Georgia Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

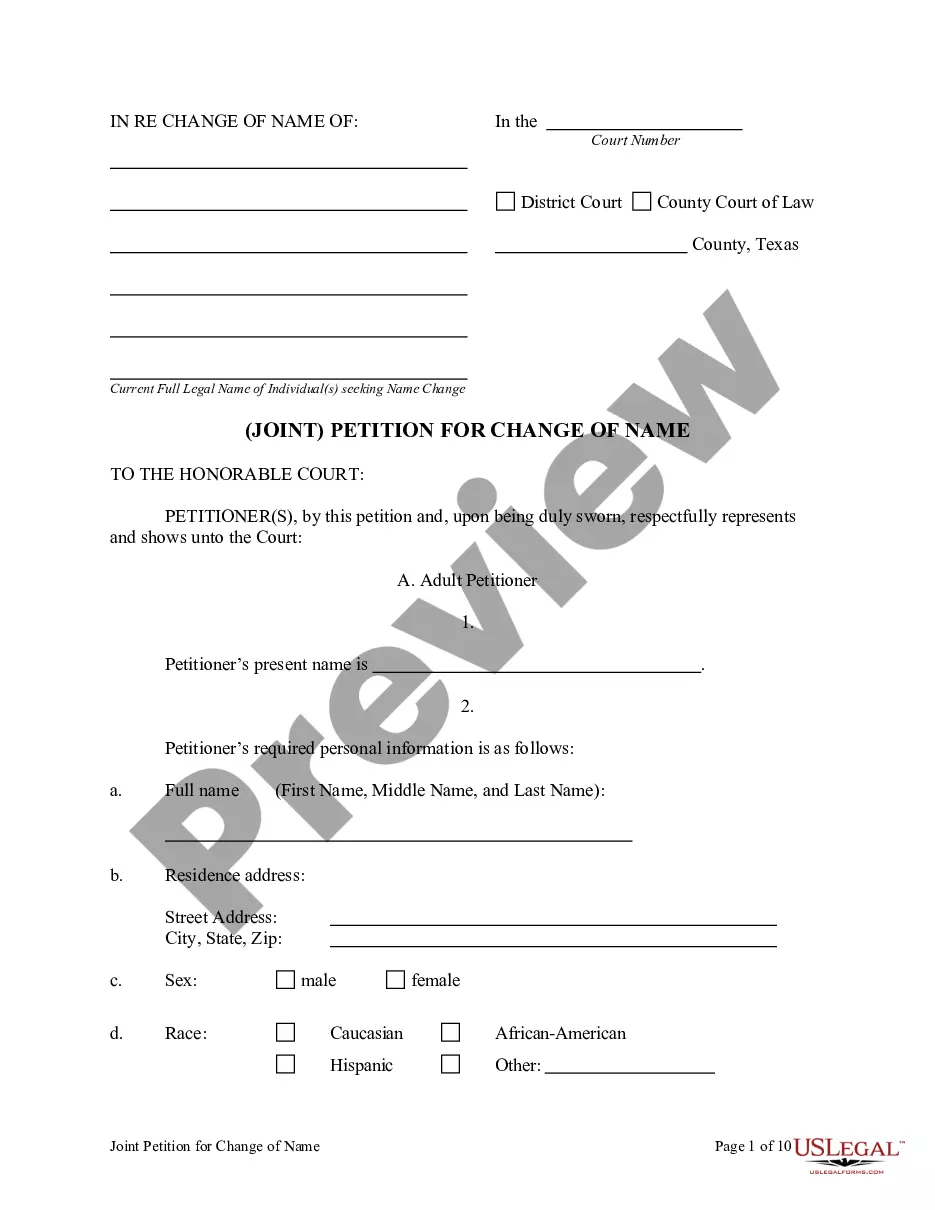

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

US Legal Forms - among the greatest libraries of legitimate forms in the States - offers a wide array of legitimate record themes you are able to down load or printing. Using the website, you may get 1000s of forms for company and personal uses, categorized by categories, suggests, or search phrases.You will find the most recent variations of forms such as the Georgia Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds in seconds.

If you currently have a registration, log in and down load Georgia Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds from the US Legal Forms local library. The Down load switch can look on each and every type you see. You have access to all previously acquired forms from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed here are easy recommendations to get you started:

- Be sure you have picked the best type for your area/area. Click on the Review switch to check the form`s articles. Read the type information to actually have chosen the appropriate type.

- In the event the type does not fit your needs, use the Lookup industry towards the top of the display to discover the one that does.

- When you are satisfied with the form, affirm your choice by clicking on the Purchase now switch. Then, opt for the rates program you want and offer your qualifications to sign up for an accounts.

- Process the deal. Utilize your credit card or PayPal accounts to accomplish the deal.

- Choose the file format and down load the form in your gadget.

- Make adjustments. Fill out, modify and printing and indication the acquired Georgia Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Each format you included in your account lacks an expiry date and it is your own property eternally. So, if you want to down load or printing another version, just proceed to the My Forms portion and click on around the type you need.

Obtain access to the Georgia Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms, probably the most comprehensive local library of legitimate record themes. Use 1000s of professional and express-distinct themes that fulfill your small business or personal demands and needs.