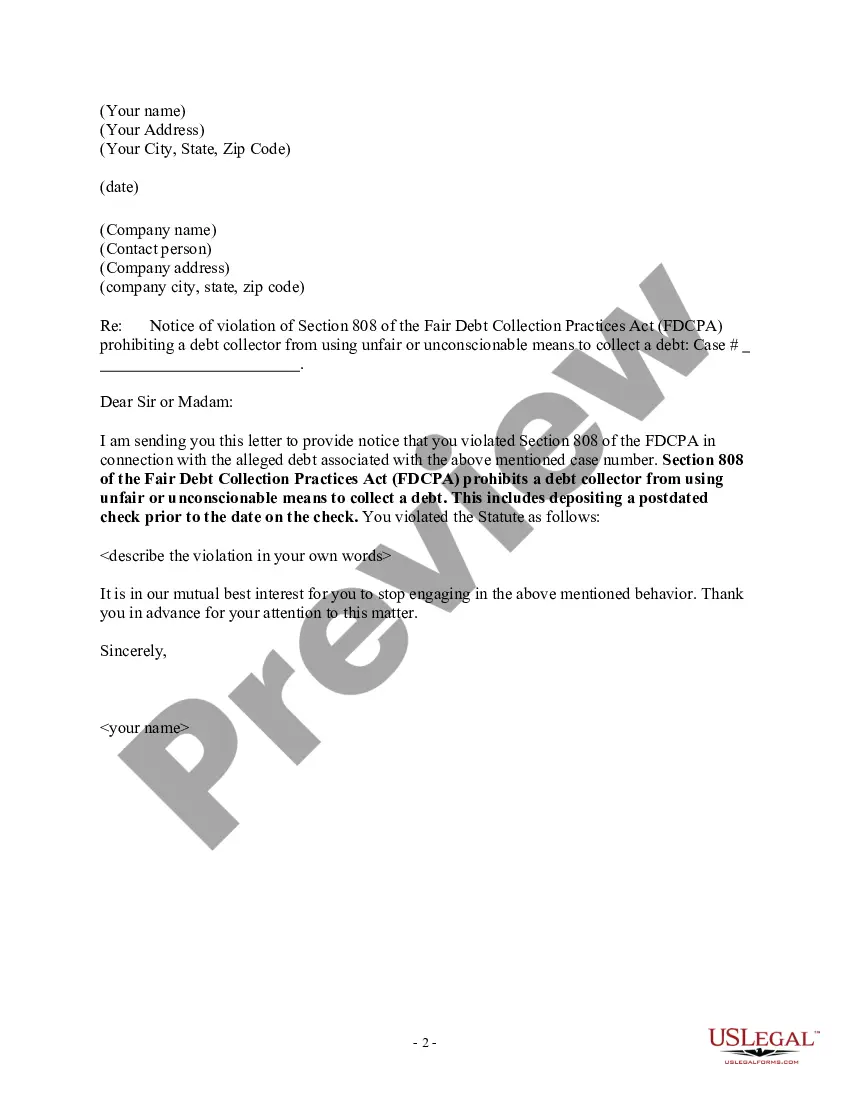

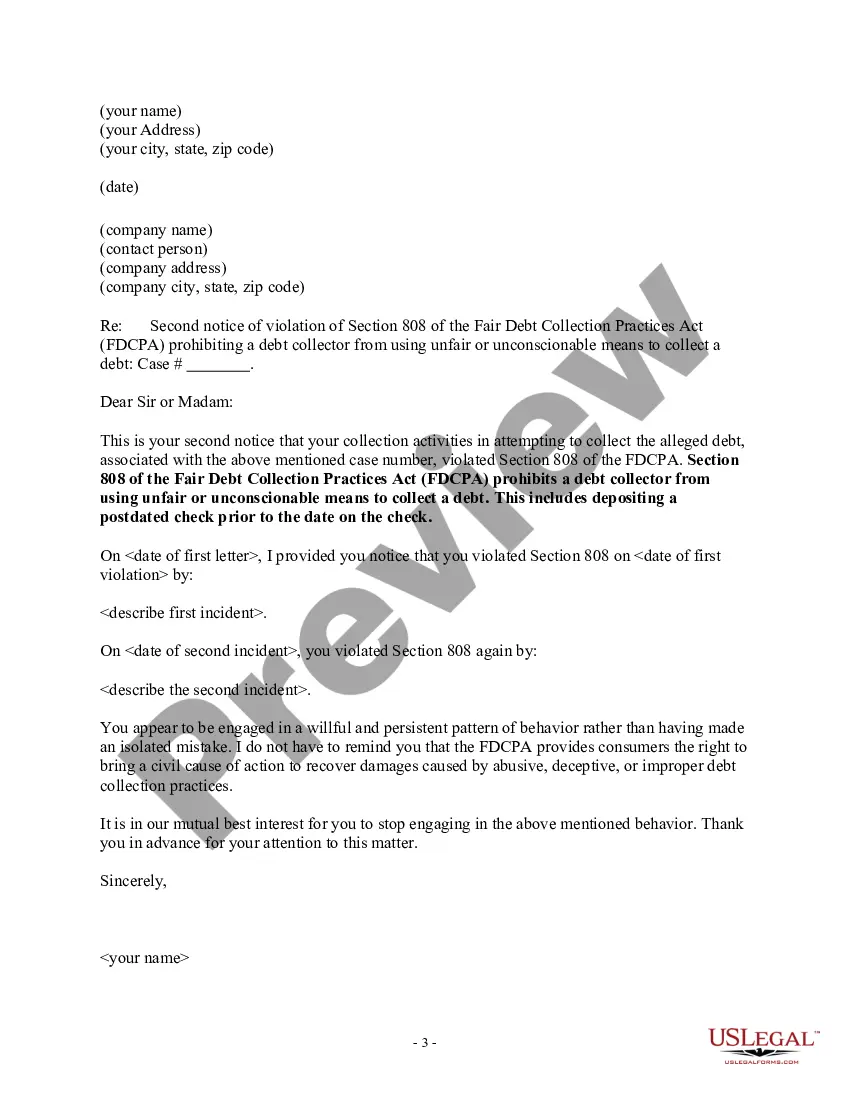

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Georgia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Georgia Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

Are you presently in a place in which you will need papers for sometimes company or person uses almost every time? There are tons of authorized document templates accessible on the Internet, but locating ones you can rely is not straightforward. US Legal Forms provides a large number of form templates, much like the Georgia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check, which are published to fulfill federal and state specifications.

When you are previously acquainted with US Legal Forms web site and have an account, basically log in. Afterward, you are able to download the Georgia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check design.

Should you not come with an account and wish to start using US Legal Forms, abide by these steps:

- Discover the form you require and ensure it is for your correct area/area.

- Make use of the Preview switch to examine the shape.

- Read the explanation to ensure that you have chosen the proper form.

- In case the form is not what you are trying to find, utilize the Lookup discipline to obtain the form that fits your needs and specifications.

- When you get the correct form, click Purchase now.

- Select the prices prepare you would like, complete the necessary information and facts to produce your bank account, and buy an order using your PayPal or charge card.

- Choose a convenient paper format and download your version.

Discover all of the document templates you have purchased in the My Forms menus. You can aquire a extra version of Georgia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check at any time, if required. Just click on the necessary form to download or produce the document design.

Use US Legal Forms, by far the most extensive variety of authorized kinds, to save efforts and stay away from mistakes. The support provides expertly made authorized document templates that can be used for a range of uses. Generate an account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

If the bank does not spot that the cheque has been post-dated, the cheque would then probably be paid before you intended or returned unpaid if you have insufficient funds in your account. This could potentially incur you charges and cause inconvenience to the recipient.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.