The Georgia Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. is a legally binding agreement that outlines the terms and conditions of a merger between these entities. This merger is aimed at combining resources, expertise, and market reach to create a stronger and more competitive entity in the retail industry. Key players in this merger include Food Lion, Inc., a well-established supermarket chain operating across several states, and Hanna ford Brothers Company, another reputable supermarket retailer serving the New England region. FL Acquisition Sub, Inc. acts as a subsidiary of Food Lion, Inc., overseeing the merger process and facilitating the integration of the two companies. The Georgia Plan of Merger encompasses various aspects of the merger process, including the exchange of shares, assets, and liabilities between the entities involved. It outlines the timeline, financial terms, and conditions for the completion of the merger, ensuring transparency and compliance with state regulations. Additionally, the Georgia Plan of Merger may outline specific objectives and goals for the merged entity, focusing on synergies, cost-efficiency, and market expansion. It may detail the organizational structure, management team, and decision-making processes for the new entity, ensuring a smooth transition and effective integration of both companies. There may be specific types of Georgia Plan of Merger depending on the nature of the merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. These could include: 1. Horizontal Merger: A merger between two companies operating in the same industry and at the same level of the supply chain. In this case, Food Lion, Inc., and Hanna ford Brothers Company may merge to gain a larger market share collectively. 2. Vertical Merger: A merger between companies operating at different levels of the same industry's supply chain. For example, if Food Lion, Inc., merges with FL Acquisition Sub, Inc., it could signify merging a supplier or distributor into the retail business, optimizing the supply chain. 3. Conglomerate Merger: A merger between companies operating in completely different industries. This might not be applicable for the merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc., as they both operate in the same industry. In conclusion, the Georgia Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. represents a strategic move in the retail industry, seeking to leverage strengths and create synergies through the merger of two reputable supermarket chains. Its comprehensive framework ensures a seamless integration process while complying with legal and regulatory requirements.

Georgia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

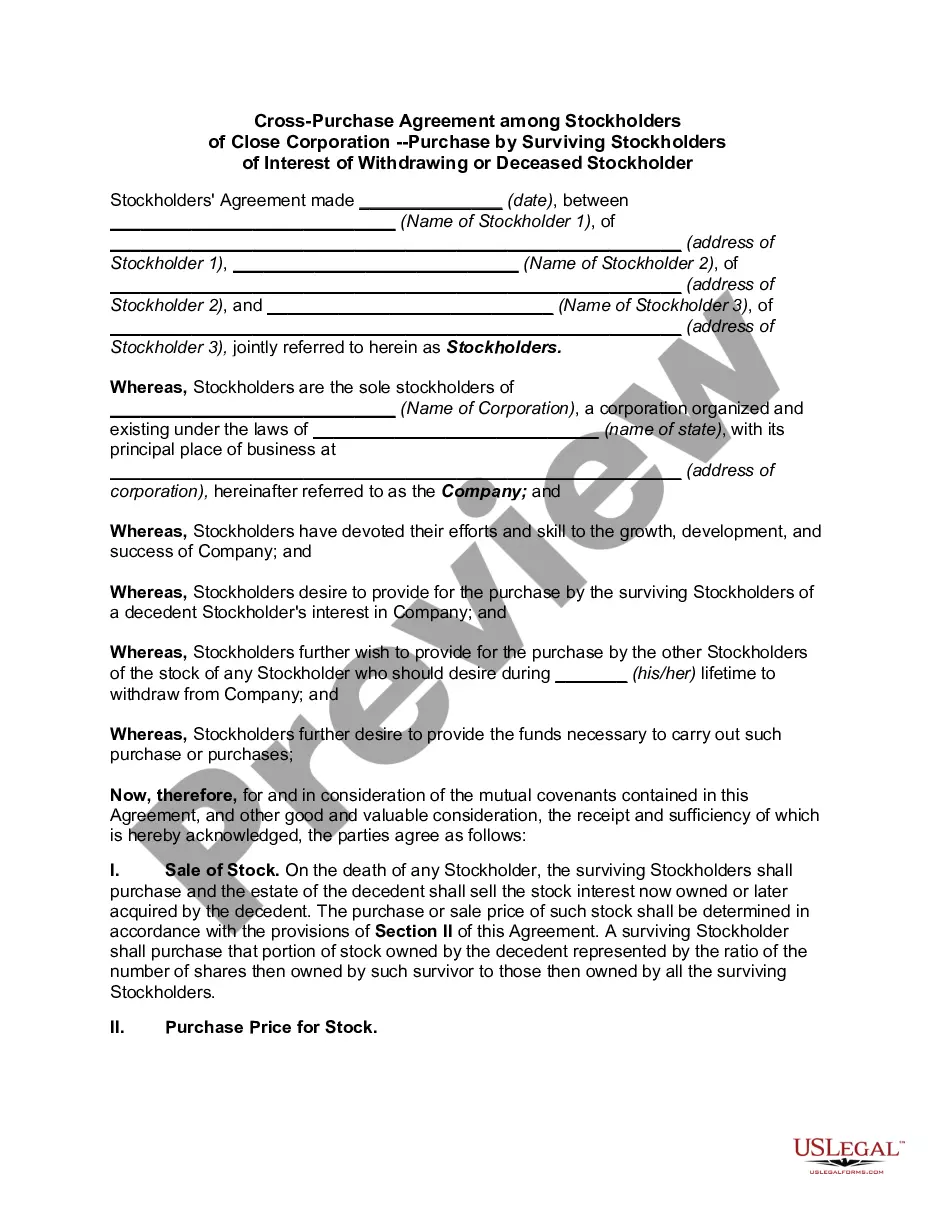

How to fill out Georgia Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

US Legal Forms - one of several biggest libraries of legal types in the USA - offers an array of legal file themes you may down load or produce. Using the site, you can get a large number of types for organization and person functions, categorized by types, claims, or keywords and phrases.You will discover the most up-to-date models of types much like the Georgia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. within minutes.

If you already possess a subscription, log in and down load Georgia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. from the US Legal Forms collection. The Obtain option will appear on every single kind you look at. You have accessibility to all earlier acquired types in the My Forms tab of your account.

If you want to use US Legal Forms the first time, listed below are easy guidelines to help you get began:

- Be sure you have chosen the right kind for the city/state. Click the Preview option to examine the form`s information. See the kind description to ensure that you have chosen the right kind.

- In the event the kind doesn`t suit your demands, use the Lookup industry on top of the monitor to discover the one who does.

- When you are satisfied with the form, validate your decision by clicking the Buy now option. Then, select the costs plan you favor and give your references to sign up for the account.

- Method the purchase. Utilize your charge card or PayPal account to complete the purchase.

- Select the file format and down load the form on your own device.

- Make adjustments. Fill up, revise and produce and indicator the acquired Georgia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Every single design you included in your account does not have an expiration time and is your own property for a long time. So, if you wish to down load or produce another backup, just proceed to the My Forms section and then click around the kind you want.

Gain access to the Georgia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. with US Legal Forms, probably the most considerable collection of legal file themes. Use a large number of specialist and state-specific themes that meet your organization or person requires and demands.

Form popularity

FAQ

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed.

The Food Town chain was acquired by the Belgium-based Delhaize Group grocery company in 1974. The Food Lion name was adopted in 1983; as Food Town expanded into Virginia, the chain encountered several stores called Foodtown in the Richmond area.

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

Food Lion's parent company is Ahold Delhaize, the same owners since 1974. Delhaize merged with Ahold in 2015 and holds a wide range of retail stores in 10 different countries. In the United States, they also own the popular online grocery service FreshDirect, as well as my beloved hometown grocery store Giant.