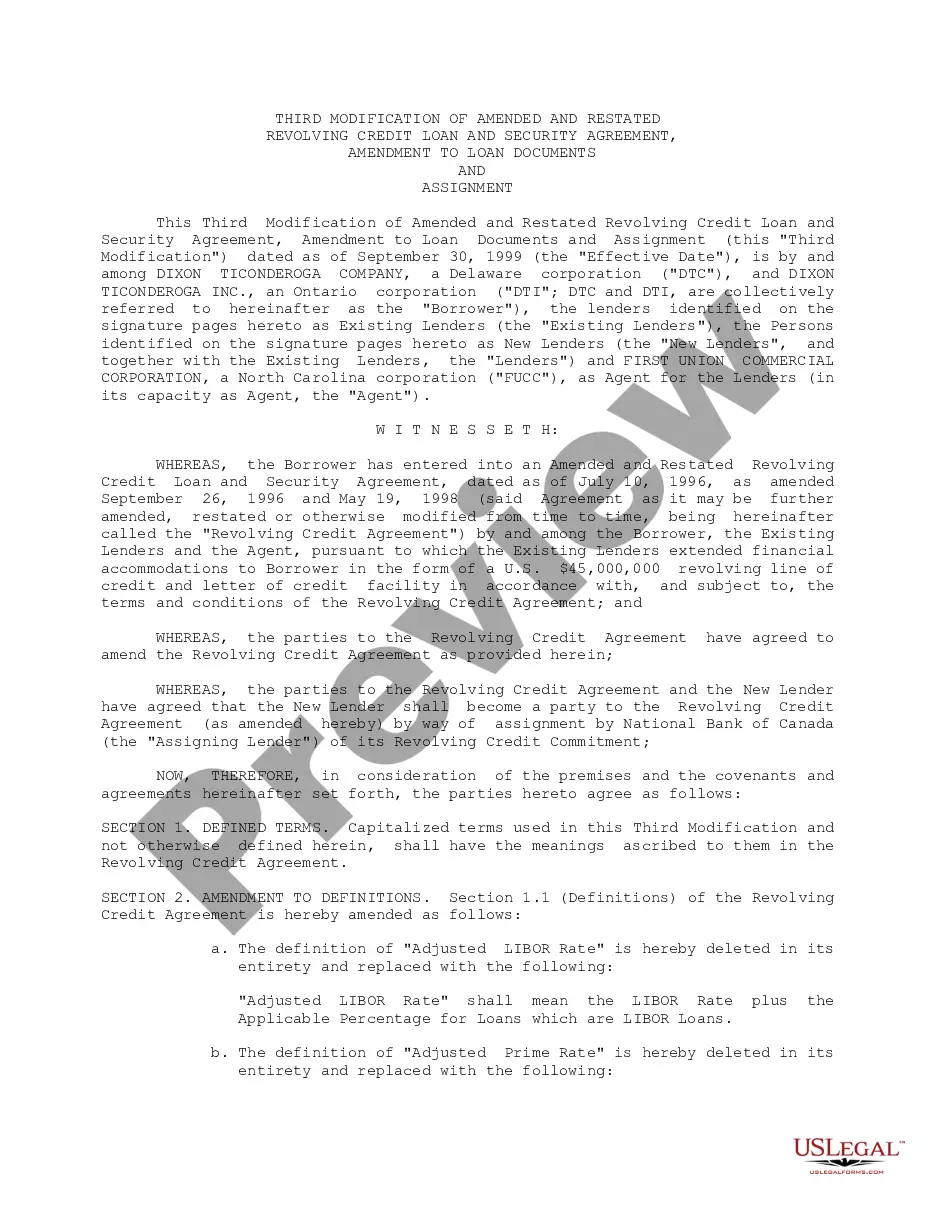

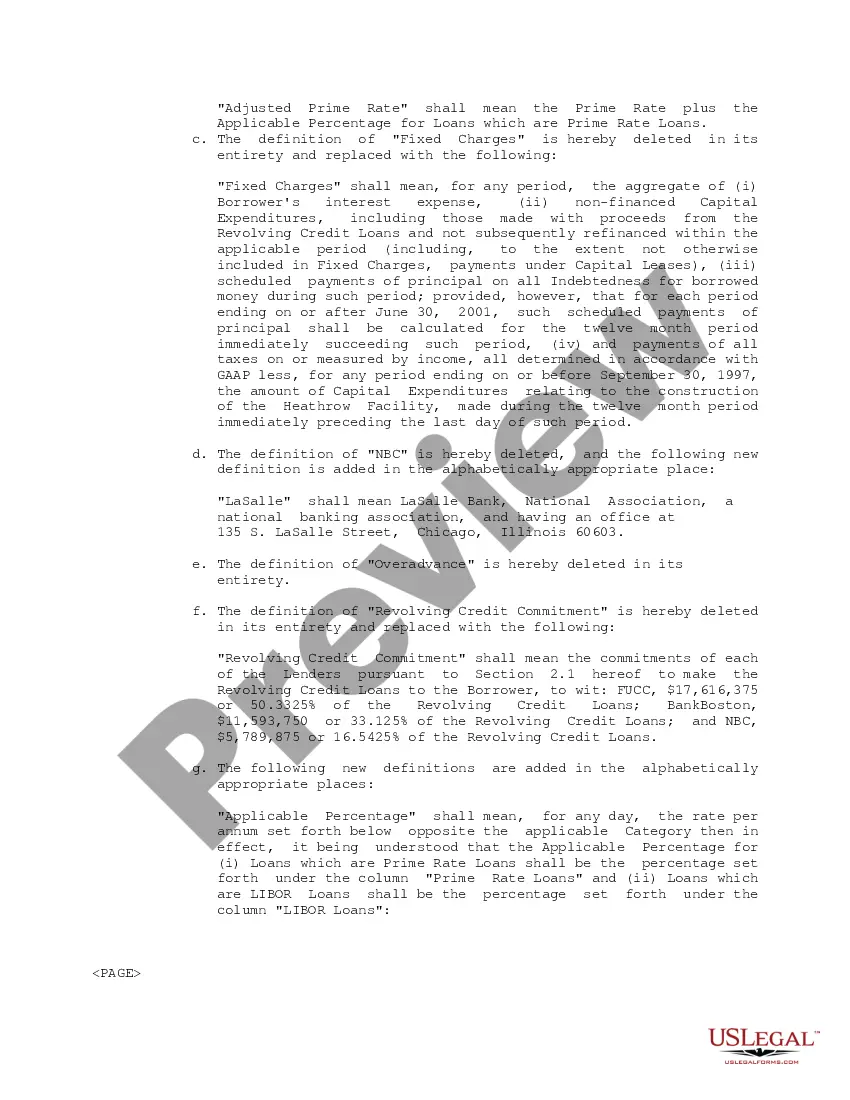

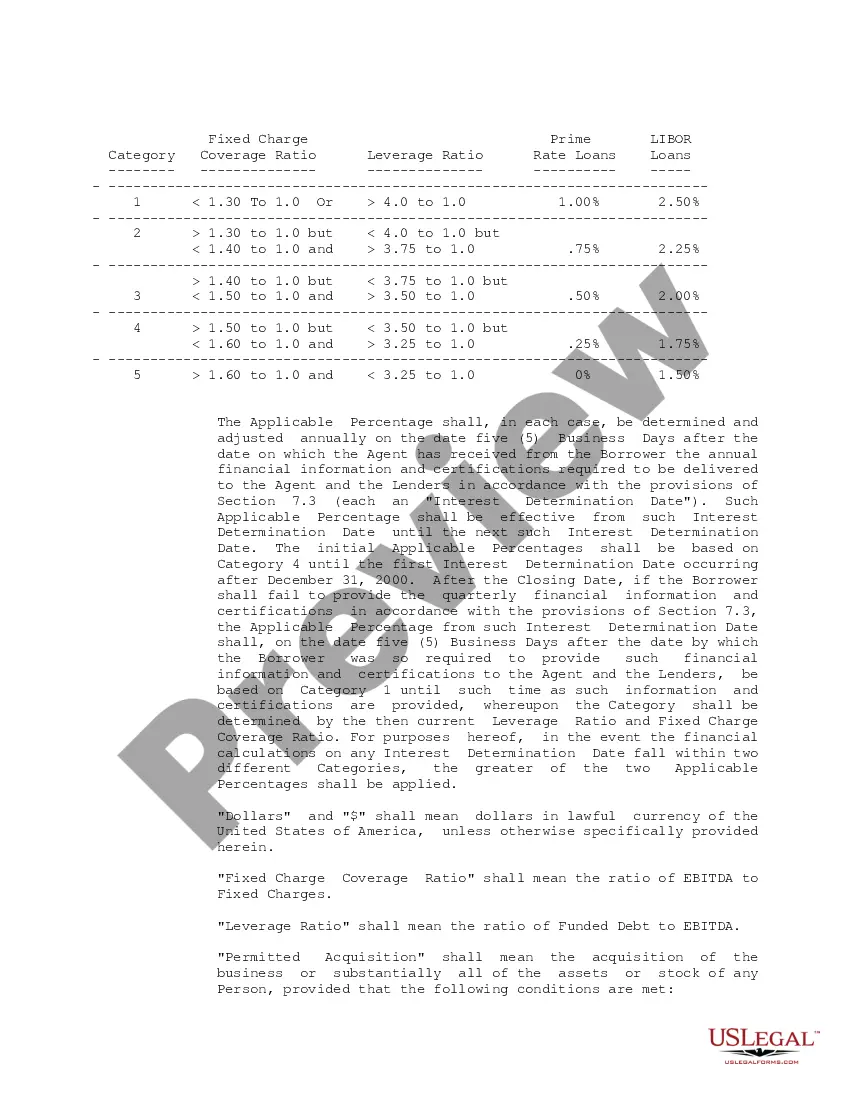

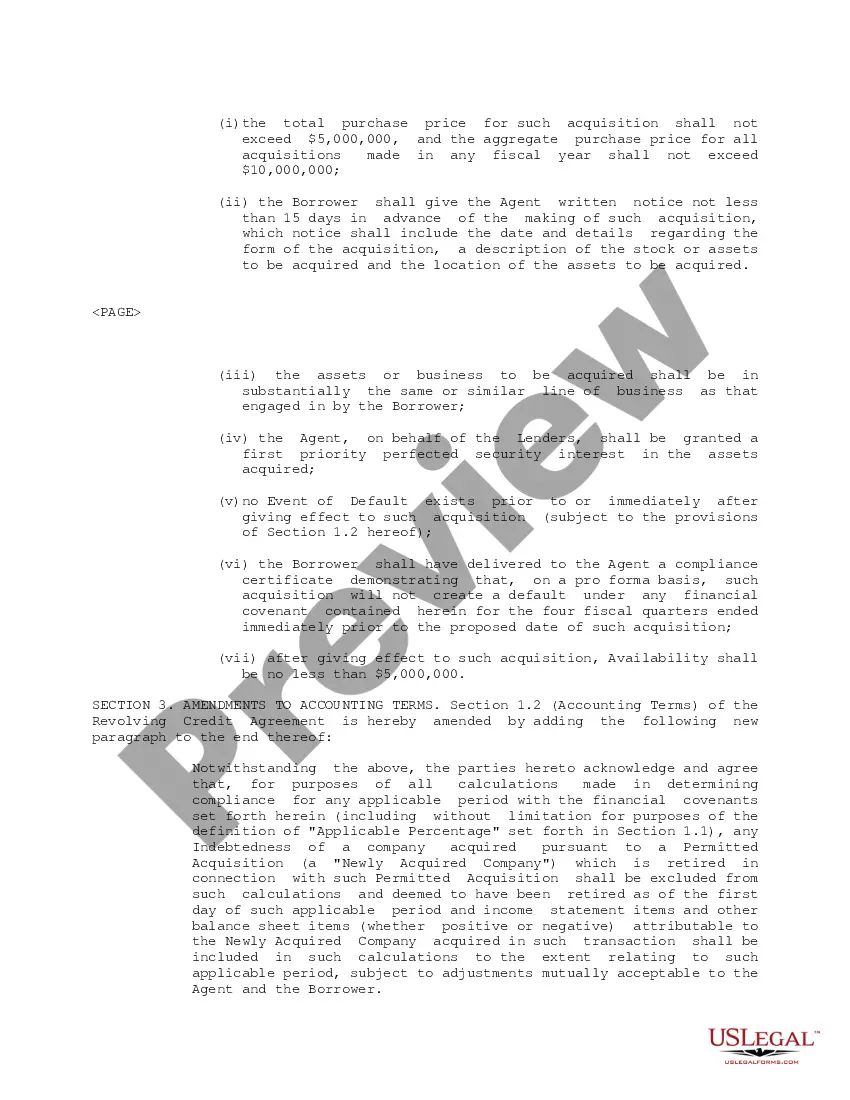

The Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. is a legal document that outlines the terms and conditions of a revolving credit loan and security arrangement between these two entities. This agreement enables Dixon Ticonderoga Co. to provide financial assistance to Dixon Ticonderoga, Inc. on a flexible basis, allowing the borrower to access funds as needed within a specified credit limit. Keywords: Georgia, Revolving Credit Loan, Security Agreement, Dixon Ticonderoga Co., Dixon Ticonderoga, Inc. Key Points: 1. Purpose: The Revolving Credit Loan and Security Agreement serves as a mechanism for Dixon Ticonderoga Co. to extend a line of credit to Dixon Ticonderoga, Inc. for various financial needs, such as working capital requirements or funding new projects. 2. Loan Structure: The agreement outlines the terms of the revolving credit loan, including the maximum credit limit available to Dixon Ticonderoga, Inc., the interest rates, repayment terms, and any associated fees or penalties. 3. Security Agreement: As a security measure to protect the lender's interests, Dixon Ticonderoga, Inc. pledges certain assets or collateral to secure the loan. These assets can include real estate, equipment, accounts receivable, and inventory. 4. Draw downs and Repayments: Dixon Ticonderoga, Inc. can request funds from the revolving credit facility in the form of draw downs, subject to the credit limit. Repayments are typically made on a predetermined schedule or as agreed upon between the parties. 5. Interest and Fees: The agreement outlines the interest rate that Dixon Ticonderoga, Inc. must pay on the outstanding balance, as well as any fees associated with the loan, such as an origination fee or late payment charges. Types of Georgia Revolving Credit Loan and Security Agreement: 1. Fixed Limit Revolving Credit Loan: This type of agreement sets a predetermined credit limit that cannot be exceeded. This provides both parties with stability and certainty in terms of the borrower's borrowing capacity. 2. Variable Limit Revolving Credit Loan: In this type of agreement, the credit limit can fluctuate based on the financial position of the borrower or other predetermined factors. This allows for more flexibility in accessing funds but may require periodic reassessment and adjustments. 3. Asset-Based Revolving Credit Loan: This agreement involves the borrower securing the loan with specific assets, such as accounts receivable or inventory. The credit limit is often tied to the value of the pledged assets, providing an additional layer of security for the lender. In summary, the Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. establishes the terms and conditions for a flexible line of credit, allowing the borrower to access funds as needed within a specified credit limit. The agreement outlines the loan structure, security measures, interest rates, and repayment terms. Different types of revolving credit loans include fixed limit, variable limit, and asset-based agreements.

Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

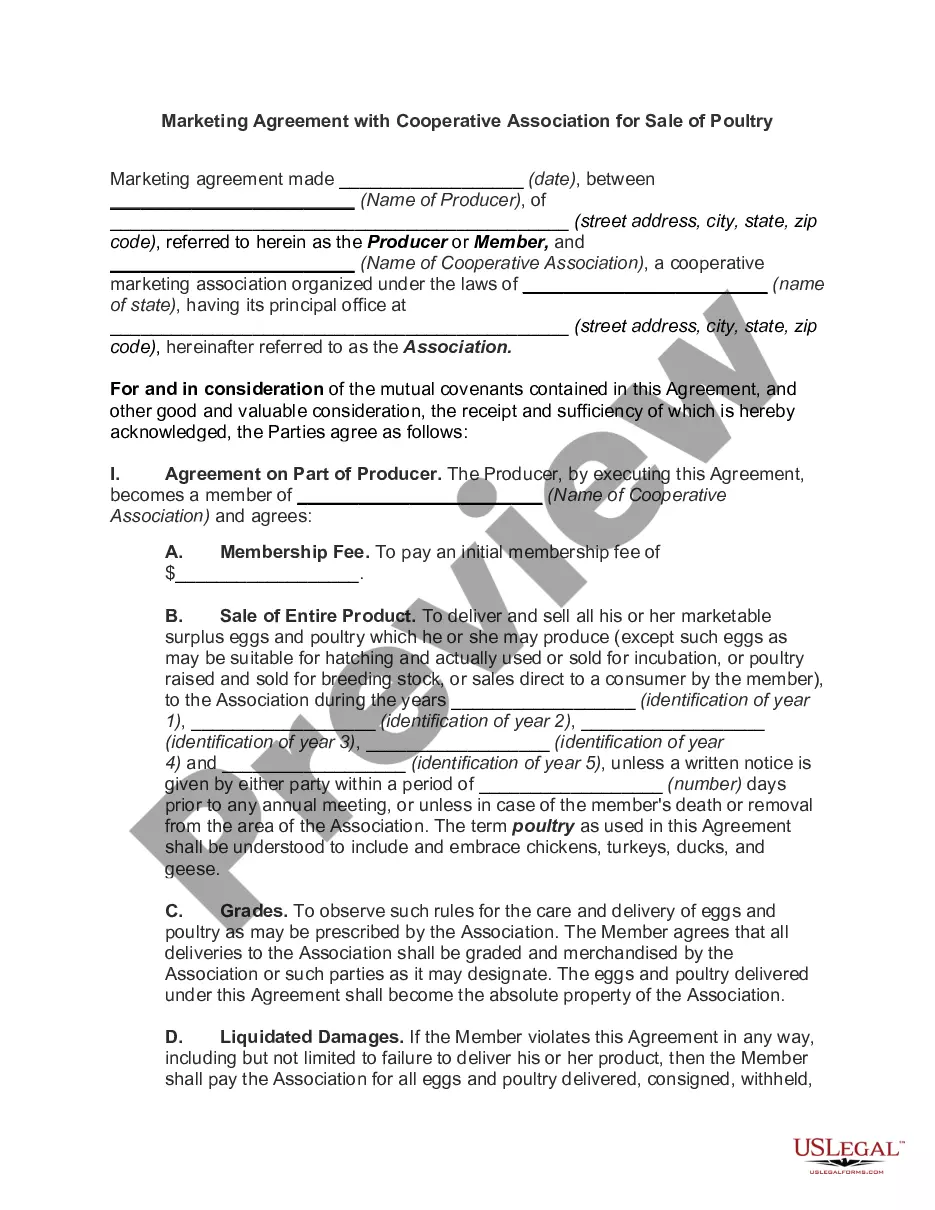

How to fill out Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

Discovering the right legitimate file web template could be a struggle. Obviously, there are plenty of themes available online, but how do you find the legitimate form you want? Make use of the US Legal Forms website. The services offers 1000s of themes, including the Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc., that can be used for business and private requires. All of the kinds are inspected by specialists and meet up with federal and state demands.

When you are previously signed up, log in to your accounts and click the Download option to get the Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.. Make use of your accounts to check throughout the legitimate kinds you might have acquired formerly. Go to the My Forms tab of the accounts and have yet another copy from the file you want.

When you are a whole new user of US Legal Forms, here are basic instructions that you can stick to:

- Initially, make sure you have selected the right form for your city/region. You are able to examine the form utilizing the Review option and look at the form description to ensure this is basically the best for you.

- In the event the form will not meet up with your needs, make use of the Seach discipline to get the appropriate form.

- When you are positive that the form is suitable, click the Get now option to get the form.

- Select the rates prepare you desire and enter in the necessary information. Make your accounts and pay for the transaction with your PayPal accounts or bank card.

- Pick the data file structure and download the legitimate file web template to your gadget.

- Full, modify and produce and indicator the obtained Georgia Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc..

US Legal Forms is definitely the largest library of legitimate kinds where you will find numerous file themes. Make use of the company to download expertly-produced files that stick to express demands.