Georgia Plan of Merger between two corporations

Description

How to fill out Plan Of Merger Between Two Corporations?

Discovering the right legal papers design can be a struggle. Needless to say, there are a variety of themes available on the Internet, but how can you get the legal develop you require? Make use of the US Legal Forms site. The assistance provides a large number of themes, including the Georgia Plan of Merger between two corporations, which you can use for enterprise and private requirements. All the varieties are inspected by specialists and fulfill state and federal requirements.

If you are already signed up, log in for your accounts and click the Acquire option to obtain the Georgia Plan of Merger between two corporations. Make use of accounts to search from the legal varieties you possess purchased formerly. Check out the My Forms tab of your respective accounts and have yet another duplicate from the papers you require.

If you are a brand new end user of US Legal Forms, listed below are straightforward directions so that you can comply with:

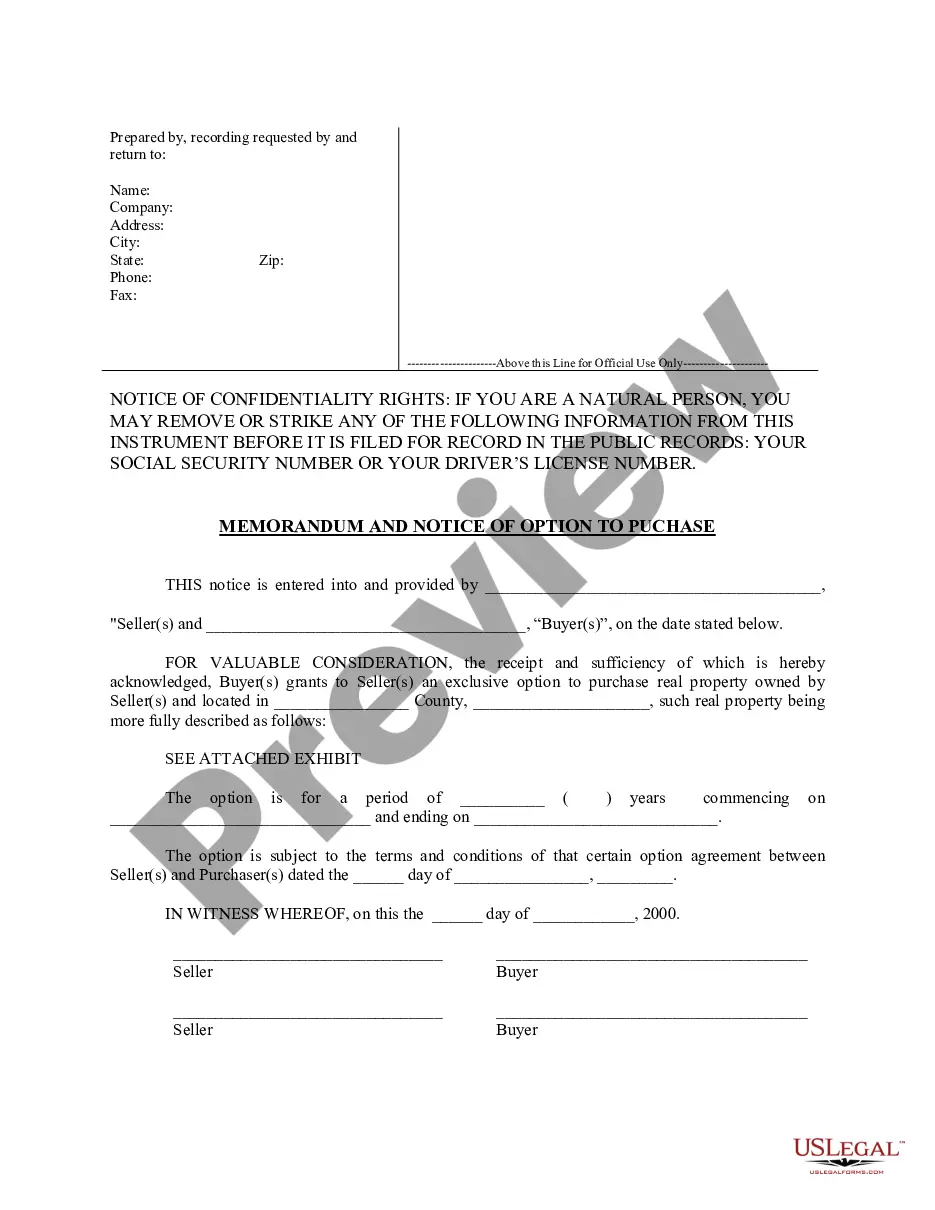

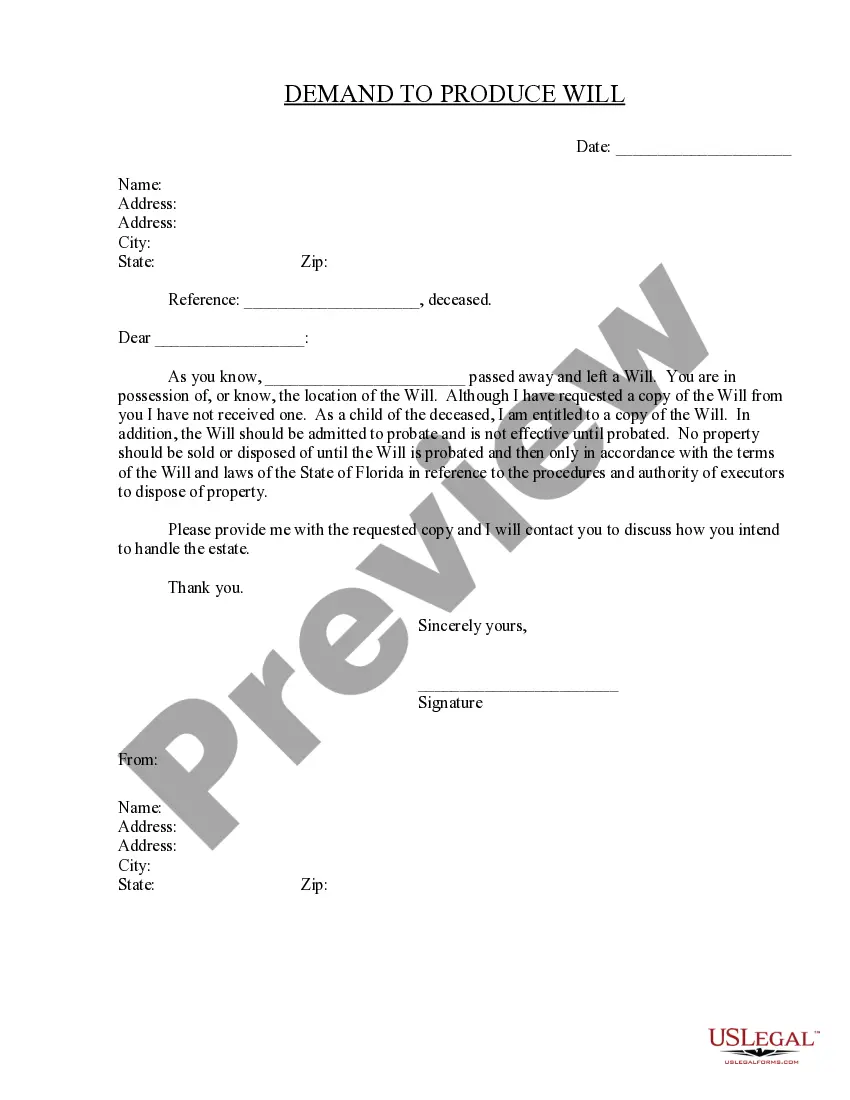

- Very first, be sure you have selected the appropriate develop for the town/county. It is possible to check out the form making use of the Preview option and look at the form explanation to ensure this is basically the best for you.

- In the event the develop is not going to fulfill your requirements, utilize the Seach discipline to obtain the appropriate develop.

- When you are positive that the form is acceptable, click on the Acquire now option to obtain the develop.

- Opt for the costs prepare you need and enter the required info. Design your accounts and buy the order with your PayPal accounts or bank card.

- Choose the file formatting and down load the legal papers design for your gadget.

- Total, revise and printing and sign the acquired Georgia Plan of Merger between two corporations.

US Legal Forms is definitely the most significant collection of legal varieties where you can see various papers themes. Make use of the company to down load expertly-produced papers that comply with express requirements.

Form popularity

FAQ

Any one or more domestic corporations may merge with one or more entities, except an entity formed under the laws of a state or jurisdiction which forbids a merger with a corporation.

The merger doctrine requires that a felonious assault which is an essential and integral element of the homicide may not be used as the underlying felony for a felony-murder conviction. Assault Leading to Homicide May Be Used To Invoke Felony-Murder Rule mercer.edu ? cgi ? viewcontent mercer.edu ? cgi ? viewcontent

In addition, language has been added to Code Section 14-2-1106(a)(2) explicitly stating that no conveyance, transfer or assignment occurs when property, including contract rights, are acquired by the surviving corporation in a merger.

The plan of merger must set forth: The name of each corporation planning to merge and the name of the surviving corporation into which each plans to merge; The terms and conditions of the planned merger; and. Georgia Code § 14-3-1101 (2022) - Plan of Merger - Justia Law justia.com ? article-11 ? section-14-3-1101 justia.com ? article-11 ? section-14-3-1101

Yes, Georgia allows you to be your own registered agent as long as you live in the state. If you operate a multi-member LLC, you can also choose one of the member's to act as the agent. The state also allows a family member or friend to act as the registered agent. Registered Agent For LLC In Georgia: Everything You Need to Know upcounsel.com ? registered-agent-for-llc-in-... upcounsel.com ? registered-agent-for-llc-in-...

Subject to the limitations set forth in Code Section 14-3-1102, one or more corporations may merge into another corporation if the plan of merger is approved as provided in Code Section 14-3-1103.

A parent corporation that owns at least 90 percent of the outstanding shares of each class and series of a subsidiary corporation may merge the subsidiary into itself or into another such subsidiary or merge itself into the subsidiary without the approval of the board of directors or shareholders of the subsidiary. Georgia Code § 14-2-1104 (2022) - Merger With Subsidiary - Justia Law justia.com ? codes ? part-1 ? section-14-2-1104 justia.com ? codes ? part-1 ? section-14-2-1104

Georgia law (O.C.G.A. § 10-1-490) requires every ?person, firm, or partnership, carrying on in this state any trade or business under any trade name or partnership name or other name? to register the trade name of the business with 30 days from ?commencing to do business.