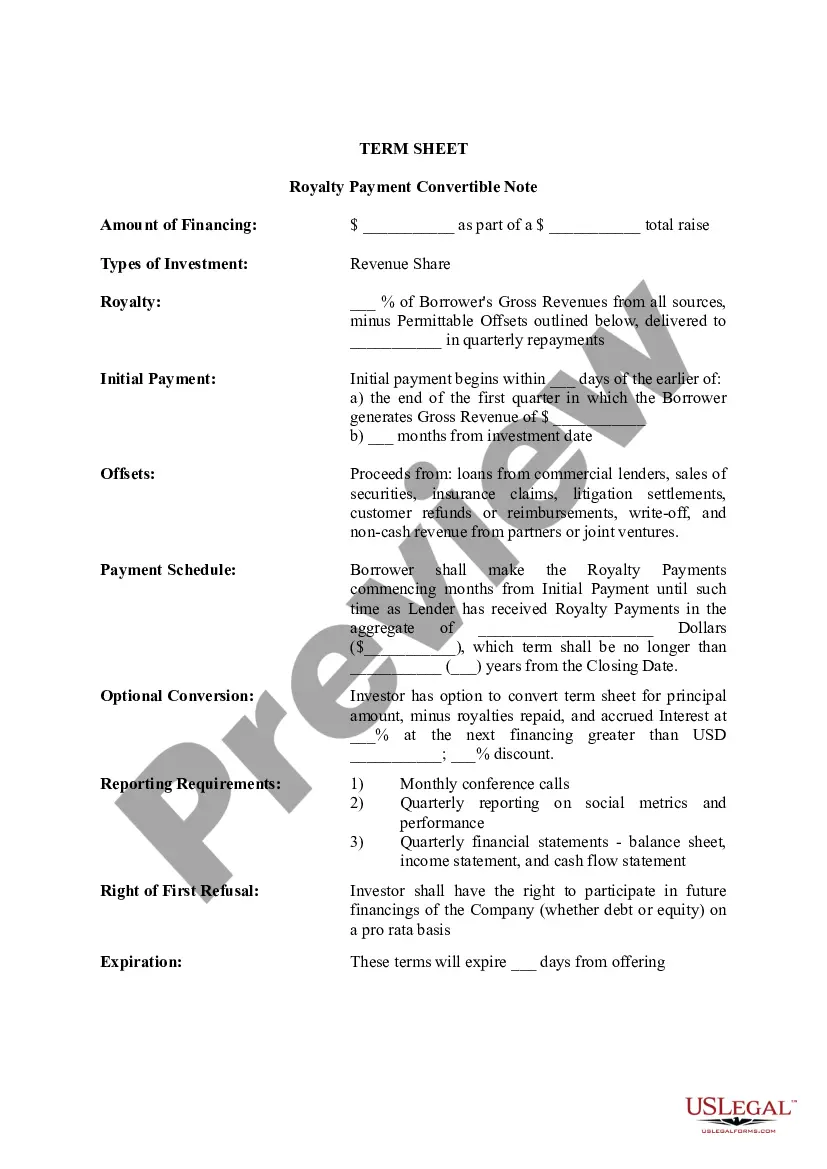

Georgia Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

You may devote hrs on the web looking for the authorized record web template that fits the federal and state demands you will need. US Legal Forms provides a large number of authorized forms which are evaluated by pros. It is possible to acquire or print out the Georgia Term Sheet - Royalty Payment Convertible Note from our services.

If you currently have a US Legal Forms account, you can log in and then click the Acquire switch. Next, you can total, change, print out, or indication the Georgia Term Sheet - Royalty Payment Convertible Note. Each authorized record web template you get is the one you have for a long time. To obtain yet another backup for any acquired form, proceed to the My Forms tab and then click the related switch.

Should you use the US Legal Forms website the first time, stick to the easy instructions under:

- Initial, make sure that you have chosen the correct record web template for your region/city of your choice. Look at the form information to make sure you have chosen the correct form. If readily available, make use of the Preview switch to search throughout the record web template also.

- If you wish to locate yet another version from the form, make use of the Research industry to find the web template that fits your needs and demands.

- Upon having found the web template you need, click on Get now to carry on.

- Pick the rates plan you need, key in your credentials, and register for your account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal account to purchase the authorized form.

- Pick the format from the record and acquire it for your gadget.

- Make adjustments for your record if necessary. You may total, change and indication and print out Georgia Term Sheet - Royalty Payment Convertible Note.

Acquire and print out a large number of record layouts making use of the US Legal Forms web site, which provides the biggest selection of authorized forms. Use professional and status-specific layouts to take on your business or person requires.

Form popularity

FAQ

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

EXAMPLE: A startup company with 1,000,000 shares of common stock closes a seed funding round of $1,000,000 in the form of a convertible note, with a valuation cap of $5,000,000 pre-money valuation on the next round of financing.

A convertible note is a short-term debt instrument that automatically turns into equity when a predetermined milestone or conversion event occurs. Essentially, a convertible note functions like a business loan that converts into equity instead of being repaid..

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

As noted above, convertible notes can be classified as all debt, all equity, or a mixture of both. To determine the appropriate classification, we need to consider the relevant definitions in IAS 32 Financial Instruments: Presentation.