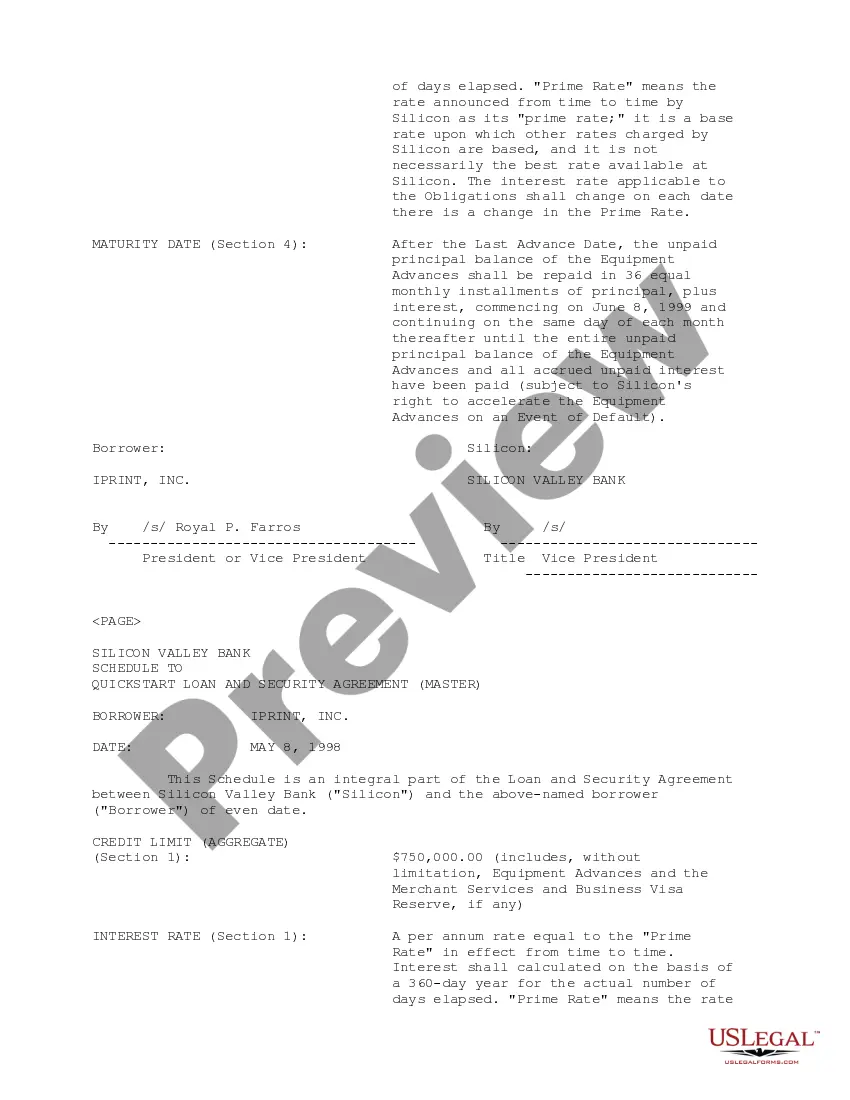

Title: Georgia Quick start Loan and Security Agreement: Comprehensive Overview | Silicon Valley Bank and print, Inc. Introduction: The Georgia Quick start Loan and Security Agreement between Silicon Valley Bank (SVB) and print, Inc. is a financial arrangement designed to support businesses in Georgia looking to secure capital for expansion or operational needs. This agreement outlines the terms and conditions under which SVB provides a loan to print, Inc. in exchange for appropriate collateral, ensuring mutual transparency and protection for both parties involved. Keywords: — GeorgiQuicstarRTTrLOAoa— - Security Agreement — Silicon Valley Ban— - iPrint, Inc. 1. General Information: The Georgia Quick start Loan and Security Agreement is a legal document that formalizes the lending relationship between Silicon Valley Bank and print, Inc., a Georgia-based business. It serves to outline the specific terms and obligations of both parties throughout the loan tenure. 2. Loan Purpose and Terms: a. Expansion Loan: This variant of the Georgia Quick start Loan is granted to businesses intending to expand their operations, invest in new technology, or explore market opportunities. It offers a flexible repayment schedule, competitive interest rates, and numerous benefits tailored to the borrower's requirements. b. Working Capital Loan: The Working Capital Loan variant assists businesses in meeting their day-to-day operational expenses, such as inventory purchases, payroll, and maintenance costs. It provides quick access to funds to enhance operational efficiency and stability. 3. Collateral and Security: To secure the loan, print, Inc. pledges collateral in accordance with the agreed terms. The collateral can include business assets, machinery, accounts receivable, inventory, or other valuable items with determined valuation. By accepting the security agreement, SVB ensures its legal rights over the collateral until the loan is repaid. 4. Loan Repayment: a. Installment Structure: The Georgia Quick start Loan allows for repayment in equal monthly installments over a specified period. This predictable repayment structure assists businesses in managing their cash flow and financial obligations responsibly. b. Prepayment Options: In some cases, the agreement may allow for early repayment without incurring prepayment penalties, providing borrowers the chance to reduce their overall interest payment and improve their financial position. 5. Interest Rates and Fees: Interest rates are determined based on various factors such as the borrower's creditworthiness, loan purpose, and current market conditions. The agreement outlines the applicable rate, ensuring transparency and preventing unexpected fluctuations. Additionally, the agreement specifies any fees associated with the loan, such as origination fees or late payment penalties. 6. Default and Remedies: To safeguard the lender's interests, the agreement defines the conditions under which a default occurs. It also outlines the remedies available to SVB, including the right to demand immediate repayment, pursue legal action, or exercise rights over the pledged collateral. Conclusion: The Georgia Quick start Loan and Security Agreement between Silicon Valley Bank and print, Inc. offers Georgia-based businesses a flexible financial tool to bolster their growth and stability. With varying loan types and specific terms tailored to individual business needs, this agreement represents a valuable opportunity for entrepreneurs and companies in Georgia to access capital while receiving sound financial guidance from Silicon Valley Bank.

Georgia Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

How to fill out Georgia Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

You may spend several hours on-line trying to find the legitimate papers template that suits the state and federal demands you require. US Legal Forms provides 1000s of legitimate forms which can be analyzed by professionals. It is possible to down load or produce the Georgia Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. from our assistance.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Acquire switch. Following that, it is possible to complete, change, produce, or sign the Georgia Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Every single legitimate papers template you buy is your own eternally. To get an additional duplicate associated with a purchased type, check out the My Forms tab and then click the related switch.

If you work with the US Legal Forms internet site for the first time, keep to the straightforward recommendations below:

- Very first, make certain you have chosen the right papers template for the region/city of your choice. See the type outline to make sure you have chosen the correct type. If readily available, make use of the Review switch to search through the papers template also.

- If you would like locate an additional edition from the type, make use of the Look for discipline to get the template that suits you and demands.

- After you have located the template you need, just click Get now to carry on.

- Pick the pricing program you need, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can use your bank card or PayPal bank account to fund the legitimate type.

- Pick the structure from the papers and down load it for your device.

- Make modifications for your papers if required. You may complete, change and sign and produce Georgia Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

Acquire and produce 1000s of papers themes utilizing the US Legal Forms web site, which provides the biggest selection of legitimate forms. Use professional and express-certain themes to deal with your company or personal needs.