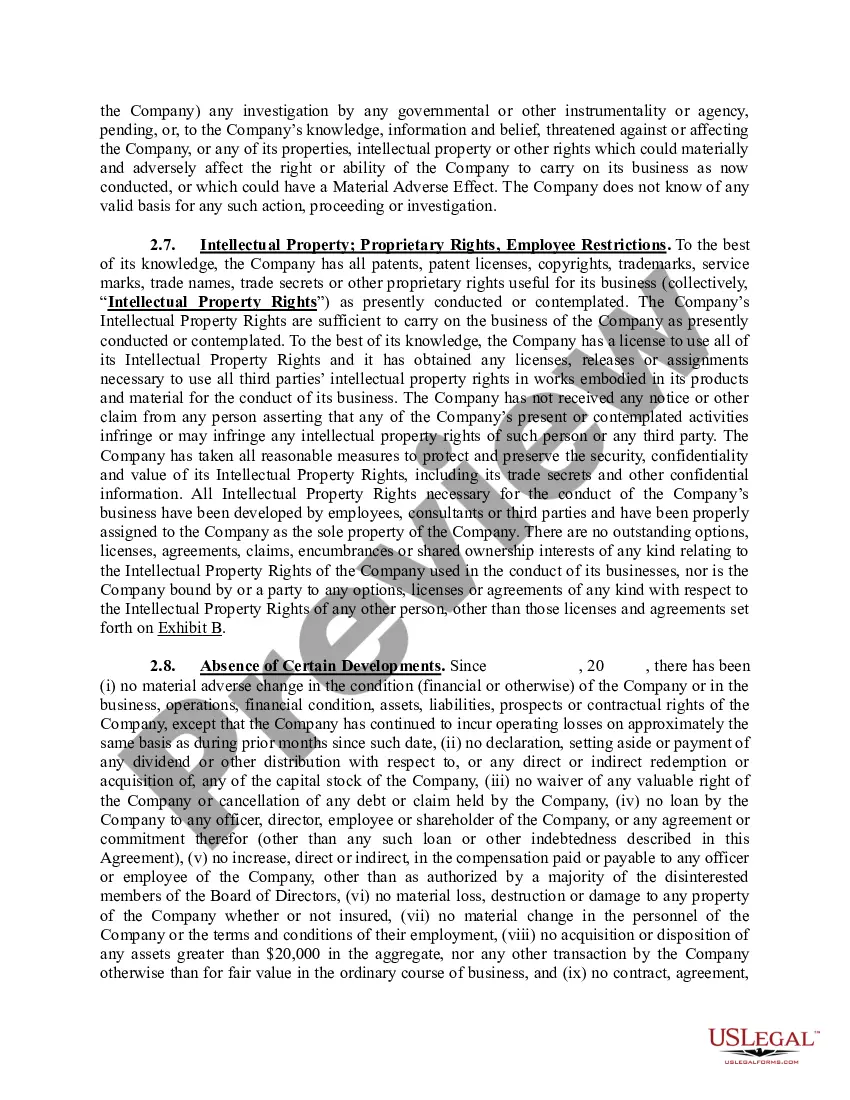

The Georgia Convertible Note Subscription Agreement is a legally binding document that outlines the terms and conditions for the purchase of convertible notes in the state of Georgia. This type of agreement is commonly used in venture capital financing, allowing investors to provide funding to startups in exchange for the right to convert their investment into equity at a later date. The Georgia Convertible Note Subscription Agreement typically includes essential information such as the names of the parties involved (investors and the startup company), the principal amount of the note, the interest rate, maturity date, conversion terms, and various representations and warranties. There are several types of Georgia Convertible Note Subscription Agreements, each serving specific purposes: 1. Simple Convertible Note Subscription Agreement: This type of agreement is the most basic form, providing straightforward terms for the purchase of convertible notes without complex provisions or additional covenants. 2. Qualified Financing Convertible Note Subscription Agreement: In the case of a qualified financing round, where the startup raises a certain amount of capital, this agreement allows investors to convert their notes into equity before the maturity date. 3. Equity Financing Convertible Note Subscription Agreement: This agreement includes additional provisions that enable investors to convert their notes into equity in the event of an equity financing round, allowing them to participate in the valuation of the startup. 4. Discounted Convertible Note Subscription Agreement: This type of agreement offers investors a discount on the conversion price, incentivizing early investment by providing a lower cost per share upon conversion. 5. Cap Convertible Note Subscription Agreement: This agreement sets a cap on the valuation of the startup during the conversion, ensuring investors are protected from excessive dilution caused by subsequent funding rounds. The Georgia Convertible Note Subscription Agreement provides a flexible and efficient financing option for startup companies to secure funding while offering potential investors the opportunity to convert their debt investments into equity. It is crucial for both parties to carefully review and understand the terms outlined in the agreement before entering into any financial transaction. It is advisable to consult legal professionals experienced in startup financing or securities law to ensure compliance and maximize the benefits of this type of investment agreement.

Georgia Convertible Note Subscription Agreement

Description

How to fill out Georgia Convertible Note Subscription Agreement?

US Legal Forms - one of several greatest libraries of legitimate forms in the United States - delivers an array of legitimate document web templates it is possible to acquire or printing. Using the internet site, you will get a large number of forms for company and individual reasons, sorted by categories, states, or keywords.You can find the latest versions of forms just like the Georgia Convertible Note Subscription Agreement within minutes.

If you currently have a monthly subscription, log in and acquire Georgia Convertible Note Subscription Agreement from your US Legal Forms library. The Obtain key will show up on every single develop you view. You gain access to all in the past acquired forms inside the My Forms tab of your own profile.

In order to use US Legal Forms for the first time, allow me to share straightforward directions to help you started:

- Make sure you have picked the best develop for the area/region. Go through the Preview key to check the form`s content. Browse the develop information to actually have chosen the right develop.

- When the develop doesn`t suit your demands, use the Lookup industry towards the top of the screen to get the one which does.

- When you are content with the form, affirm your selection by visiting the Get now key. Then, choose the costs program you favor and supply your credentials to sign up on an profile.

- Approach the purchase. Use your charge card or PayPal profile to accomplish the purchase.

- Pick the structure and acquire the form in your product.

- Make adjustments. Fill up, modify and printing and signal the acquired Georgia Convertible Note Subscription Agreement.

Every web template you included in your account does not have an expiry date and it is your own property permanently. So, if you want to acquire or printing an additional duplicate, just proceed to the My Forms portion and then click in the develop you require.

Obtain access to the Georgia Convertible Note Subscription Agreement with US Legal Forms, the most considerable library of legitimate document web templates. Use a large number of professional and status-distinct web templates that fulfill your business or individual needs and demands.

Form popularity

FAQ

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

EXAMPLE: A startup company with 1,000,000 shares of common stock closes a seed funding round of $1,000,000 in the form of a convertible note, with a valuation cap of $5,000,000 pre-money valuation on the next round of financing.

Convertible loan notes (?CLN?) and advance subscription agreements (?ASA?) are ways of companies getting a cash injection which may later convert into shares, rather than being paid back in cash. ASAs tend to be shorter agreements than CLNs and therefore involve less negotiation.

Discount. The discount rate, typically 15% to 25% percent, gets applied to the per-share price of the new investor. For example, let's say your convertible note had a 20% discount and the new investors are paying $1 per share. The convertible note investor will convert at $0.80 per share.

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.