Georgia Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp

Description

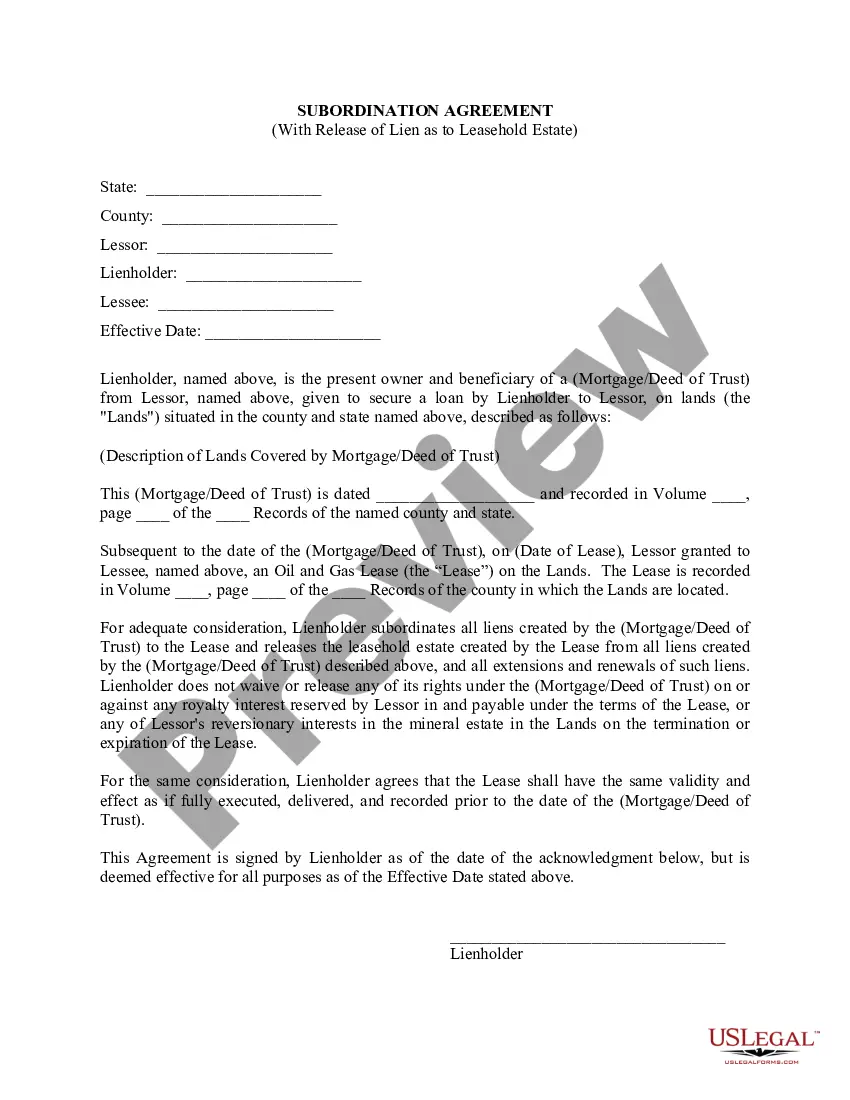

How to fill out Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

US Legal Forms - among the biggest libraries of legal types in America - provides a variety of legal document layouts you are able to obtain or produce. Using the website, you may get 1000s of types for company and personal purposes, sorted by groups, claims, or keywords and phrases.You will discover the latest variations of types such as the Georgia Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp in seconds.

If you currently have a monthly subscription, log in and obtain Georgia Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp from the US Legal Forms library. The Obtain key will appear on each develop you perspective. You have access to all formerly saved types in the My Forms tab of your accounts.

If you would like use US Legal Forms initially, listed below are simple guidelines to obtain began:

- Be sure to have picked out the right develop for your city/county. Click the Review key to analyze the form`s articles. Browse the develop description to ensure that you have chosen the proper develop.

- In case the develop does not match your needs, take advantage of the Search discipline on top of the display to discover the the one that does.

- If you are content with the shape, validate your option by clicking on the Get now key. Then, select the pricing strategy you favor and offer your credentials to sign up for the accounts.

- Procedure the financial transaction. Use your bank card or PayPal accounts to accomplish the financial transaction.

- Choose the structure and obtain the shape on your own system.

- Make alterations. Load, revise and produce and indicator the saved Georgia Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp.

Every design you included with your bank account lacks an expiration day which is the one you have permanently. So, if you want to obtain or produce one more duplicate, just go to the My Forms segment and click around the develop you will need.

Gain access to the Georgia Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp with US Legal Forms, probably the most considerable library of legal document layouts. Use 1000s of skilled and condition-specific layouts that satisfy your organization or personal demands and needs.