The Georgia Stock Option Agreement is a legal document specific to Interwar, Inc. — a company based in the state of Georgia, USA. This agreement outlines the terms and conditions surrounding the issuance and exercise of stock options, primarily designed to compensate employees or investors. Keywords: Georgia, Stock Option Agreement, Interwar, Inc., legal document, terms and conditions, issuance, exercise, stock options, compensation, employees, investors. There might not be different types of Georgia Stock Option Agreement specific to Interwar, Inc., but it's worth mentioning that there can be various types of stock option agreements in general, depending on the specific terms and conditions included within each agreement, such as: 1. Employee Stock Option Agreement: This type of agreement is entered into between Interwar, Inc. and its employees, allowing them to purchase a certain number of company shares at a predetermined price within a specific period. 2. Incentive Stock Option (ISO) Agreement: This stock option agreement grants employees the right to purchase shares at a specific price for certain tax benefits. SOS must adhere to certain requirements set by the Internal Revenue Service (IRS). 3. Non-Qualified Stock Option (NO) Agreement: This type of agreement provides employees or investors with the ability to purchase shares at a predetermined price. Nests do not qualify for the same tax benefits as SOS and may be subject to different tax treatment. 4. Restricted Stock Option Agreement: Here, employees or investors are granted stock options that have restrictions, such as a vesting schedule or limitations on transferability, which is intended to encourage their commitment to the company. 5. Stock Option Plan: This refers to the overall framework established by Interwar, Inc. to administer and regulate stock option grants. It outlines the terms and guidelines for granting, exercising, and managing stock options. 6. Employee Stock Ownership Plan (ESOP): While not specifically a stock option agreement, an ESOP is a type of qualified retirement plan where employees are granted ownership shares in the company. It allows employees to acquire company stock as part of their retirement benefits. Remember, the specific type of Stock Option Agreement provided by Interwar, Inc. can only be determined by reviewing the actual agreement itself.

Georgia Stock Option Agreement of Intraware, Inc.

Description

How to fill out Georgia Stock Option Agreement Of Intraware, Inc.?

You are able to devote hrs on-line trying to find the legitimate file format that fits the federal and state needs you require. US Legal Forms provides a huge number of legitimate forms that happen to be examined by pros. You can actually obtain or print the Georgia Stock Option Agreement of Intraware, Inc. from my service.

If you currently have a US Legal Forms profile, you are able to log in and then click the Obtain option. Afterward, you are able to complete, change, print, or sign the Georgia Stock Option Agreement of Intraware, Inc.. Each legitimate file format you purchase is your own forever. To have yet another version associated with a acquired form, visit the My Forms tab and then click the related option.

If you use the US Legal Forms internet site initially, follow the simple instructions below:

- Initial, make sure that you have selected the correct file format for the county/metropolis of your choice. Read the form explanation to make sure you have picked out the appropriate form. If accessible, take advantage of the Review option to check from the file format at the same time.

- In order to discover yet another edition of the form, take advantage of the Look for discipline to obtain the format that suits you and needs.

- When you have discovered the format you need, simply click Buy now to carry on.

- Select the costs prepare you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the purchase. You can use your credit card or PayPal profile to fund the legitimate form.

- Select the format of the file and obtain it for your product.

- Make modifications for your file if needed. You are able to complete, change and sign and print Georgia Stock Option Agreement of Intraware, Inc..

Obtain and print a huge number of file web templates while using US Legal Forms site, that provides the greatest selection of legitimate forms. Use expert and express-particular web templates to deal with your organization or personal requirements.

Form popularity

FAQ

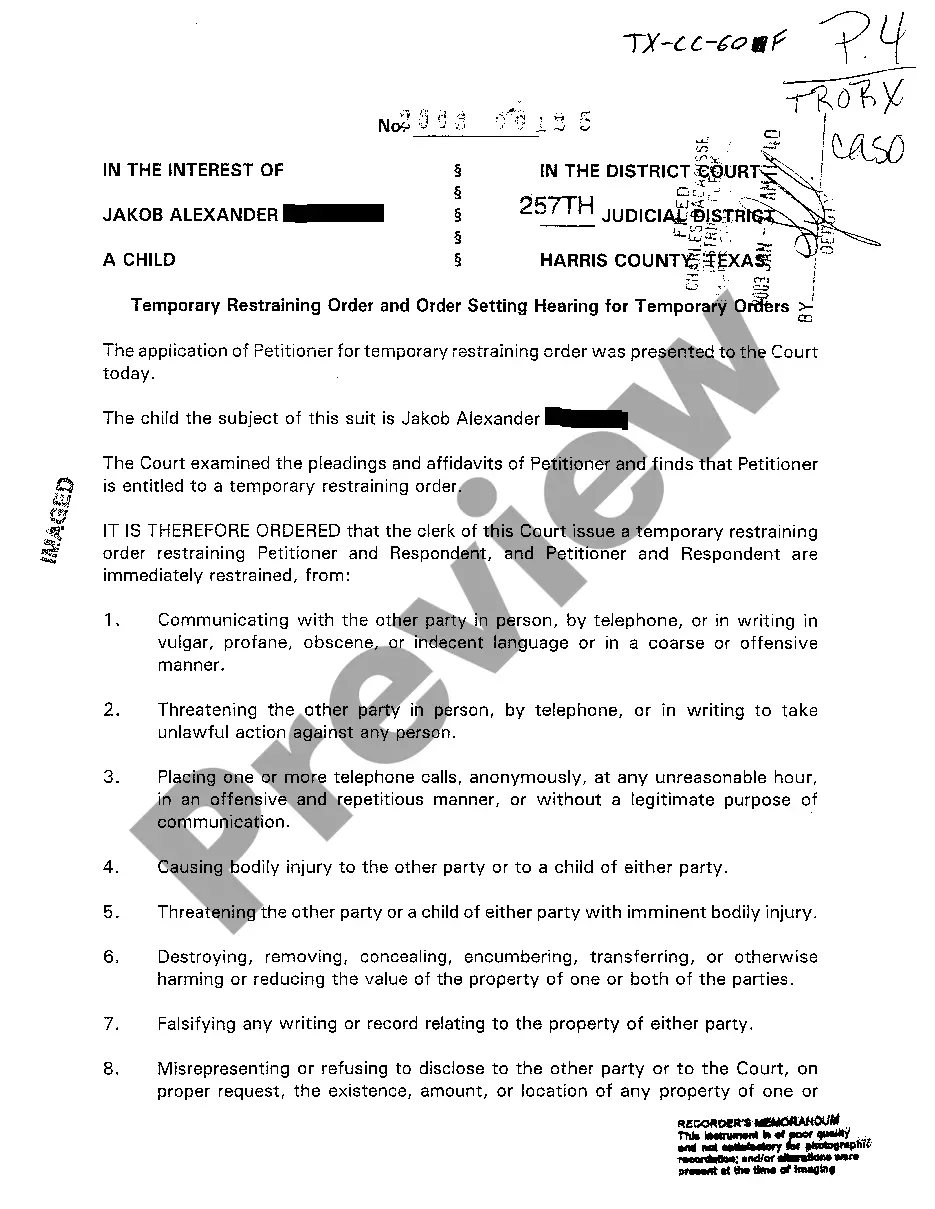

Stock options are granted in ance with the terms of a company's stock option plan. A stock option plan sets out the general terms that the company will set for Consultants to potentially receive option agreements, and sets out the company's intention to give Consultants options.

This Amendment may be executed in counterparts, each of which when signed by the Company or Employee will be deemed an original and all of which together will be deemed the same agreement. Form of Amendment to Stock Option Agreement - SEC.gov sec.gov ? Archives ? edgar ? data ? dex101 sec.gov ? Archives ? edgar ? data ? dex101

Option Contracts at a Glance A seller may option the opportunity to purchase stock at a certain price for a set period of time. By accepting money in exchange for this option to buy the underlying stock, the seller has essentially provided a warranty that they won't revoke the offer.

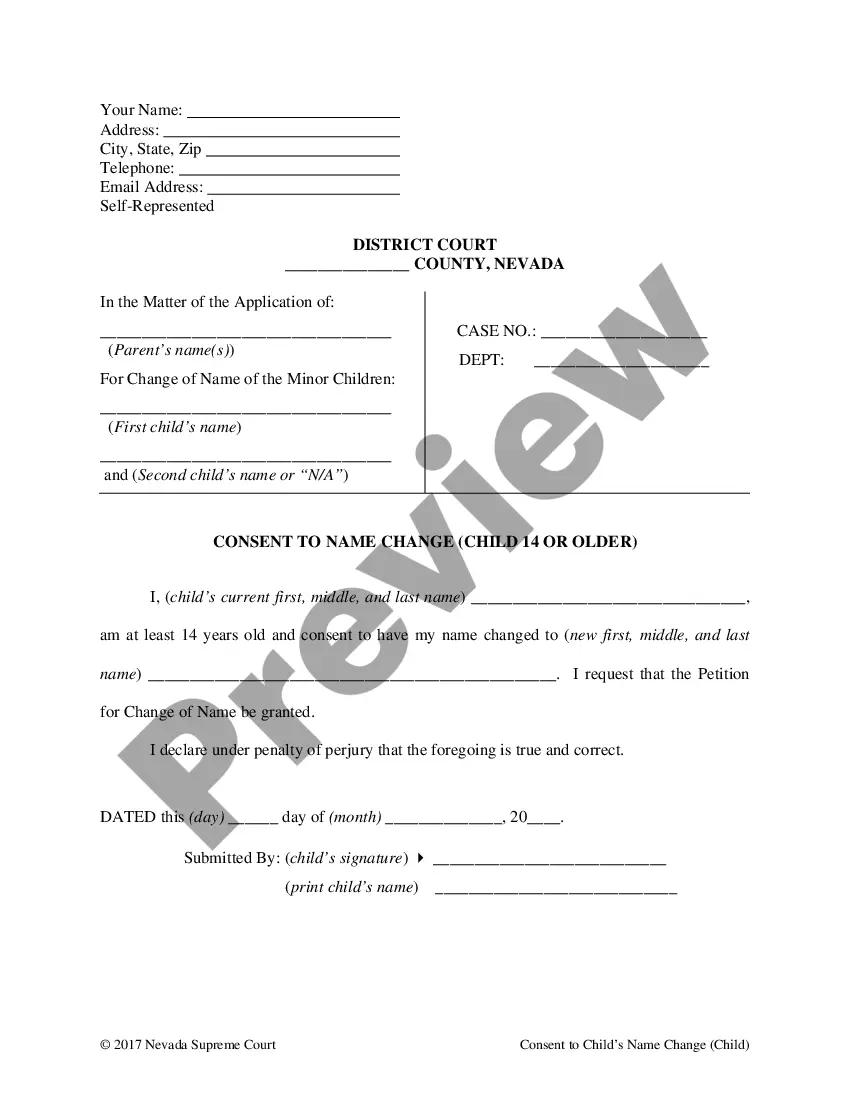

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire. 10 Tips About Stock Option Agreements When Evaluating a Job ... melmedlaw.com ? how-to-evaluate-stock-op... melmedlaw.com ? how-to-evaluate-stock-op...