Georgia Mortgage Review Worksheets are comprehensive documents designed to assist individuals in evaluating and analyzing their mortgage information. These worksheets provide valuable insights into various aspects of mortgage loans in the state of Georgia, including interest rates, repayment terms, and financial standing. By utilizing these worksheets, borrowers can make informed decisions about their mortgage options and determine the most suitable course of action. The Georgia Mortgage Review Worksheets serve as a tool to assess and review multiple types of mortgages available to residents in Georgia. Some various types of worksheets include: 1. Fixed-Rate Mortgage Worksheet: This worksheet is specifically designed for individuals with fixed-rate mortgages. It allows borrowers to review the interest rates, monthly payments, and the total amount paid over the loan term. By comparing different scenarios, borrowers can determine the financial impact of various interest rates and loan durations. 2. Adjustable-Rate Mortgage (ARM) Worksheet: For borrowers with adjustable-rate mortgages, this worksheet helps evaluate the changes in interest rates over time. It provides a comprehensive overview of the initial interest rate, adjustment periods, and possible adjustments in the future. This allows borrowers to anticipate and plan for potential fluctuations in their mortgage payments. 3. Refinance Worksheet: This worksheet is specifically tailored for borrowers considering mortgage refinancing in Georgia. It enables individuals to analyze the potential savings and costs associated with refinancing their existing mortgage. By comparing interest rates, closing costs, and new loan terms, borrowers can decide if refinancing is a financially viable option. 4. Home Equity Loan Worksheet: Homeowners interested in accessing their home equity can utilize this worksheet to evaluate different home equity loan options. It provides insights into interest rates, repayment terms, and monthly payments. By comparing multiple loan scenarios, borrowers can determine the most beneficial option for their specific financial goals. 5. Debt Consolidation Worksheet: This worksheet assists borrowers in assessing the feasibility of consolidating their debts using a mortgage loan. It allows individuals to compare the interest rates, monthly payments, and personal financial situation before and after consolidation. By using this worksheet, borrowers can evaluate if consolidating debts through a mortgage loan is a prudent financial decision. In summary, Georgia Mortgage Review Worksheets help borrowers in Georgia make informed decisions about their mortgage options. These worksheets analyze various types of mortgages, including fixed-rate and adjustable-rate mortgages, refinancing options, home equity loans, and debt consolidation. By utilizing these worksheets, individuals can assess interest rates, payment terms, and their financial situation to make the best choice for their mortgage needs.

Georgia Mortgage Review Worksheets

Description

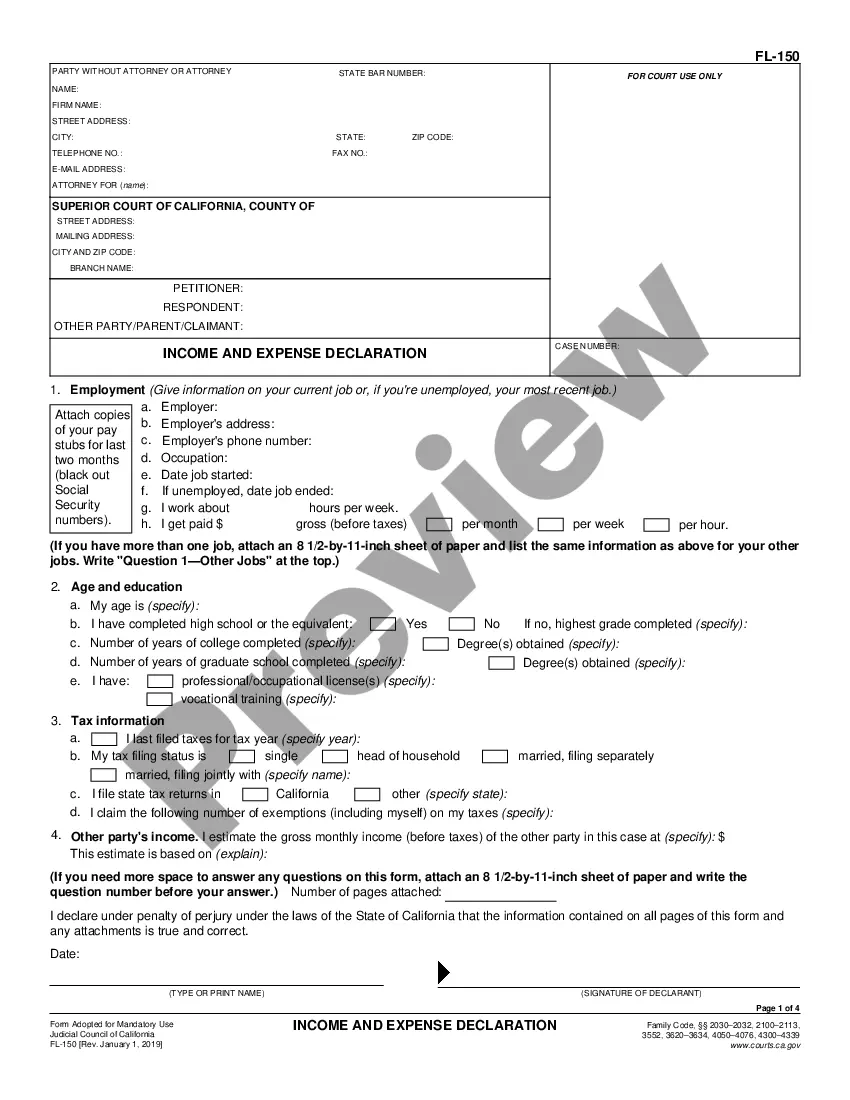

How to fill out Georgia Mortgage Review Worksheets?

Are you in a situation that you require paperwork for sometimes organization or individual purposes nearly every day time? There are tons of legal document layouts available on the Internet, but getting kinds you can rely isn`t straightforward. US Legal Forms provides a huge number of type layouts, like the Georgia Mortgage Review Worksheets, that are written to satisfy federal and state demands.

Should you be already familiar with US Legal Forms website and have a free account, simply log in. Following that, it is possible to down load the Georgia Mortgage Review Worksheets format.

If you do not have an bank account and want to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is for your proper city/state.

- Take advantage of the Preview switch to analyze the shape.

- Look at the description to ensure that you have chosen the right type.

- In the event the type isn`t what you are searching for, take advantage of the Research area to obtain the type that fits your needs and demands.

- When you get the proper type, simply click Acquire now.

- Select the costs strategy you would like, submit the required information to produce your bank account, and buy the order making use of your PayPal or charge card.

- Choose a convenient document format and down load your duplicate.

Discover every one of the document layouts you may have bought in the My Forms food list. You can get a further duplicate of Georgia Mortgage Review Worksheets whenever, if needed. Just click on the required type to down load or produce the document format.

Use US Legal Forms, probably the most substantial collection of legal forms, to save lots of efforts and stay away from errors. The service provides appropriately created legal document layouts which you can use for a variety of purposes. Make a free account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

This new program ? the HHF Down Payment Assistance Program (HHF DPA) ? provides $15,000 in down payment and closing cost assistance to eligible borrowers purchasing an existing home in seven of Georgia's hardest hit counties. Funds are available on a first-come, first-serve basis. FACT SHEET: NEW HHF DPA PROGRAM Georgia Department of Community Affairs (.gov) ? sites ? default ? files Georgia Department of Community Affairs (.gov) ? sites ? default ? files PDF

The Georgia Dream Hardest Hit Fund (HHF) was created to reduce obstacles for homeownership and to stabilize those counties that have been the hardest hit with serious delinquency, negative equity, distressed sales and foreclosures.

FHA and VA loans: Since COVID-19 most Georgia lenders will require a credit score of at least 640 for these two types of loans to get the best rate and qualify for flexible underwriting. USDA, Jumbo, and Conventional loans: This category commands the highest credit score requirement at 660. Georgia Credit Score Needed to Buy A House | Moreira Team Mortgage moreirateam.com ? georgia ? what-credit-score-is-... moreirateam.com ? georgia ? what-credit-score-is-...

The Georgia Dream Homeownership Program makes purchasing a home possible for eligible residents. Georgia Dream provides affordable financing options, down payment and closing cost assistance, and homebuyer education. Apply for the Georgia Dream Homeownership Program Georgia.gov ? apply-georgia-dream-homeowne... Georgia.gov ? apply-georgia-dream-homeowne...

The down payment assistance is a 0% interest loan with no monthly payment. A second mortgage lien is placed on your property. It is due when you sell, refinance or no longer occupy the home as your primary residence. When funds are paid back, we use the money to help the next generation of applicants start the process.

Biden's Down Payment Toward Equity Act is a down payment grant that offers a pathway to homeownership for first-generation home buyers. If the bill becomes law, qualified home buyers could receive up to $25,000 in grant funding for their home purchase. $25,000 Downpayment Toward Equity Act | What To Know mymortgageinsider.com ? 25000-downpayment-t... mymortgageinsider.com ? 25000-downpayment-t...

The American Rescue Plan Act of 2021 established the Homeowner Assistance Fund (HAF) to help homeowners mitigate hardships caused by the pandemic. The HAF program is funded by the US Treasury and administered for the state of Georgia through GHFA Affordable Housing, Inc., under the name Georgia Mortgage Assistance.

How Much House Can You Afford? Monthly Pre-Tax IncomeRemaining Income After Average Monthly Debt PaymentEstimated Home Value$3,000$2,400$79,000$4,000$3,400$138,000$5,000$4,400$197,000$6,000$5,400$256,0004 more rows