Georgia Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

You can spend several hours on the Internet trying to find the legal document format which fits the state and federal specifications you require. US Legal Forms offers 1000s of legal types which can be evaluated by experts. You can actually download or print out the Georgia Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc from your service.

If you already possess a US Legal Forms account, you are able to log in and click on the Obtain option. After that, you are able to complete, edit, print out, or sign the Georgia Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc. Each legal document format you acquire is your own property forever. To obtain one more version of any bought form, check out the My Forms tab and click on the related option.

If you use the US Legal Forms website the very first time, adhere to the easy guidelines under:

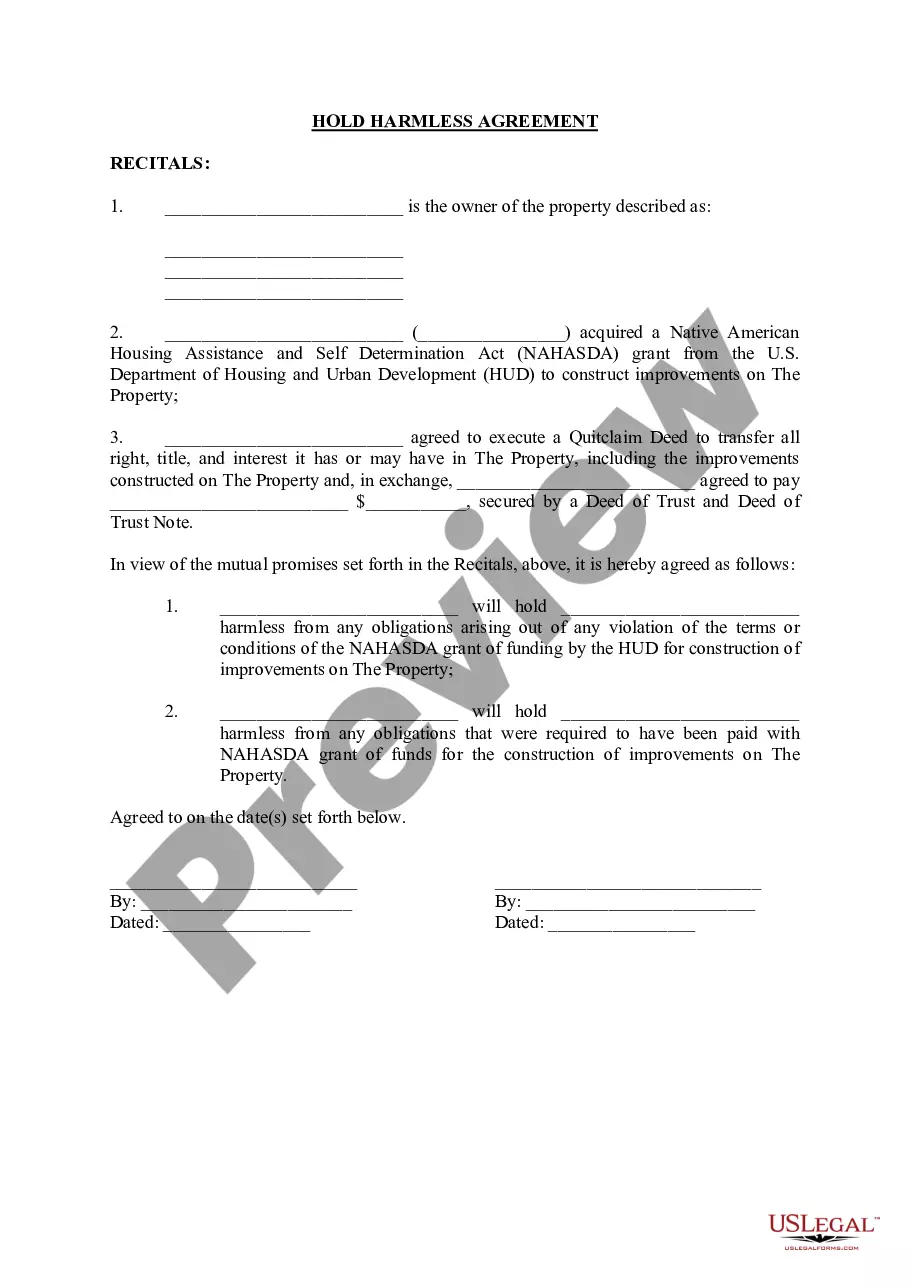

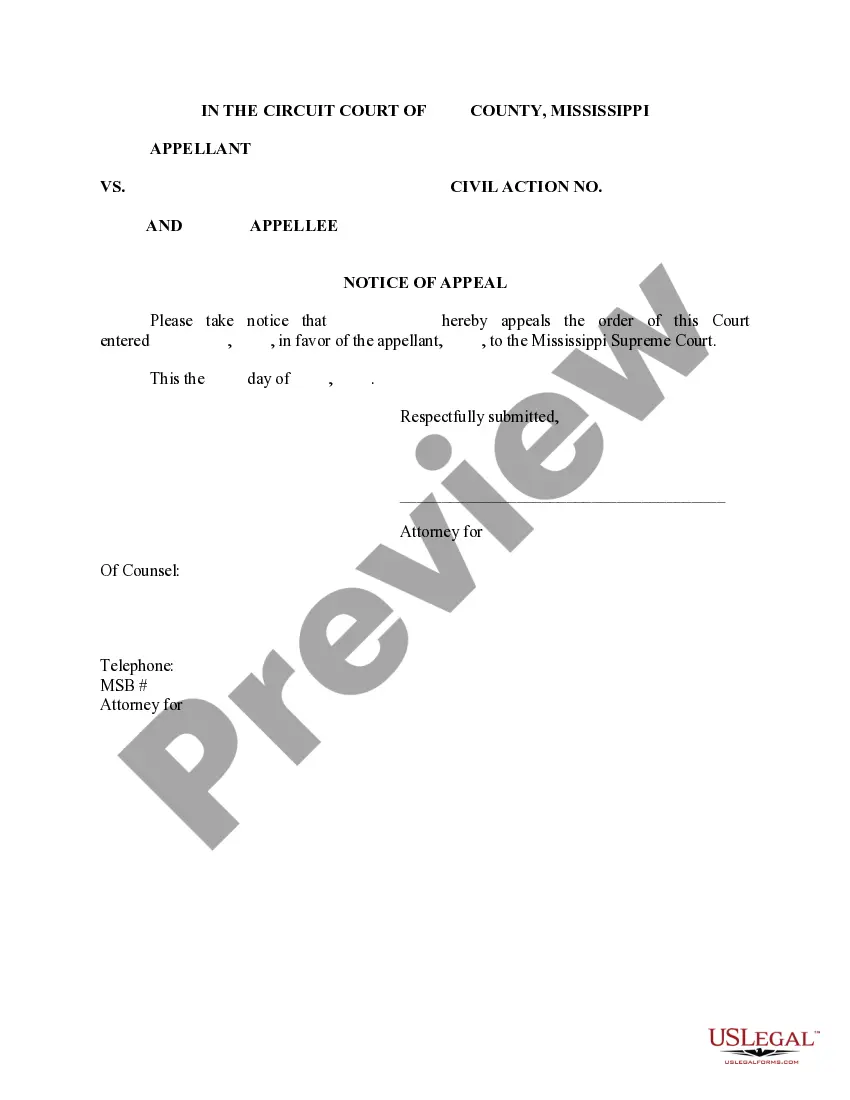

- Very first, be sure that you have chosen the right document format for the area/area of your choice. Read the form outline to make sure you have picked out the proper form. If offered, take advantage of the Review option to search from the document format as well.

- If you would like locate one more model in the form, take advantage of the Lookup discipline to find the format that meets your needs and specifications.

- After you have identified the format you would like, click on Buy now to proceed.

- Select the rates strategy you would like, enter your qualifications, and register for a merchant account on US Legal Forms.

- Total the transaction. You may use your Visa or Mastercard or PayPal account to fund the legal form.

- Select the formatting in the document and download it to the product.

- Make modifications to the document if needed. You can complete, edit and sign and print out Georgia Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

Obtain and print out 1000s of document themes making use of the US Legal Forms web site, which provides the biggest collection of legal types. Use specialist and status-certain themes to handle your company or specific requirements.