Georgia Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Georgia Nonqualified Defined Benefit Deferred Compensation Agreement?

Choosing the right authorized file design can be a struggle. Obviously, there are tons of web templates accessible on the Internet, but how do you find the authorized develop you require? Take advantage of the US Legal Forms website. The support provides 1000s of web templates, like the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement, that can be used for organization and private requirements. All the types are checked out by professionals and meet up with federal and state requirements.

When you are presently signed up, log in to your accounts and then click the Download option to have the Georgia Nonqualified Defined Benefit Deferred Compensation Agreement. Use your accounts to appear with the authorized types you might have acquired formerly. Go to the My Forms tab of your own accounts and have another copy of the file you require.

When you are a fresh user of US Legal Forms, listed here are simple directions so that you can follow:

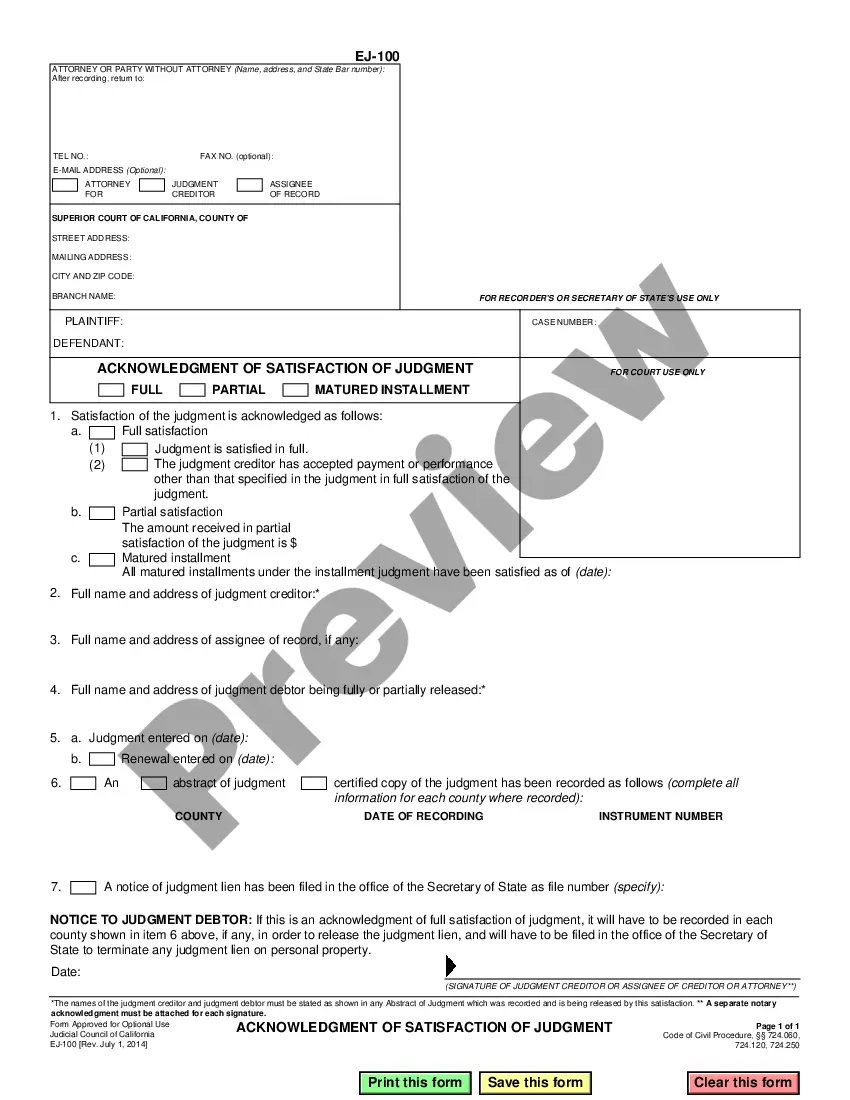

- Initially, ensure you have selected the correct develop for your personal town/county. You are able to look through the shape making use of the Review option and study the shape description to guarantee it will be the right one for you.

- If the develop is not going to meet up with your needs, make use of the Seach industry to get the proper develop.

- When you are certain the shape is proper, click the Purchase now option to have the develop.

- Opt for the rates plan you need and enter in the necessary information. Make your accounts and pay money for the order with your PayPal accounts or Visa or Mastercard.

- Select the data file structure and obtain the authorized file design to your system.

- Total, change and produce and indication the obtained Georgia Nonqualified Defined Benefit Deferred Compensation Agreement.

US Legal Forms may be the largest library of authorized types where you can see a variety of file web templates. Take advantage of the service to obtain appropriately-made paperwork that follow condition requirements.

Form popularity

FAQ

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

Section 457 plans are nonqualified, unfunded deferred compensation plans established by state and local government and tax-exempt employers.

Nonqualified deferred compensation provides an excellent way to offer executives additional benefits beyond what's provided for the general employee base. Putting these plans into play may increase your ability to attract and retain top employee talent.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

A nonqualified deferred compensation (NQDC) plan is an arrangement that an employer and employee agree to where the employer accepts to pay the employee sometime in the future. Executives often utilize NQDC plans to defer income taxes on their earnings. They differ drastically from qualified plans, like 401(k)s.

Nonqualified plans are retirement savings plans. They are called nonqualified because unlike qualified plans they do not adhere to Employee Retirement Income Security Act (ERISA) guidelines. Nonqualified plans are generally used to provide high-paid executives with an additional retirement savings option.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.