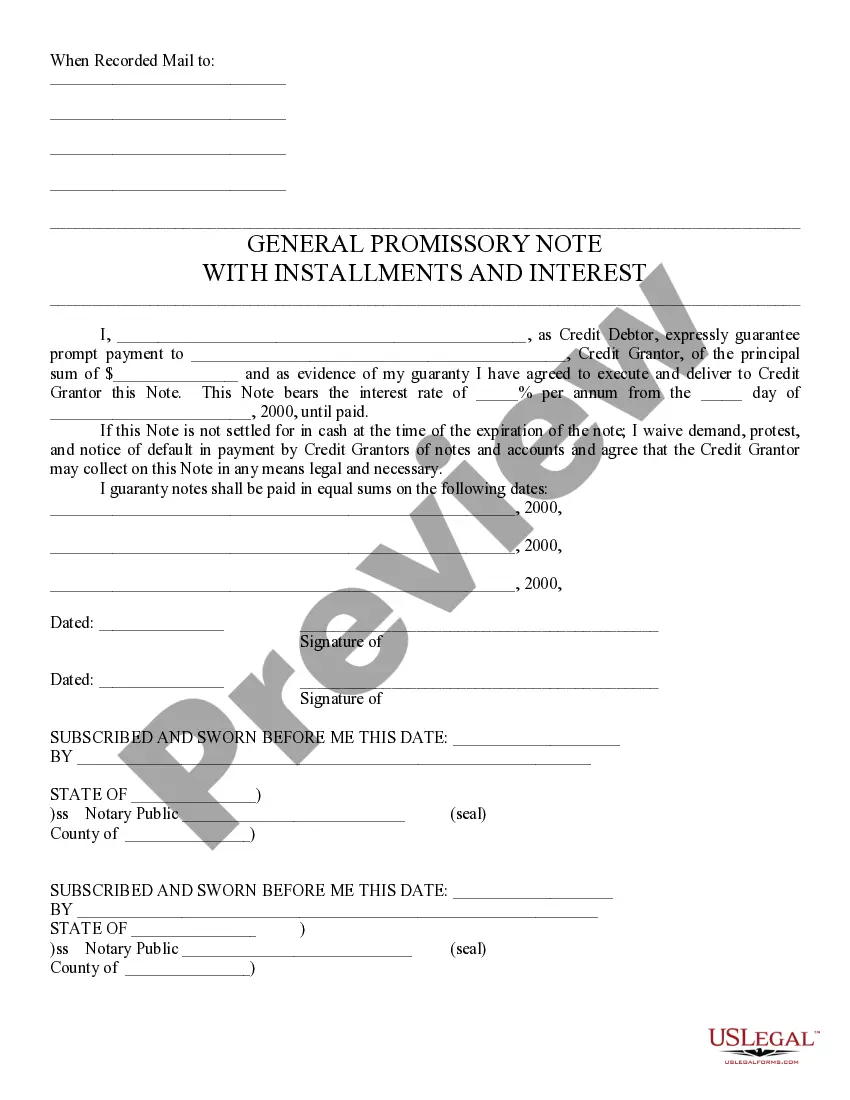

Georgia Linking Agreement

Description

How to fill out Linking Agreement?

Are you currently in a place in which you will need documents for possibly business or individual reasons almost every time? There are a lot of legitimate record templates available online, but discovering kinds you can trust is not simple. US Legal Forms provides thousands of kind templates, like the Georgia Linking Agreement, that are created to satisfy state and federal demands.

If you are previously informed about US Legal Forms web site and possess a free account, simply log in. Afterward, you are able to down load the Georgia Linking Agreement format.

Unless you come with an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is to the right metropolis/county.

- Use the Review button to analyze the shape.

- Browse the outline to ensure that you have selected the right kind.

- In the event the kind is not what you`re searching for, use the Lookup field to obtain the kind that meets your needs and demands.

- If you obtain the right kind, just click Purchase now.

- Select the costs plan you desire, submit the desired information and facts to create your money, and purchase an order utilizing your PayPal or charge card.

- Select a convenient file file format and down load your version.

Find all the record templates you have purchased in the My Forms food selection. You can obtain a extra version of Georgia Linking Agreement whenever, if possible. Just click on the essential kind to down load or print out the record format.

Use US Legal Forms, the most considerable assortment of legitimate forms, to save time and avoid faults. The services provides expertly created legitimate record templates that you can use for a selection of reasons. Generate a free account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

Do not staple or attach your check, W-2s or any other documents to your return. Submit proper documentation (schedules, statements and supporting documentation, including W-2s, other states' tax returns, or necessary federal returns and schedules).

You can request a payment plan: Online using your GTC account, or. Complete and mail a paper request using Form GA-9465 Installment Agreement Request.

Create a profile for a Business Go to the Georgia Tax Center. Click on Sign up. Review the requirements to confirm you are eligible and what you need to apply. ... Select the appropriate Account Type, click Next. Provide the Account Information, click Next. Enter any required extra validation account information, click Next.

Create a profile for a Business Go to the Georgia Tax Center. Click on Sign up. Review the requirements to confirm you are eligible and what you need to apply. ... Select the appropriate Account Type, click Next. Provide the Account Information, click Next. Enter any required extra validation account information, click Next.

Make a Quick Payment Go to the Georgia Tax Center. Under Tasks, click on Make a Quick Payment. Review the Request details and click Next. For Customer Type, select on Individual. For your ID Type, select the box Social Security # or Individual Taxpayer ID #. ... Select Yes or No if you have a payment number.

Form G-4 Employee Withholding.

The Georgia Department of Revenue's Offer in Compromise program allows a taxpayer to settle a tax liability for less than the total amount owed. Generally, the Department approves an offer in compromise when the amount offered represents the most the Department can expect to collect within a reasonable period of time.

New employers with private, agriculture, and domestic employment can submit an Online Employer Tax Registration ( ) and obtain a GDOL account number, if liable, upon submission.

The Georgia Milestones Assessment System (Georgia Milestones) is a comprehensive summative assessment pro?gram spanning grades 3 through high school.

Georgia Milestones measures how well students have learned the knowledge and skills outlined in the state-mandated content standards in English language arts (ELA), mathematics, science, and social studies.